May 2018

Energy Efficiency Portfolio

Report

CALIFORNIA PUBLIC UTILITIES COMMISSION

Energy Efficiency Report | 1

Table of Contents

Acronyms ............................................................................................................................................................................. 7

Executive Summary ............................................................................................................................................................ 8

Scope of California’s Energy Efficiency Programs ................................................................................................... 8

Portfolio Impacts and Success of the 2013-2015 Energy Efficiency Programs .................................................. 8

Introduction ....................................................................................................................................................................... 13

Scope of this Report .................................................................................................................................................... 13

Organization of this Report ........................................................................................................................................ 14

Evaluation Methodology and Terminology ............................................................................................................. 14

2013-2015 Portfolio Overview ....................................................................................................................................... 16

Goals and Overview of 2013-2015 Portfolio Activities ......................................................................................... 16

Impacts of the 2013-2015 Energy Efficiency Portfolio ......................................................................................... 17

Common Challenges across the Portfolio ................................................................................................................ 25

Residential .......................................................................................................................................................................... 26

Overview ........................................................................................................................................................................ 26

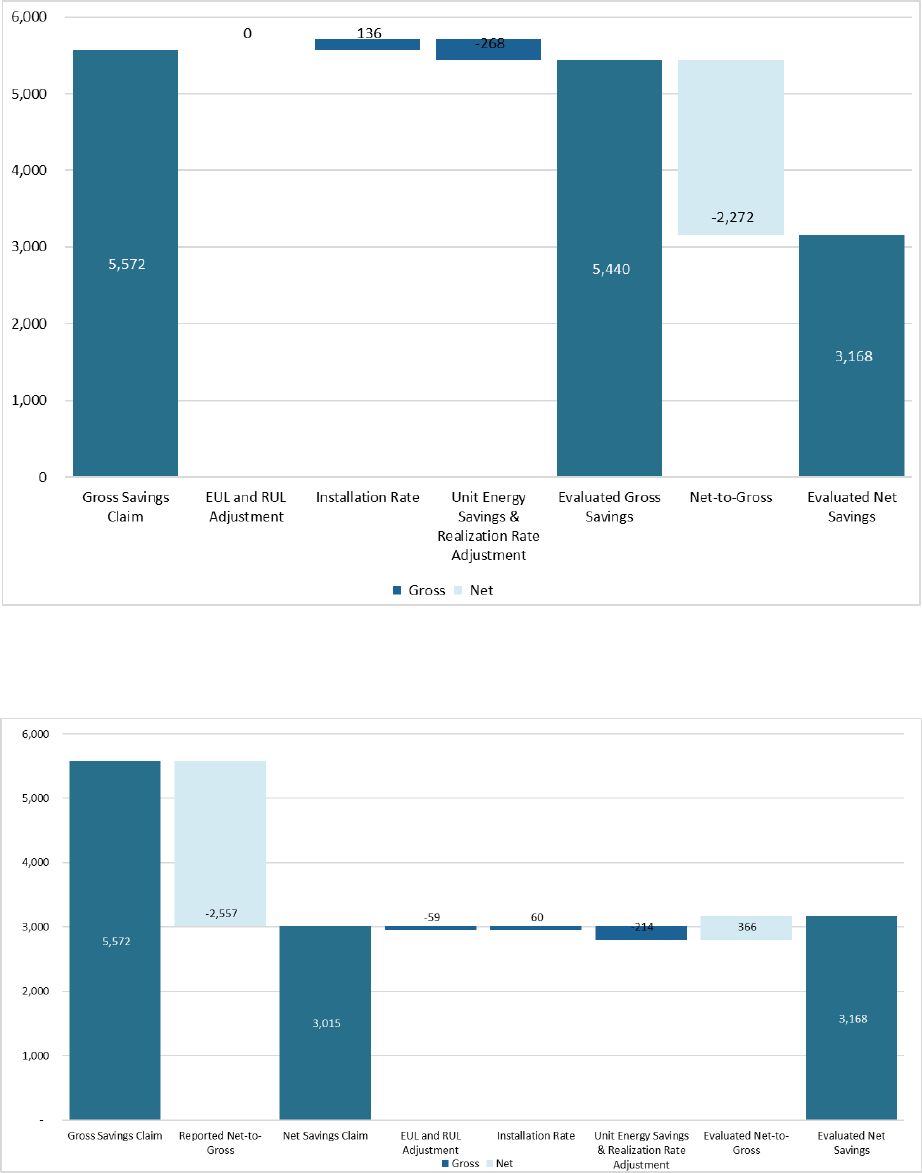

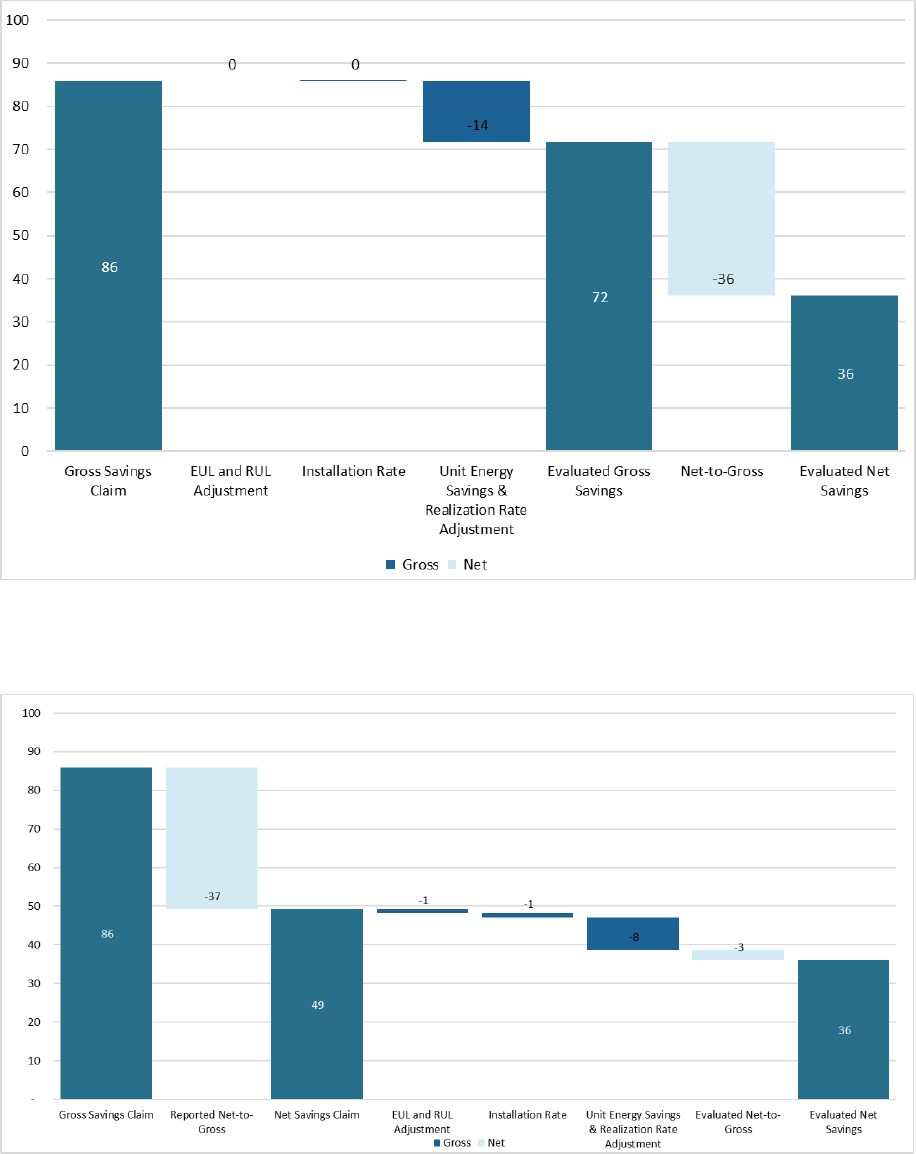

Estimated Savings ........................................................................................................................................................ 26

Residential Energy Efficiency Programs .................................................................................................................. 27

Highlights....................................................................................................................................................................... 27

Findings .......................................................................................................................................................................... 28

Path to Statewide Goals .............................................................................................................................................. 30

Commercial ........................................................................................................................................................................ 32

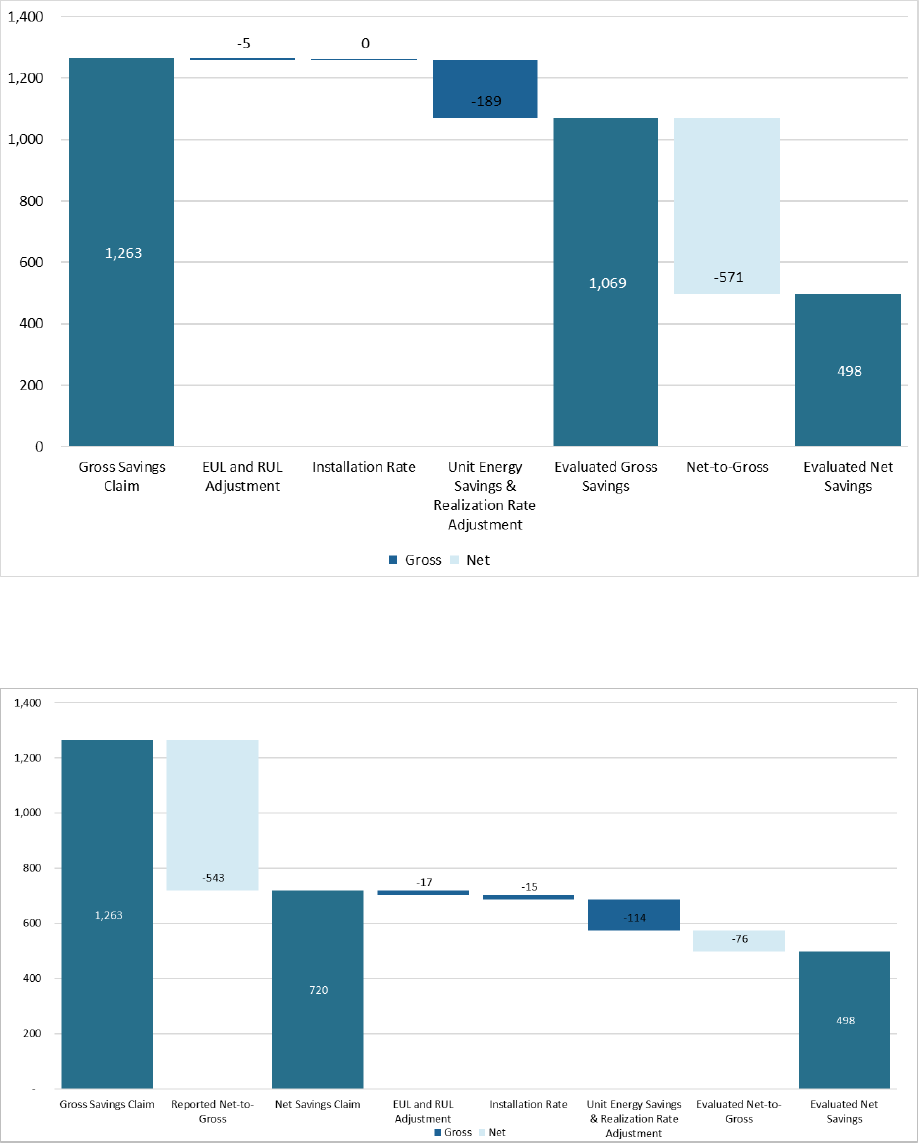

Overview ........................................................................................................................................................................ 32

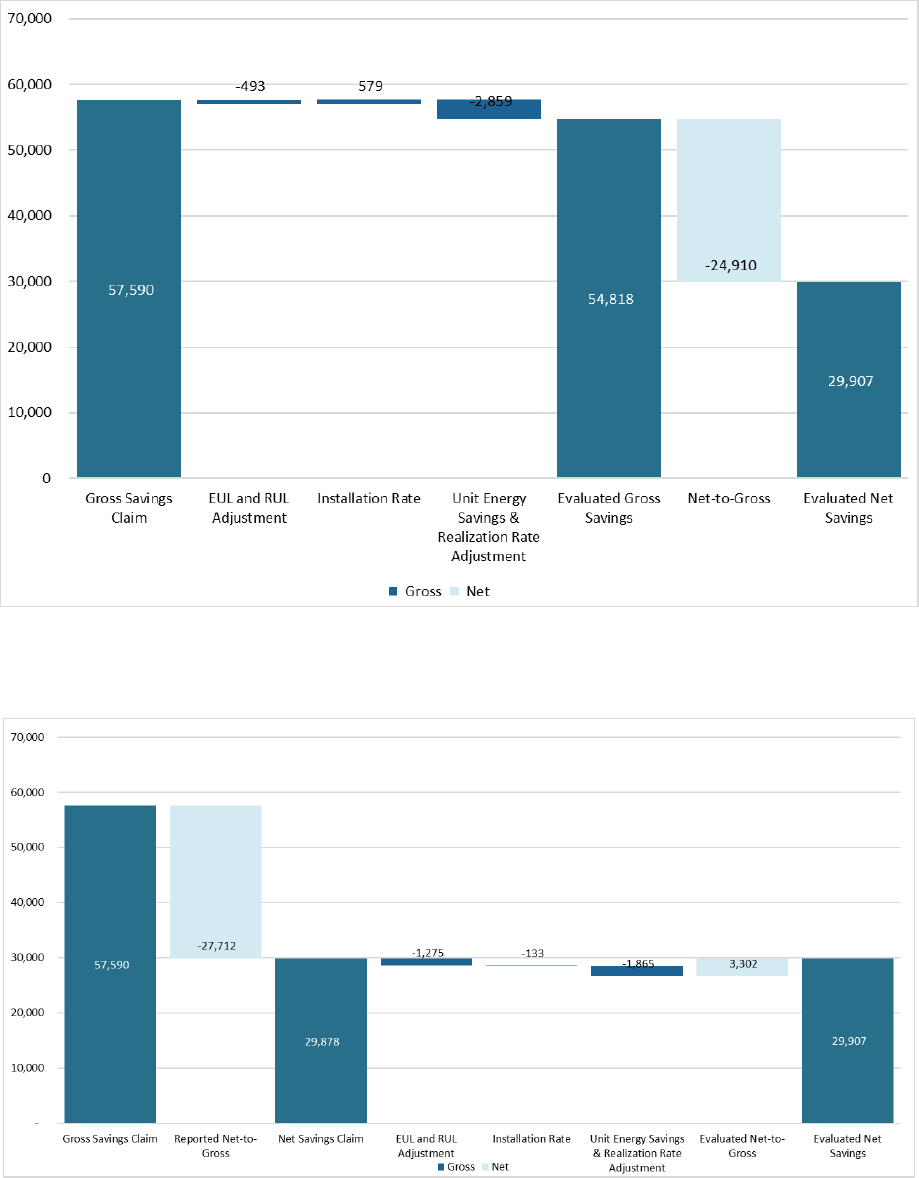

Estimated Savings ........................................................................................................................................................ 33

Commercial Programs ................................................................................................................................................. 33

Highlights....................................................................................................................................................................... 34

Findings .......................................................................................................................................................................... 35

Path to Statewide Goals .............................................................................................................................................. 36

Institutional Partnerships ................................................................................................................................................. 38

Overview ........................................................................................................................................................................ 38

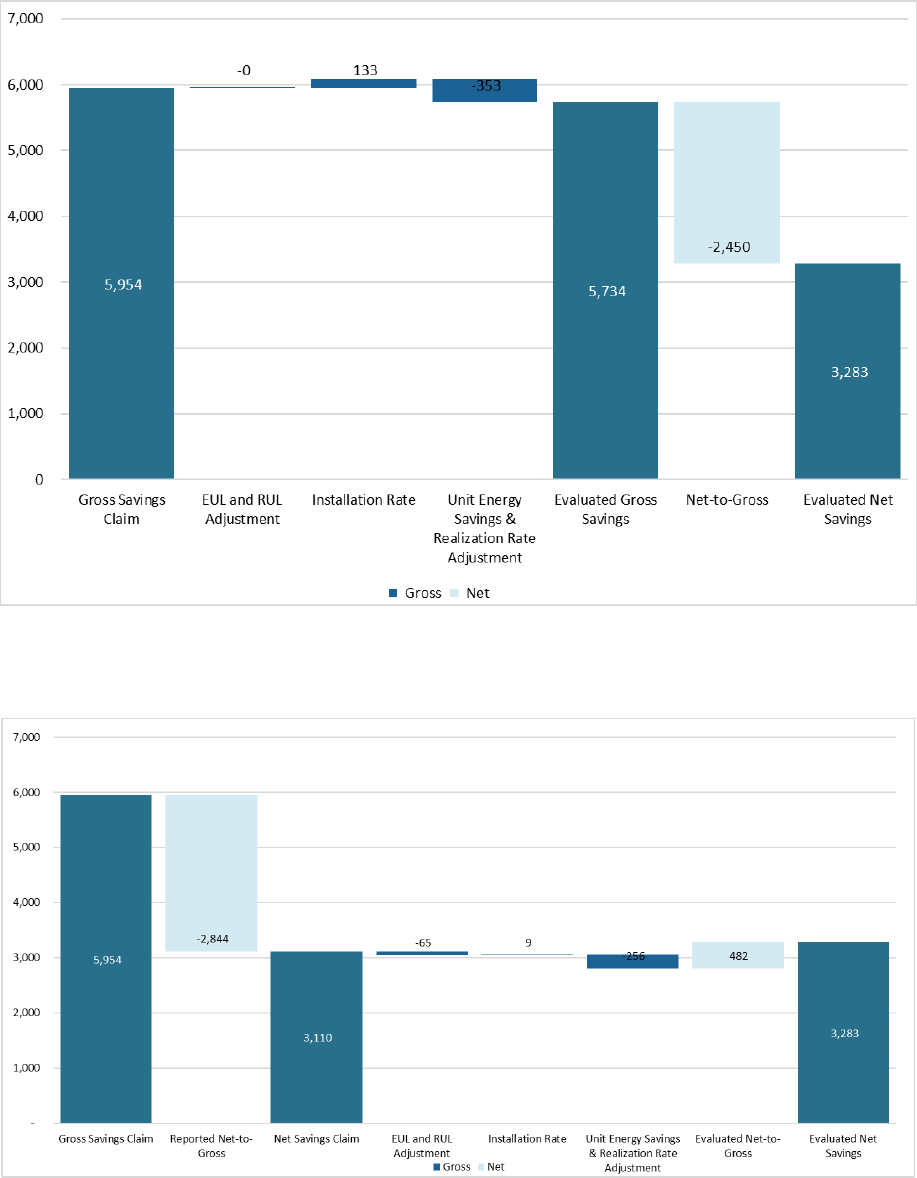

Estimated Savings ........................................................................................................................................................ 38

Institutional Partnership Programs ........................................................................................................................... 39

Highlights....................................................................................................................................................................... 40

Energy Efficiency Report | 2

Findings .......................................................................................................................................................................... 40

Industrial and Agriculture ................................................................................................................................................ 41

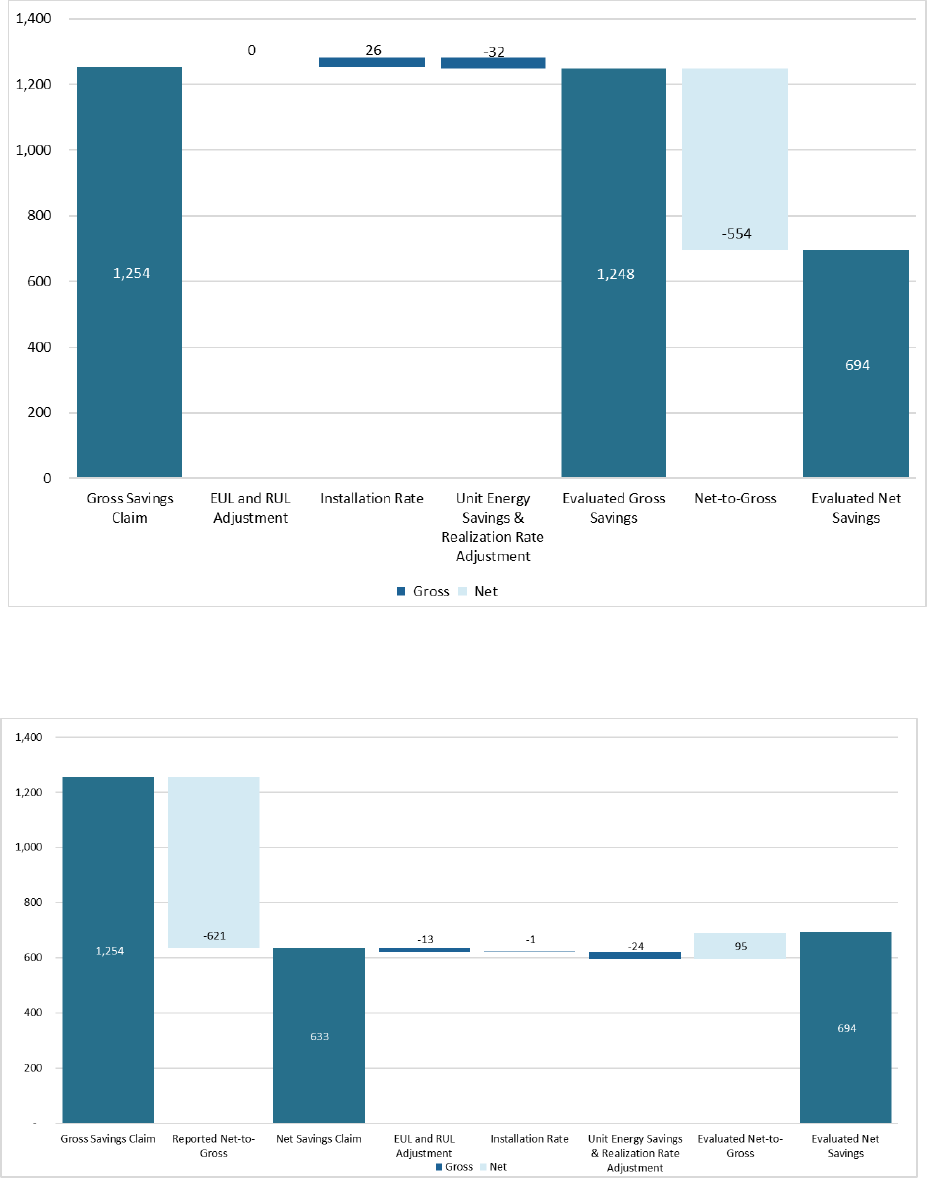

Overview ........................................................................................................................................................................ 41

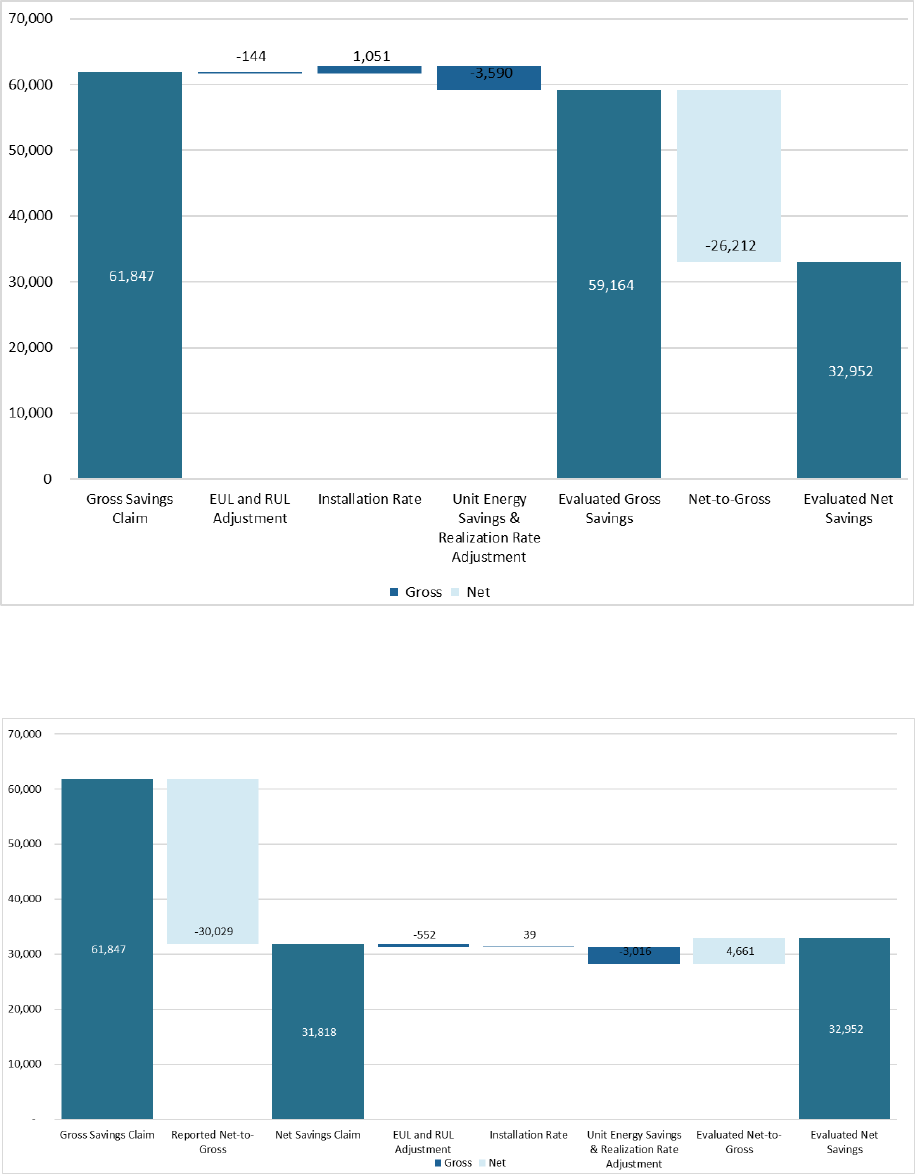

Estimated Savings ........................................................................................................................................................ 41

Industrial & Agricultural Programs ........................................................................................................................... 42

Highlights....................................................................................................................................................................... 43

Findings .......................................................................................................................................................................... 43

Path to Statewide Goals .............................................................................................................................................. 45

Heating, Ventilation, and Air Conditioning .................................................................................................................. 46

Overview ........................................................................................................................................................................ 46

Estimated Savings ........................................................................................................................................................ 47

HVAC Energy Efficiency Programs ......................................................................................................................... 47

Highlights....................................................................................................................................................................... 48

Findings .......................................................................................................................................................................... 48

Path to Statewide Savings ........................................................................................................................................... 51

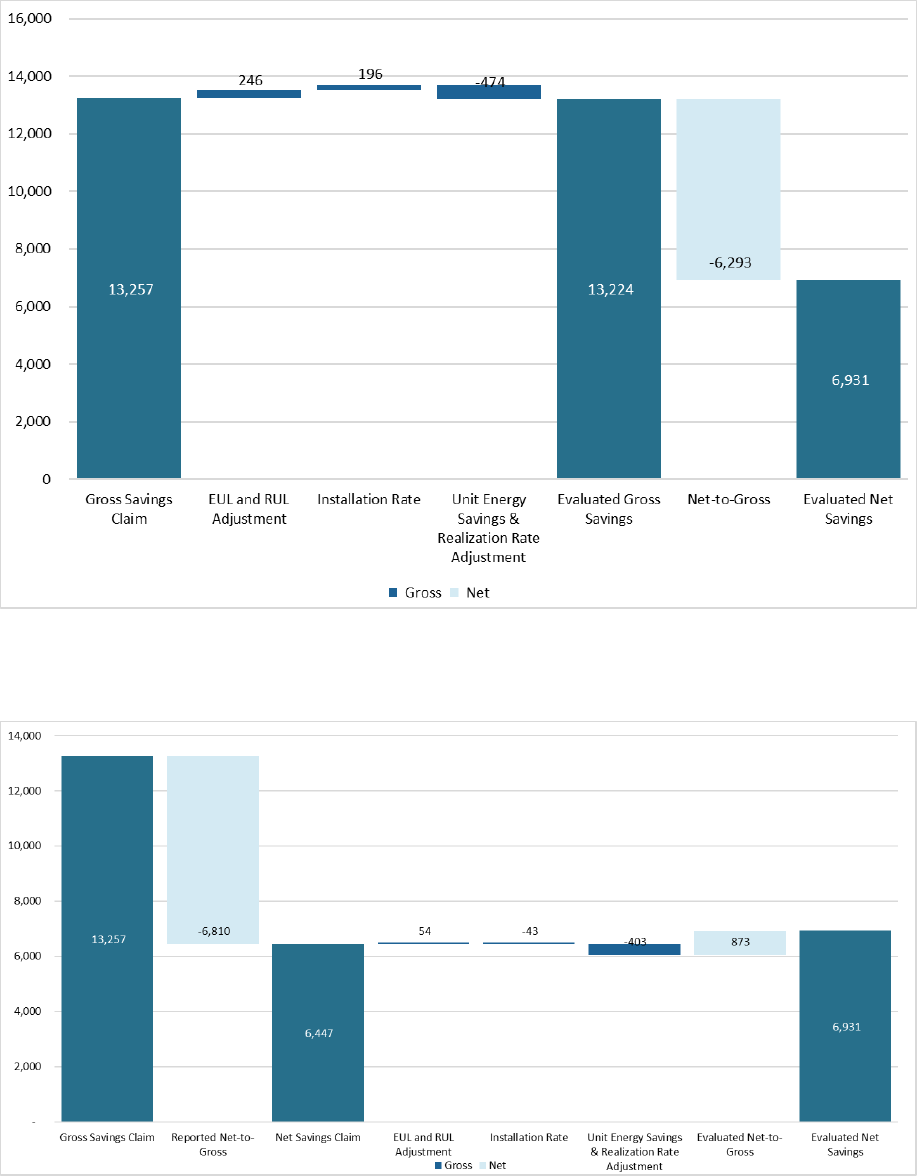

Lighting ............................................................................................................................................................................... 52

Overview ........................................................................................................................................................................ 52

Estimated Savings ........................................................................................................................................................ 53

Lighting Programs ........................................................................................................................................................ 53

Findings .......................................................................................................................................................................... 54

Path to Statewide Goals .............................................................................................................................................. 56

Zero Net Energy / New Construction ......................................................................................................................... 57

Overview ........................................................................................................................................................................ 57

Estimated Savings ........................................................................................................................................................ 58

Zero Net Energy / New Construction Programs .................................................................................................. 58

Highlights....................................................................................................................................................................... 59

Findings .......................................................................................................................................................................... 59

Path to Statewide Goals .............................................................................................................................................. 60

Codes and Standards ........................................................................................................................................................ 62

Overview ........................................................................................................................................................................ 62

Estimated Savings ........................................................................................................................................................ 63

Codes and Standards Programs ................................................................................................................................. 63

Highlights....................................................................................................................................................................... 64

Energy Efficiency Report | 3

Findings .......................................................................................................................................................................... 67

Path to Statewide Goals .............................................................................................................................................. 68

Integrated Demand-Side Management .......................................................................................................................... 69

Overview ........................................................................................................................................................................ 69

Estimated Savings ........................................................................................................................................................ 69

IDSM Programs............................................................................................................................................................ 69

Highlights....................................................................................................................................................................... 70

Findings .......................................................................................................................................................................... 70

Path to Statewide Goals .............................................................................................................................................. 71

Workforce Education & Training .................................................................................................................................. 72

Overview ........................................................................................................................................................................ 72

Estimated Savings ........................................................................................................................................................ 72

WE&T Programs ......................................................................................................................................................... 72

Highlights....................................................................................................................................................................... 73

Findings .......................................................................................................................................................................... 74

Path to Statewide Goals .............................................................................................................................................. 75

Marketing, Education, and Outreach ............................................................................................................................ 76

Overview ........................................................................................................................................................................ 76

Estimated Savings ........................................................................................................................................................ 76

Marketing, Education, and Outreach Programs ...................................................................................................... 76

Highlights....................................................................................................................................................................... 77

Findings .......................................................................................................................................................................... 79

Path to Statewide Goals .............................................................................................................................................. 83

Emerging Technologies ................................................................................................................................................... 84

Overview ........................................................................................................................................................................ 84

Estimated Savings ........................................................................................................................................................ 84

Emerging Technologies Programs ............................................................................................................................ 85

Highlights....................................................................................................................................................................... 85

Findings .......................................................................................................................................................................... 85

Path to Statewide Goals .............................................................................................................................................. 87

Local Government Partnerships .................................................................................................................................... 88

Overview ........................................................................................................................................................................ 88

Energy Efficiency Report | 4

Estimated Savings ........................................................................................................................................................ 89

Local Government Partnership Programs ............................................................................................................... 89

Highlights....................................................................................................................................................................... 90

Findings .......................................................................................................................................................................... 90

Path to Statewide Goals .............................................................................................................................................. 93

Regional Energy Networks & Community Choice Aggregators .............................................................................. 94

Overview ........................................................................................................................................................................ 94

Estimated Savings ........................................................................................................................................................ 95

Overview of Non-IOU Programs ............................................................................................................................. 96

Highlights....................................................................................................................................................................... 97

Findings .......................................................................................................................................................................... 98

Finance.............................................................................................................................................................................. 101

Overview ...................................................................................................................................................................... 101

Estimated Savings ...................................................................................................................................................... 101

Energy Efficiency Financing Programs .................................................................................................................. 101

Highlights..................................................................................................................................................................... 105

Findings ........................................................................................................................................................................ 106

Path to Statewide Goals ............................................................................................................................................ 107

Public Utilities Code 913.9 Report ............................................................................................................................... 108

Glossary ............................................................................................................................................................................ 110

Appendices ....................................................................................................................................................................... 115

Appendix A: IOU Savings Compared to CPUC Savings Goals ......................................................................... 115

Appendix B: Energy Savings by Sector and End Use .......................................................................................... 119

Appendix C: Emissions Reductions ........................................................................................................................ 129

Appendix D: Cost-Effectiveness Results ............................................................................................................... 131

Appendix E: Program Level Detail – Net Lifecycle kW, kWh, Therms ........................................................... 134

Appendix F: Ex-Post Gross Lifecycle Savings by Sector, GWh, MMTherms ................................................ 135

Appendix G: Processing and Updating Utility Claim Data with Evaluation Results Data ........................... 143

Appendix H: Evaluation Decision Framework .................................................................................................... 146

Appendix I: Order-Independent Impacts of Ex Post Parameter updates on Ex Ante Reported Parameters.

....................................................................................................................................................................................... 159

Appendix J: Chapter Data Overlaps ....................................................................................................................... 170

Energy Efficiency Report | 5

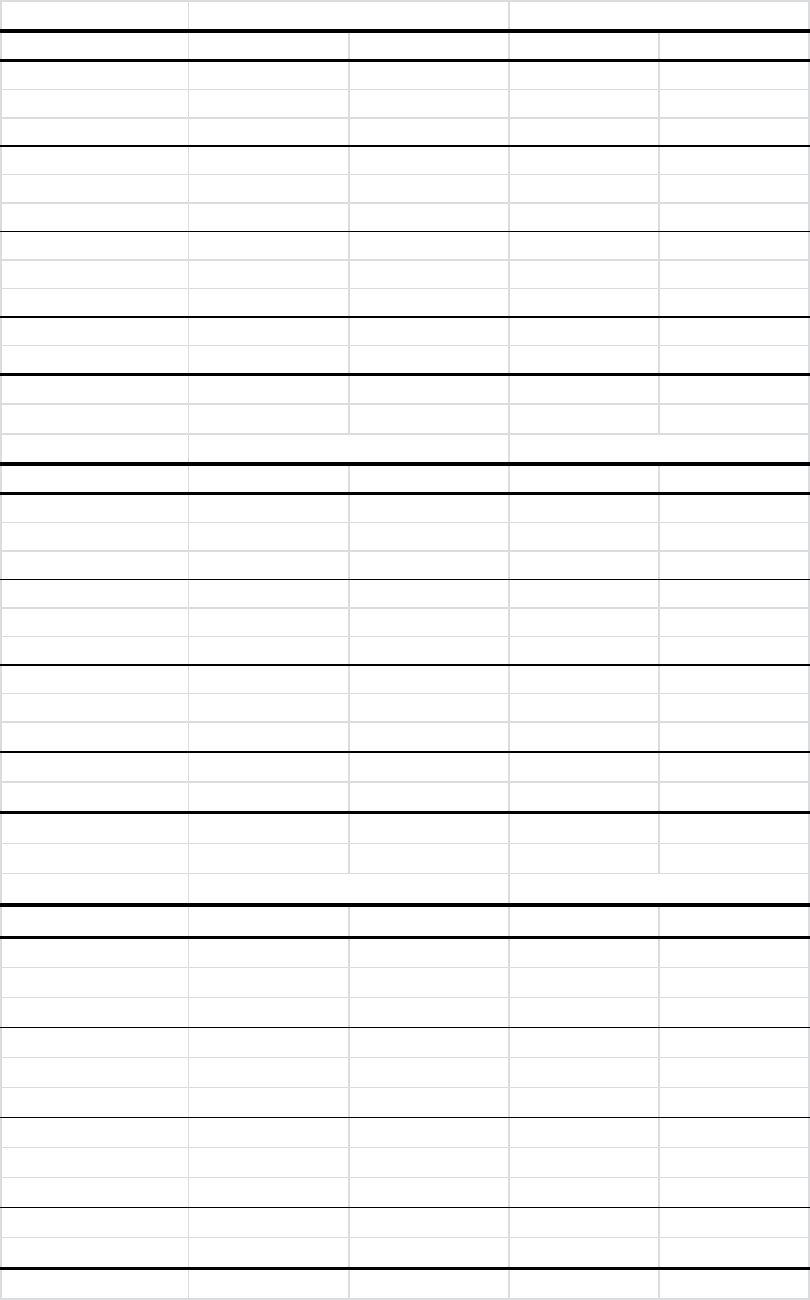

Tables & Figures

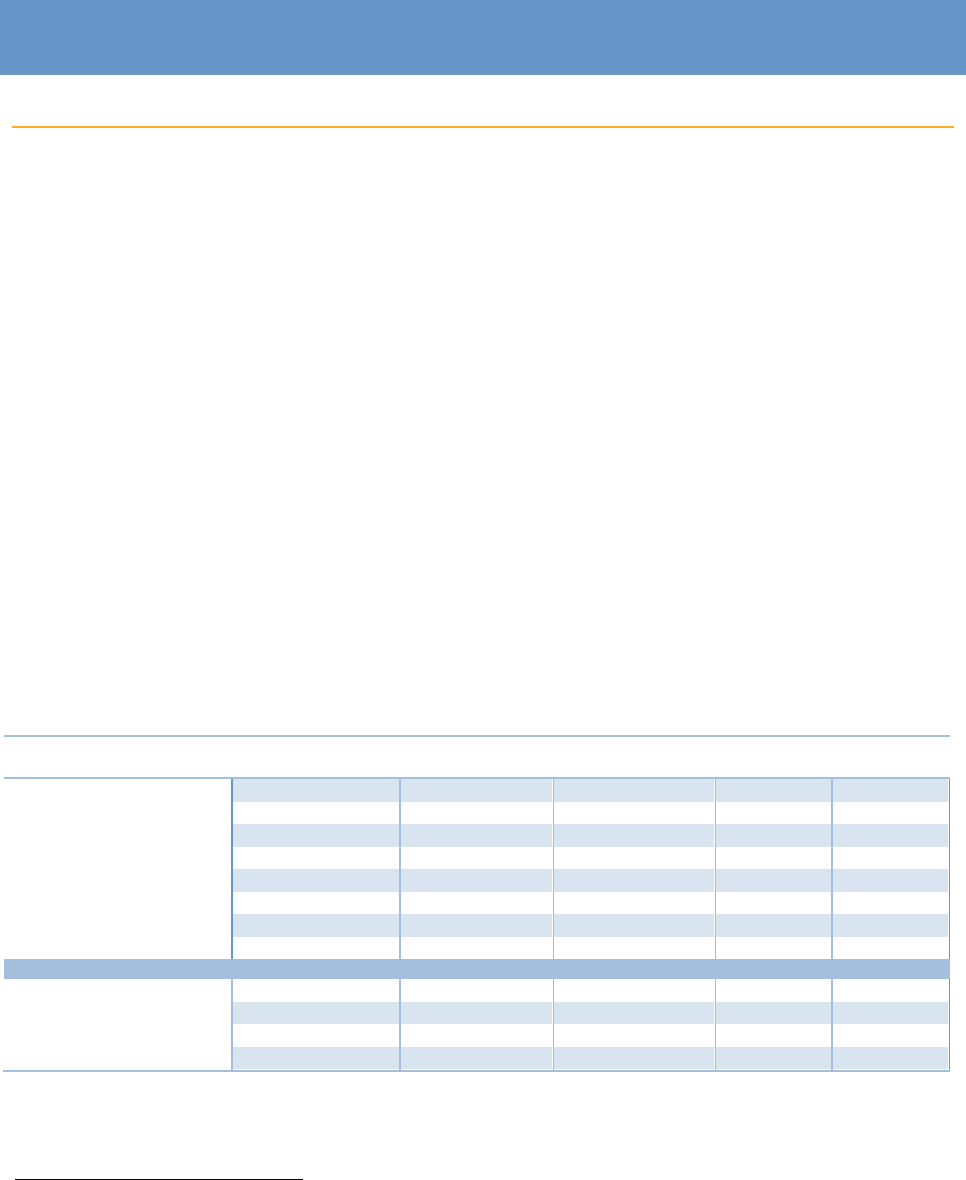

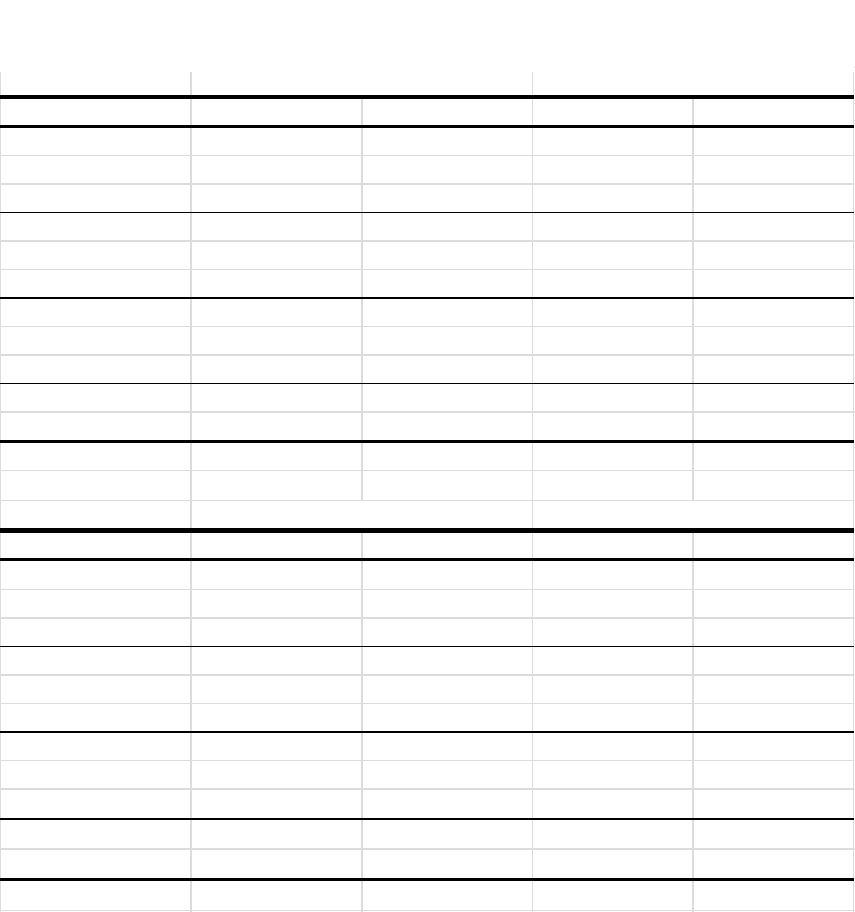

Table ES-1: Energy Efficiency Savings Goals ............................................................................................................... 8

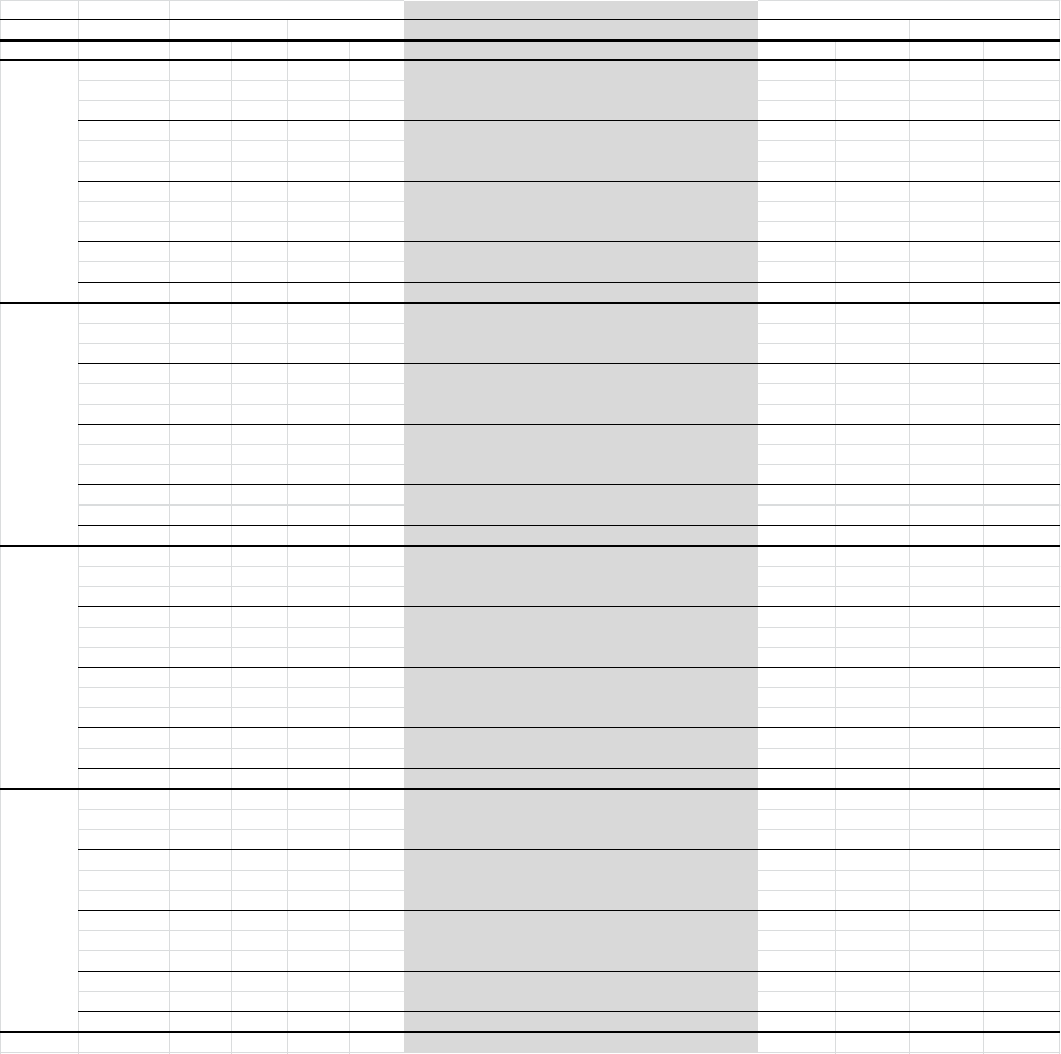

Table ES-2: 2013-2015 Energy Efficiency Programs Energy and Emissions Savings ............................................ 9

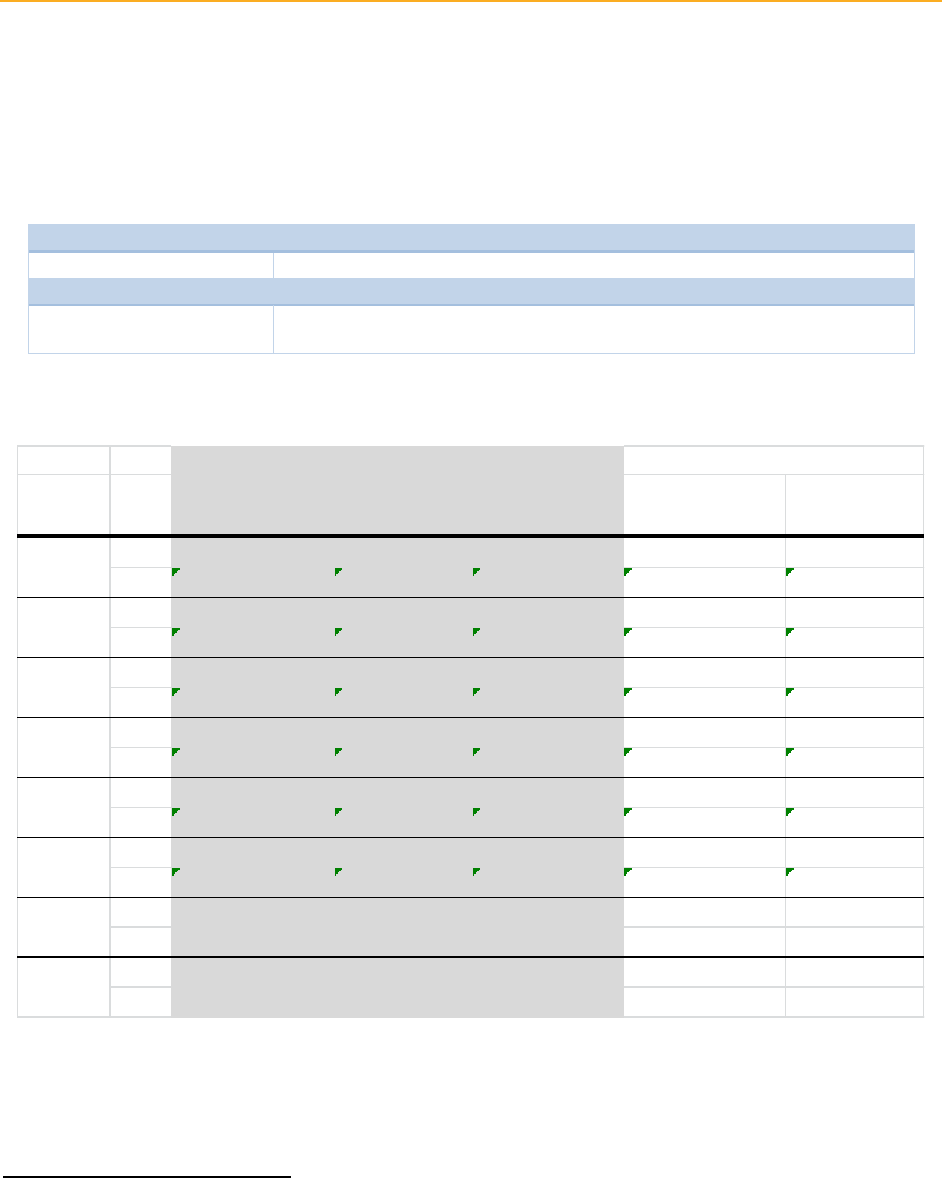

Table ES-3: Total Resource Cost by Year .................................................................................................................... 11

Table 1: 2013-2015 IOU Program Goals ...................................................................................................................... 16

Table 2: Savings, Emissions, and Cost-Effectiveness of 2013-2015 Portfolio ....................................................... 18

Table 3: Goals for the 2013-2015 Portfolio ................................................................................................................. 19

Table 4: Residential Sector Savings Snapshot .............................................................................................................. 26

Table 5: Commercial Building Types by Square Footage ......................................................................................... 32

Table 6: Commercial Sector Savings Snapshot ............................................................................................................ 33

Table 7: Institutional Partnerships Programs Savings Snapshot ............................................................................... 39

Table 8: Institutional Partnerships - Resource Partnerships ...................................................................................... 39

Table 9: Institutional Partnerships - Non-Resource Partnerships ............................................................................ 40

Table 10: Industrial and Agriculture Sector Savings Snapshot* ................................................................................ 41

Table 11: HVAC Program Savings Snapshot* ............................................................................................................. 47

Table 12: Lighting Savings Snapshot ............................................................................................................................. 53

Table 13: Zero Net Energy Programs Savings Snapshot ........................................................................................... 58

Table 14: 2013-2015 Codes and Standards Portfolio Goals ...................................................................................... 62

Table 15: Table 14: 2013-2015 Codes and Standards Savings Snapshot ................................................................. 63

Table 16: Title 20 Standards ............................................................................................................................................ 65

Table 17: Federal Standards ............................................................................................................................................ 65

Table 18: Title 24 Standards ............................................................................................................................................ 66

Table 19: Codes and Standards ....................................................................................................................................... 66

Table 20: Compliance Improvement Training Classes ............................................................................................... 67

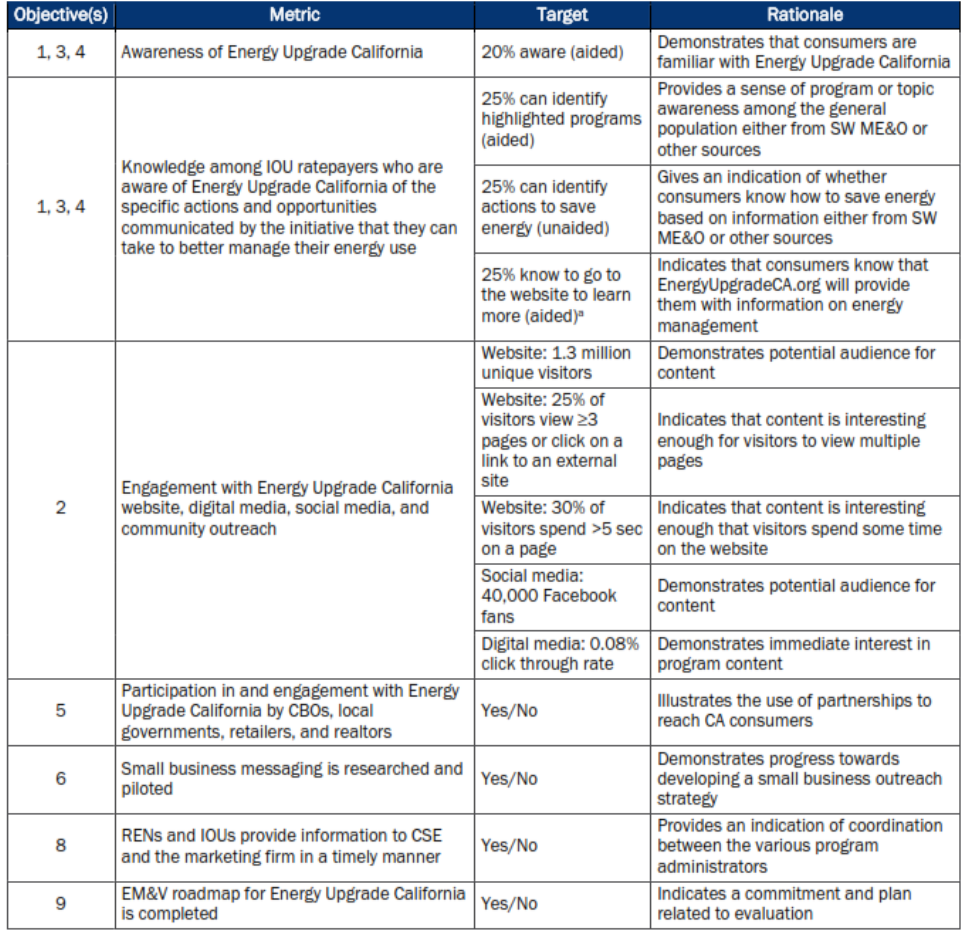

Table 21: Marketing, Education & Outreach Objectives ........................................................................................... 77

Table 22: Emerging Technologies Program Budget by IOU .................................................................................... 84

Table 23: Local Government Partnerships Savings Snapshot ................................................................................... 89

Table 24: RENs and CCAs Savings Snapshot ............................................................................................................. 95

Table 25: Subprograms Included in the EM&V Studies ............................................................................................ 98

Table 26: On-Bill Financing Loan fund Activities from Program Inception to December 31, 2015 ............... 104

Table 27: OBF Loans Issued Statewide ...................................................................................................................... 104

Table 28: Statewide Lending by Market ...................................................................................................................... 105

Table 29: Cumulative Loan Defaults and Partial Payments since Inception through 2015 ............................... 106

Table A-1: Statewide Energy Savings for 2013-2015 Portfolio: Goals, Reported, Evaluated ............................ 115

Table A-2: PG&E Energy Savings for 2013-2015 Portfolio ................................................................................... 116

Table A-3: SCE Energy Savings for 2013-2015 Portfolio ........................................................................................ 116

Table A-4: SCG Energy Savings for 2013-2015 Portfolio ....................................................................................... 117

Table A-5: SDG&E Energy Savings for 2013-2015 Portfolio ................................................................................ 117

Table B-1a: 2013-2015 Statewide First Year Energy Savings by Sector ................................................................ 120

Table B-1b: 2013-2015 Statewide Lifecycle Energy Savings by Sector .................................................................. 121

Table B-2a: 2013-2015 First Year Savings by Sector and Program Administrator .............................................. 122

Table B-2b: 2013-2015 Lifecycle Savings by Sector and Program Administrator ............................................... 123

Table B-3a: 2013-2015 Statewide First Year Energy Savings by End Use ............................................................ 124

Energy Efficiency Report | 6

Table B-3b: 2013-2015 Statewide Lifecycle Savings by End Use ........................................................................... 125

Table B-4a: 2013-2015 Statewide First Year Savings by Sector and End Use ...................................................... 126

Table B-4b: 2013-2015 Statewide Lifecycle Savings by Sector and End Use ....................................................... 127

Table C-1a: Evaluated First Year Emissions Reductions by Program Administrator ......................................... 128

Table C-1b: Evaluated Lifecycle Emissions Reductions by Program Administrator .......................................... 129

Table D-1: IOU Reported and Commission Evaluated Cost Effectiveness - with and without Codes &

Standards (C&S) .............................................................................................................................................................. 131

Table H-1: Impact Evaluation Reports by Program Year(s) Studied ..................................................................... 145

Table H-2: Ex-Post Targeted ESPI Classifications and Uncertain Measures and Evaluation Reports ............ 146

Table H-3: Impact Evaluation Reports by Program Year(s) Studied ..................................................................... 152

Table H-4: Ex-Post Targeted ESPI Classifications and Uncertain Measures and Evaluation Reports ............ 153

Table J-1: Savings Impacts of Lighting and HVAC Measures on Market Sectors ............................................... 169

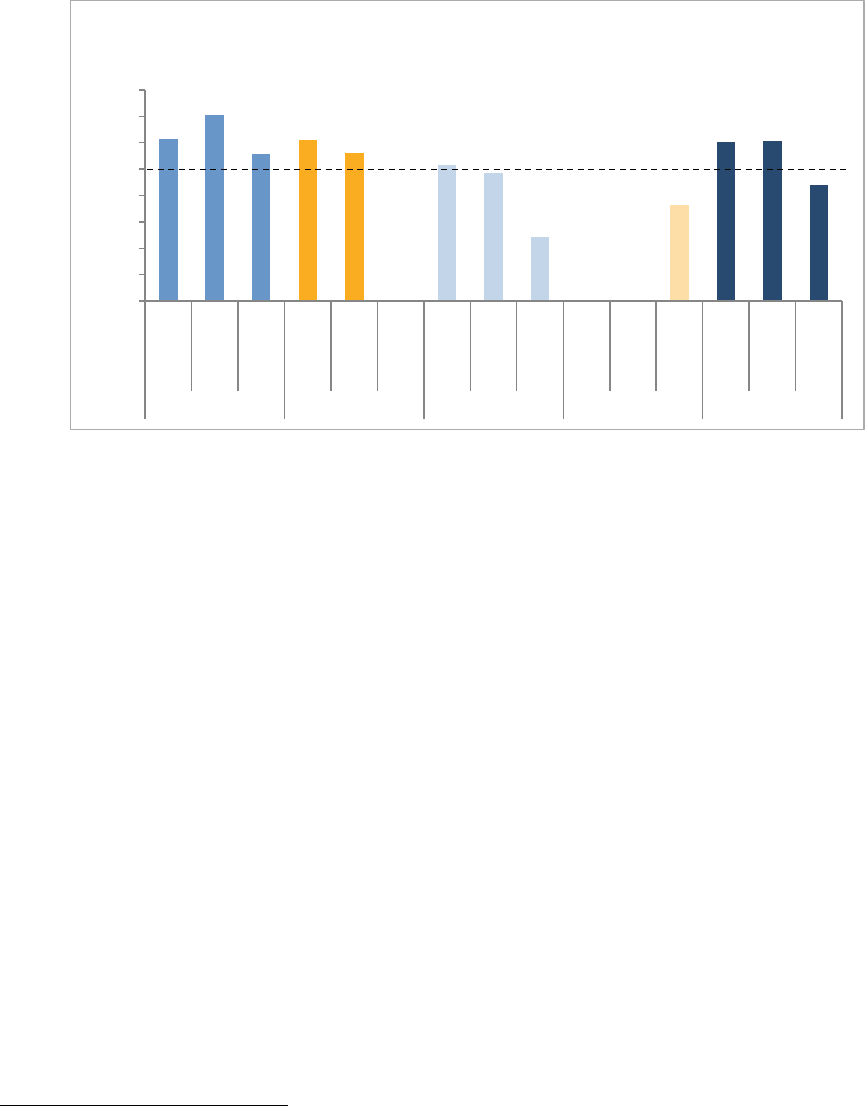

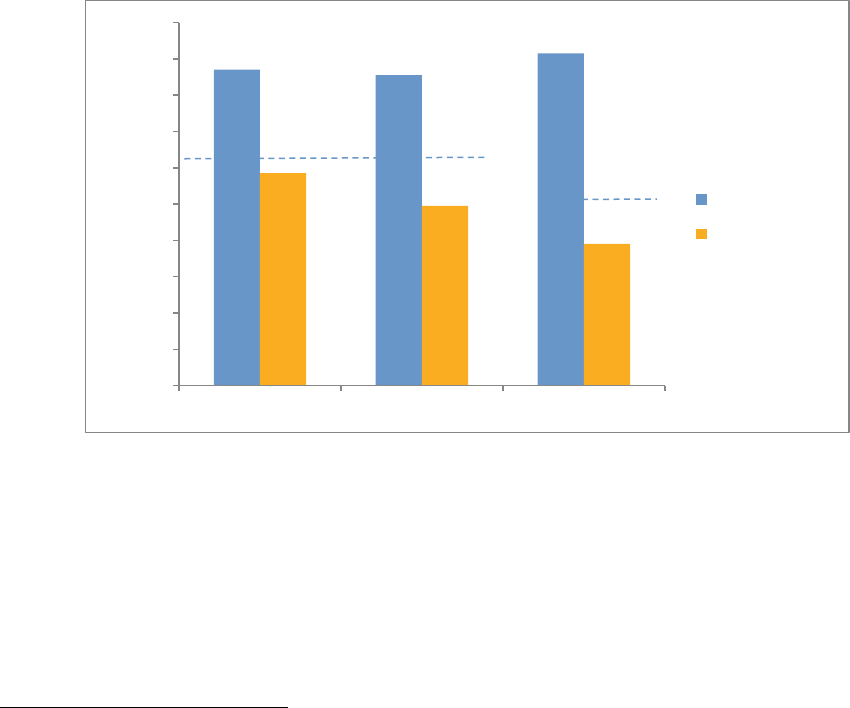

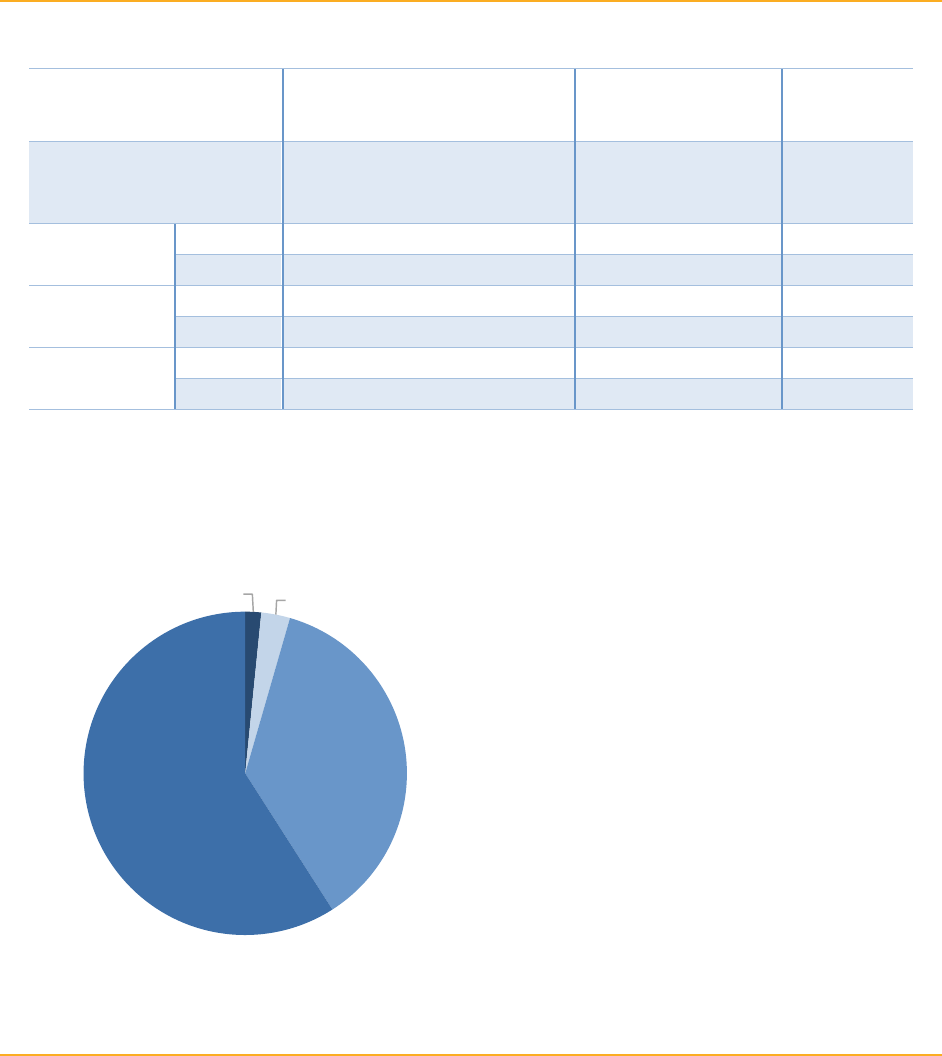

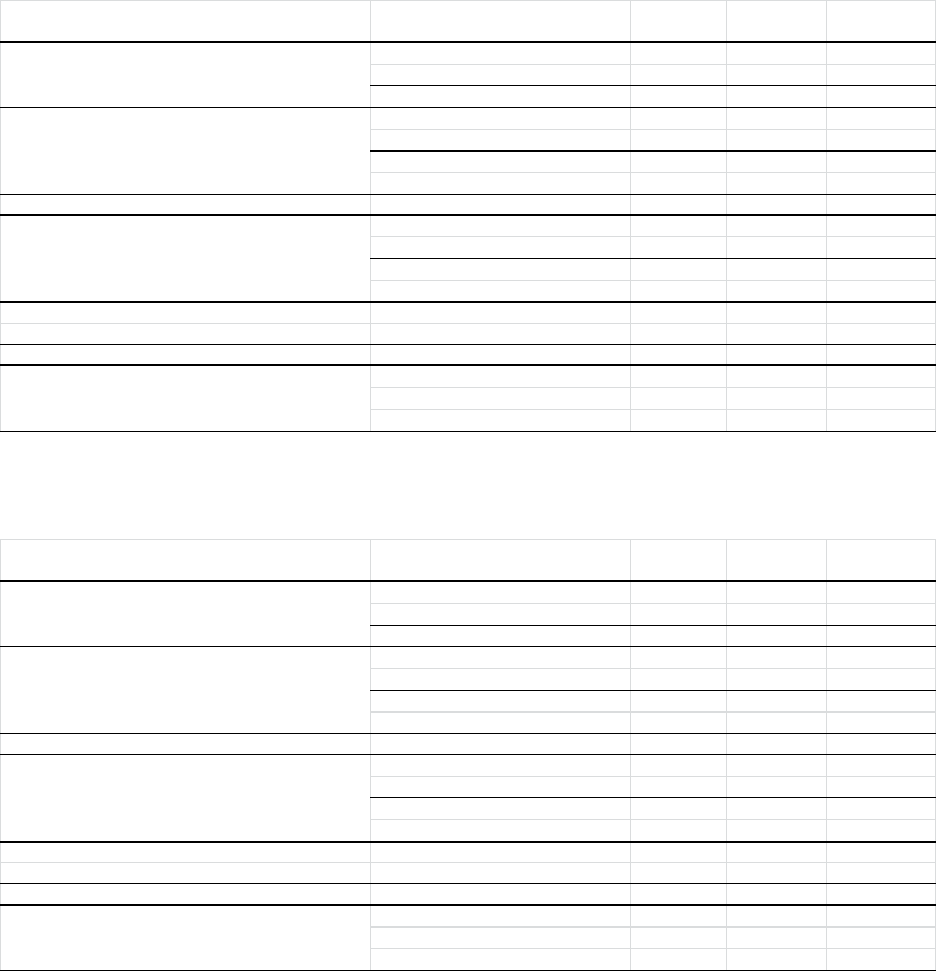

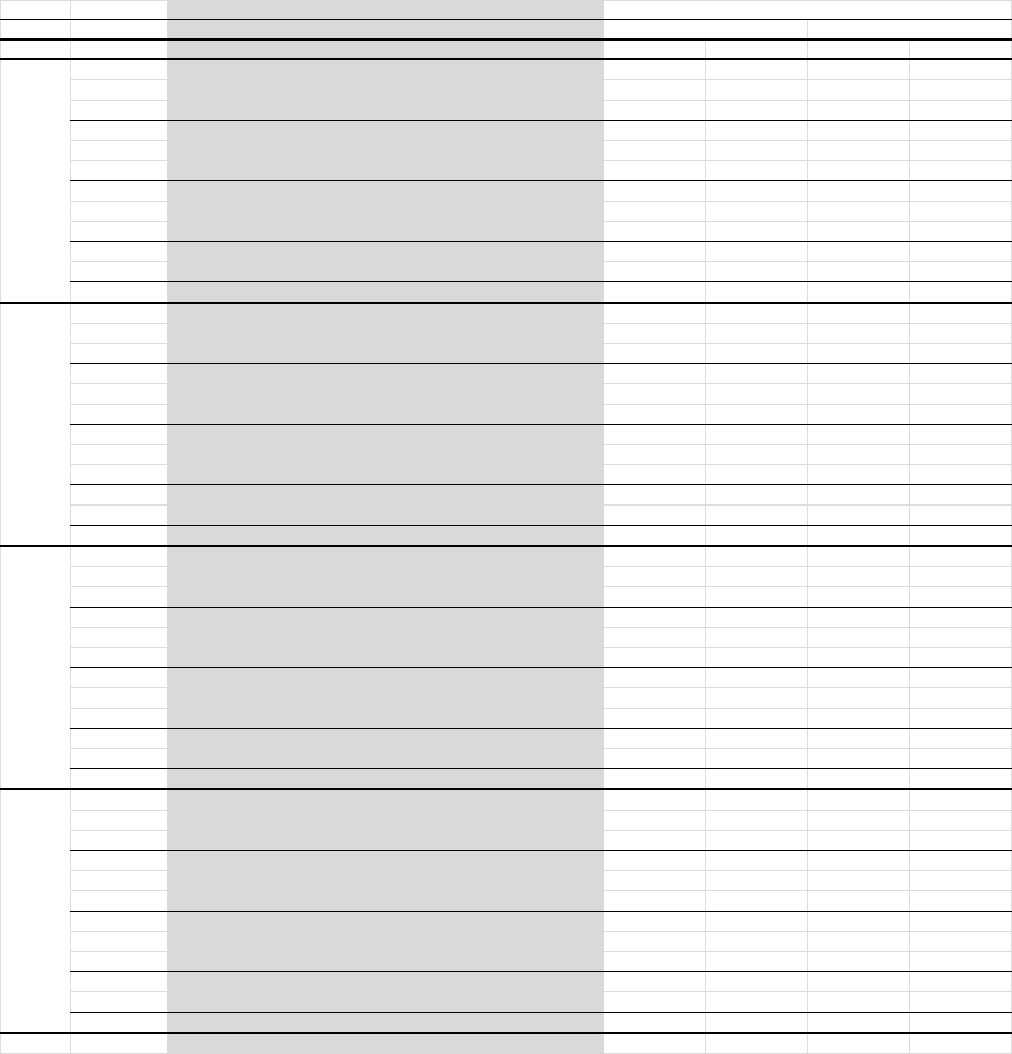

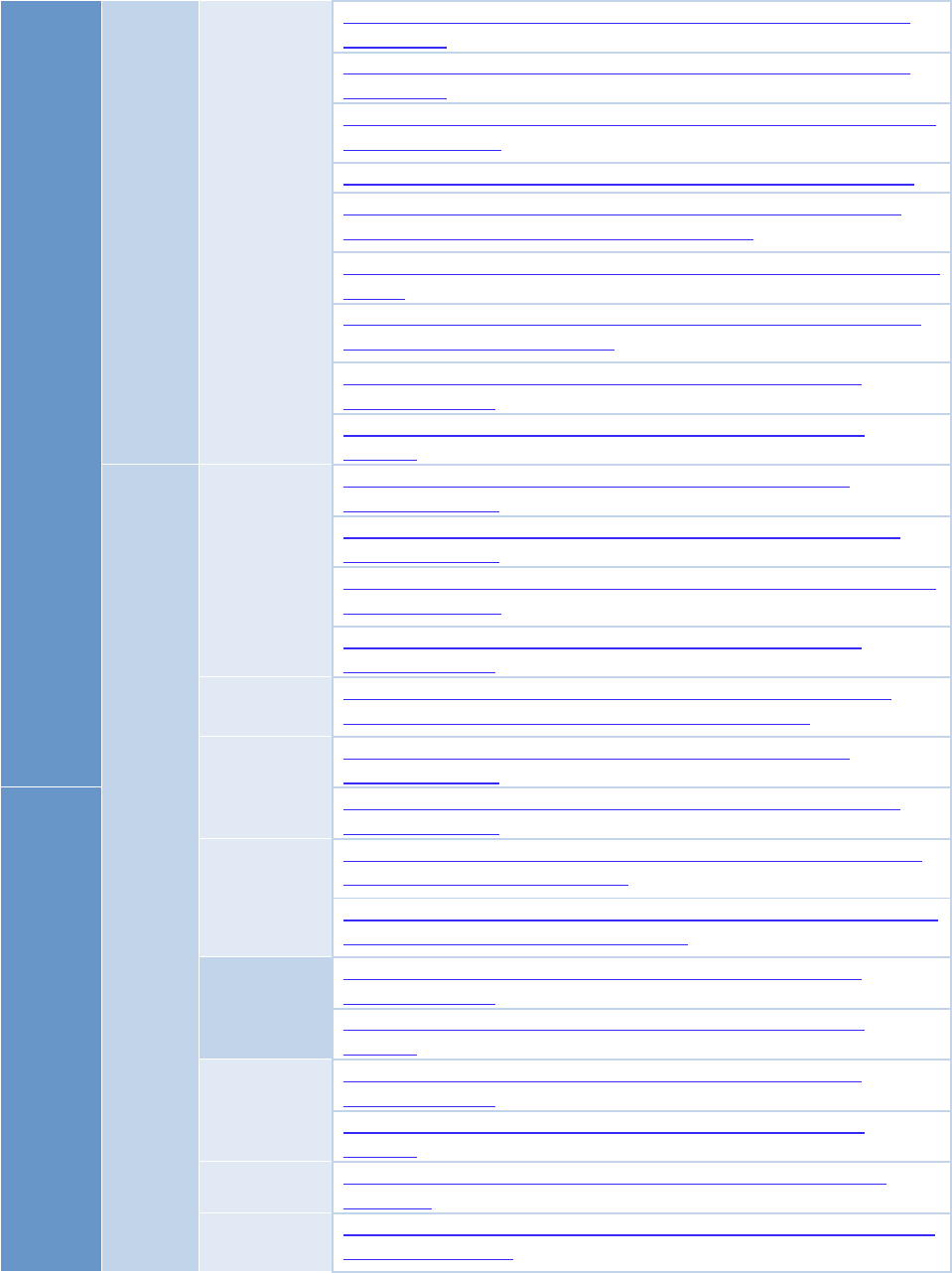

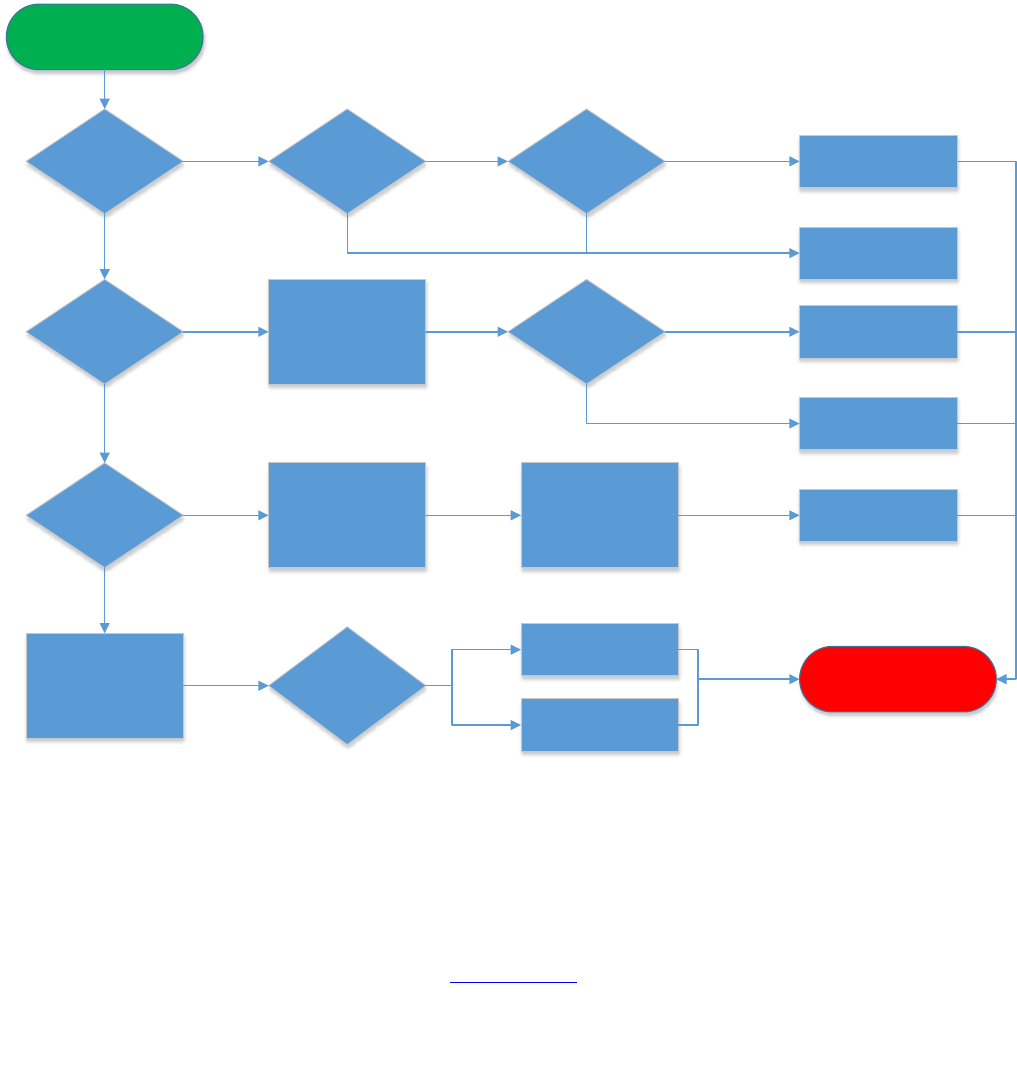

Figure ES-1: 2013-2015 Energy Efficiency Goal Attainment by IOU .................................................................... 10

Figure 1: 2013-2015 Energy Efficiency Goal Attainment by IOU ........................................................................... 19

Figure 2: Annual IOU Portfolio Cost Effectiveness Ratios (2013-2015) ................................................................ 20

Figure 3: Portfolio Cost-Effectiveness Ratios, Including Codes & Standards ....................................................... 21

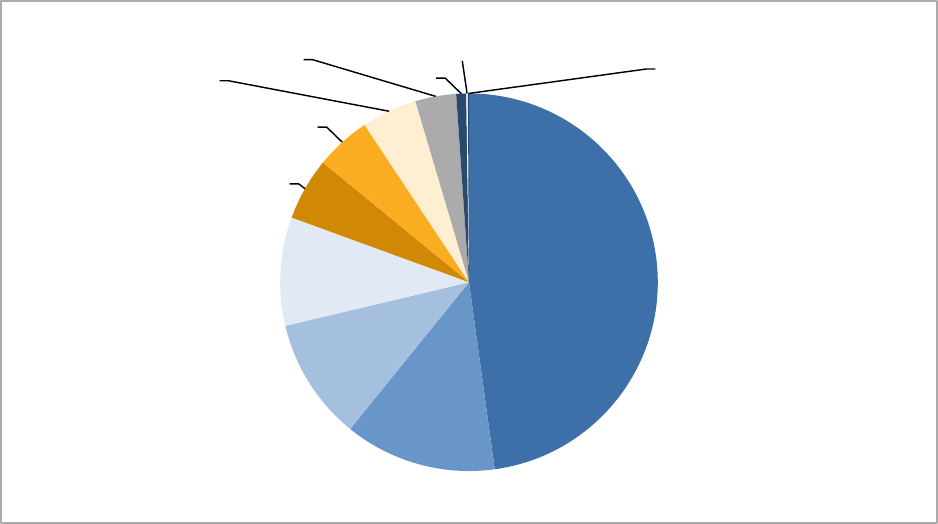

Figure 4: Percentage of Electricity Savings by End Use ............................................................................................. 23

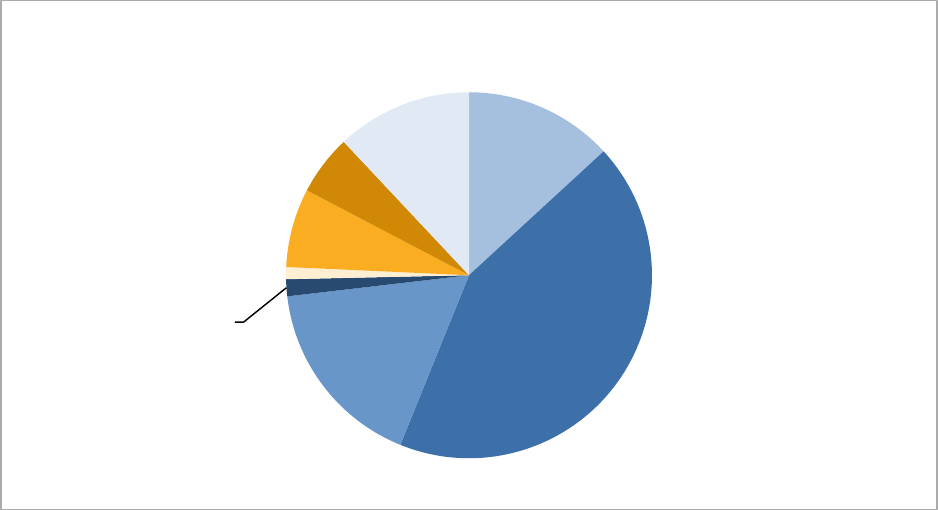

Figure 5: Percentage of Natural Gas Savings by End Use ......................................................................................... 24

Figure 6: Percent of 2013-2015 Evaluated Net Energy Savings from Lighting Measures by Sector .................. 53

Figure 7: Percent of Energy Savings by Lighting Measure ........................................................................................ 54

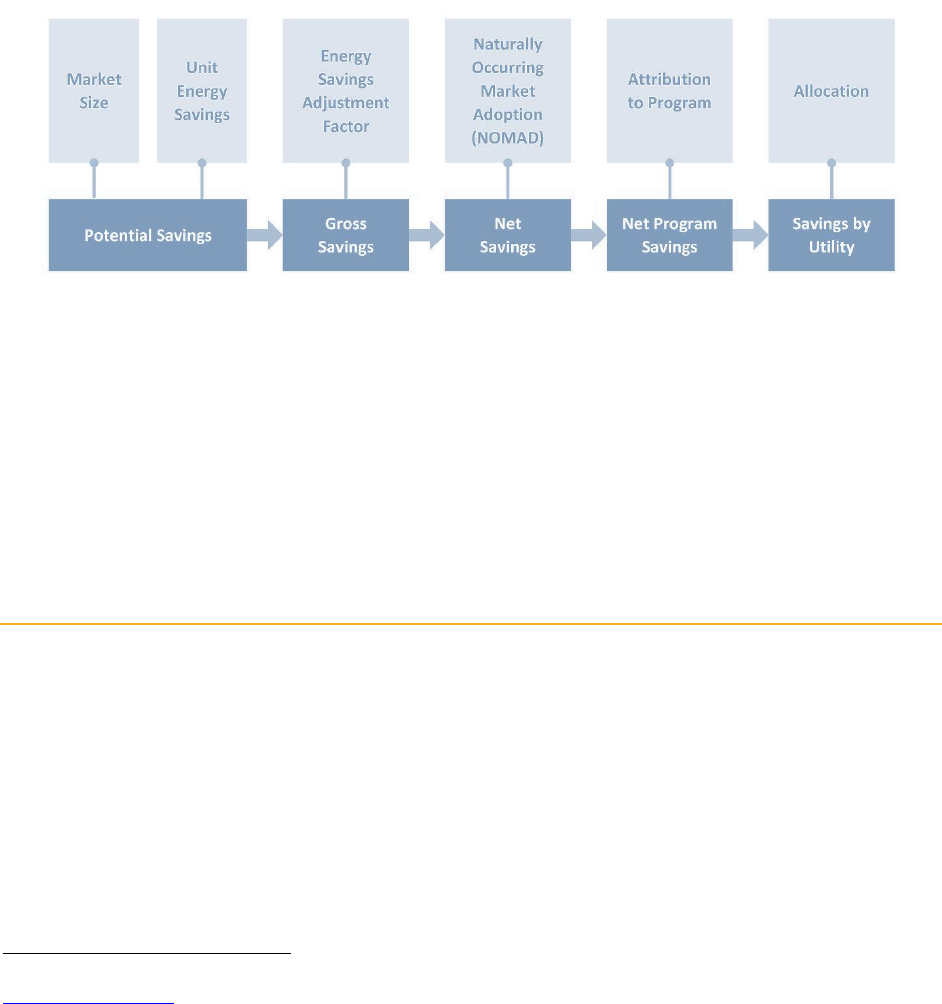

Figure 8: Codes and Standards Advocacy Program Evaluation Protocol ............................................................... 64

Figure 9: Summary of SW ME&O Objectives and Associated Objectives ............................................................. 78

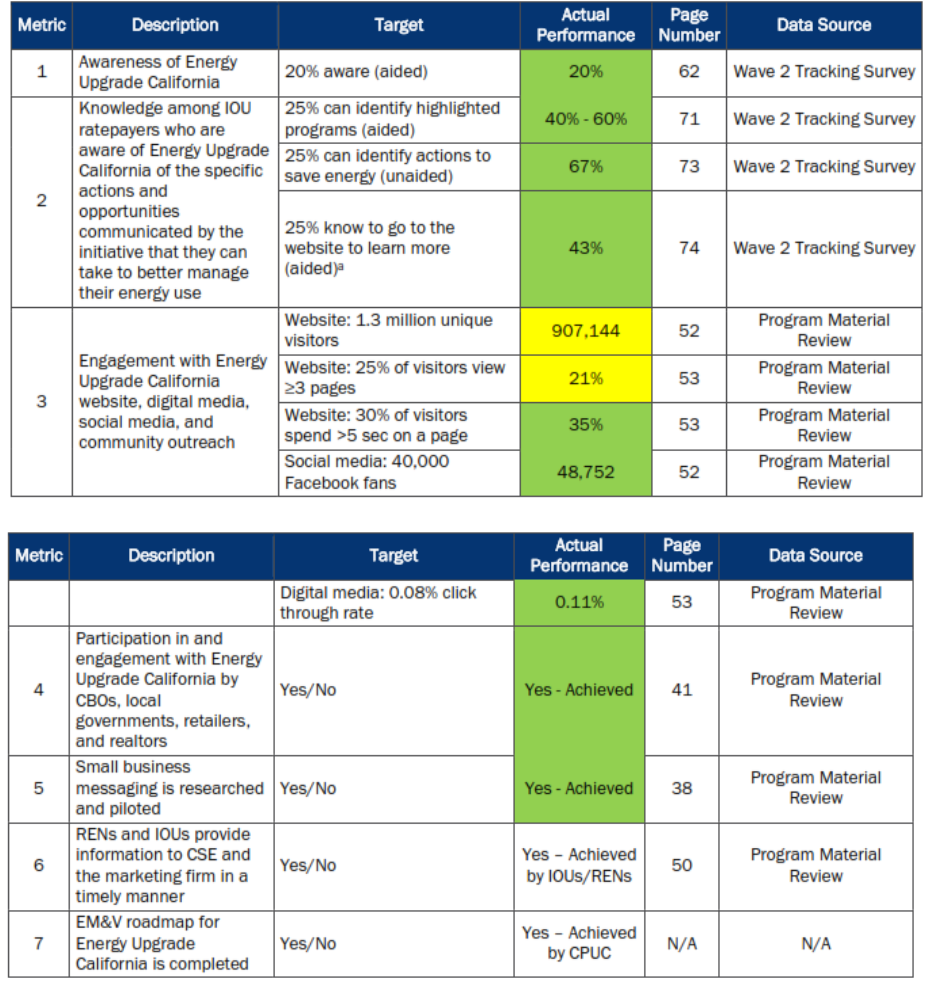

Figure 10: SW ME&O Program Performance Against Approved Metrics ............................................................. 80

Energy Efficiency Report | 7

Acronyms

C & S Codes and Standards

CCA Community Choice Aggregator

CEC California Energy Commission

CLEESP California Long-Term Energy Efficiency Strategic Plan (Strategic Plan)

CO2 Carbon Dioxide

CPUC California Public Utilities Commission

EMT Energy Management Technology

EUC Energy Upgrade California

ETP Emerging Technologies Program

EM&V Evaluation, Measurement, and Verification

GWh Gigawatt-hours

HVAC Heating, Ventilation, Air Conditioning

IDSM Integrated Demand Side Management

IOU Investor-owned utility

MCE Marin Clean Energy

ME&O Marketing, Education, & Outreach

MMBTU Million British Thermal Units

NTGR Net to Gross Ratio

NOx Nitrogen Oxide

PA Program administrator

PIP Program Implementation Plan

PG&E Pacific Gas & Electric

REN Regional Energy Network

SCE Southern California Edison

SCG Southern California Gas Company

SDG&E San Diego Gas & Electric

SEM Strategic Energy Management

TRC Total Resource Cost

ZNE Zero Net Energy

Energy Efficiency Report | 8

Executive Summary

Scope of California’s Energy Efficiency Programs

The California Public Utilities Commission’s (CPUC) Energy Efficiency Portfolio Report summarizes the

achievements of California’s energy efficiency programs implemented from the start of 2013 through 2015.

These programs help California become more energy efficient by reducing electricity and natural gas

consumption while collectively resulting in significant reductions to California’s greenhouse gas emissions.

Energy savings were measured through more than 100 evaluation studies conducted across the set of more

than 400 programs that constituted the 2013-2015 energy efficiency program portfolio. These studies verified

the energy savings and accurately measured the progress toward meeting state energy efficiency and climate

goals. The success of energy efficiency programs affects the future need for additional power plants and

related energy infrastructure. Accurate measurement of the savings impact of California’s energy efficiency

programs, through these evaluation studies, is therefore of critical importance to planning California’s energy

future. Impact evaluations of programs take place after the program year of interest has concluded. These

evaluation studies can take a year or more to complete, with additional time needed for data processing. The

CPUC thus received data from the last of the 2015 impact evaluations in mid-2017. Compilation and analysis

of the full program cycle data set, along with writing itself, were then conducted to produce this report.

While the CPUC provides direction and oversight for the energy efficiency programs, the programs

themselves are implemented and administered by program administrators (PAs). Program administrators in

the 2013-2015 energy efficiency portfolio included the four major investor-owned utilities (IOUs): Pacific

Gas & Electric (PG&E), Southern California Edison (SCE), Southern California Gas Company (SCG), and

San Diego Gas & Electric (SDG&E), as well as two regional energy networks, BayREN and SoCalREN, and

one community choice aggregator, Marin Clean Energy (MCE).

The 2013-2015 portfolio cycle is the last cycle to follow the 3-year program cycle structure. In 2013, the

CPUC issued the “Order Instituting Rulemaking Concerning Energy Efficiency Rolling Portfolios, Policies,

Programs, Evaluation, and Related Issues.” The Rolling Portfolio framework is envisioned as a long-term

(e.g. 10-year) authorization and planning framework for energy efficiency programs after 2015. The CPUC is

currently in the process of implementing this new framework.

Portfolio Impacts and Success of the 2013-2015 Energy Efficiency Programs

The CPUC considers a portfolio successful if the program meets the energy savings goals set at the beginning

of the program and is cost-effective. The effectiveness of the energy efficiency portfolio is measured via four

distinct metrics (corresponding units in parentheses):

energy savings (electricity in GWh and natural gas in MM therms)

peak electricity demand savings (MW)

emissions savings (tons of CO2 and tons of NOx)

Cost-effectiveness (overall dollar savings of from the program exceeds the program costs)

Throughout this document, there is a distinction made between “net” and “gross” savings. This distinction

refers to the fact that some program incentives are provided to customers who would have adopted the

Energy Efficiency Report | 9

energy efficiency equipment or practice even without at utility program. The gross savings estimate includes

these so-called free riders (i.e., gross savings estimates simply represent the estimated savings per EE widget

times the number of rebates provided for the EE widget), whereas the net savings estimates back out savings

attributed to these free riders to determine what savings occurred as a result of the EE program’s existence.

The discussion of energy savings at the portfolio level focuses on evaluated gross savings because the 2013-

2015 portfolio goals were set for evaluated gross savings. In individual sector or program chapters, however,

the default savings values discussed are evaluated net savings, in order to focus the discussion on the savings

that occurred as a direct result of program impacts and because cost-effectiveness is calculated based on net

savings.

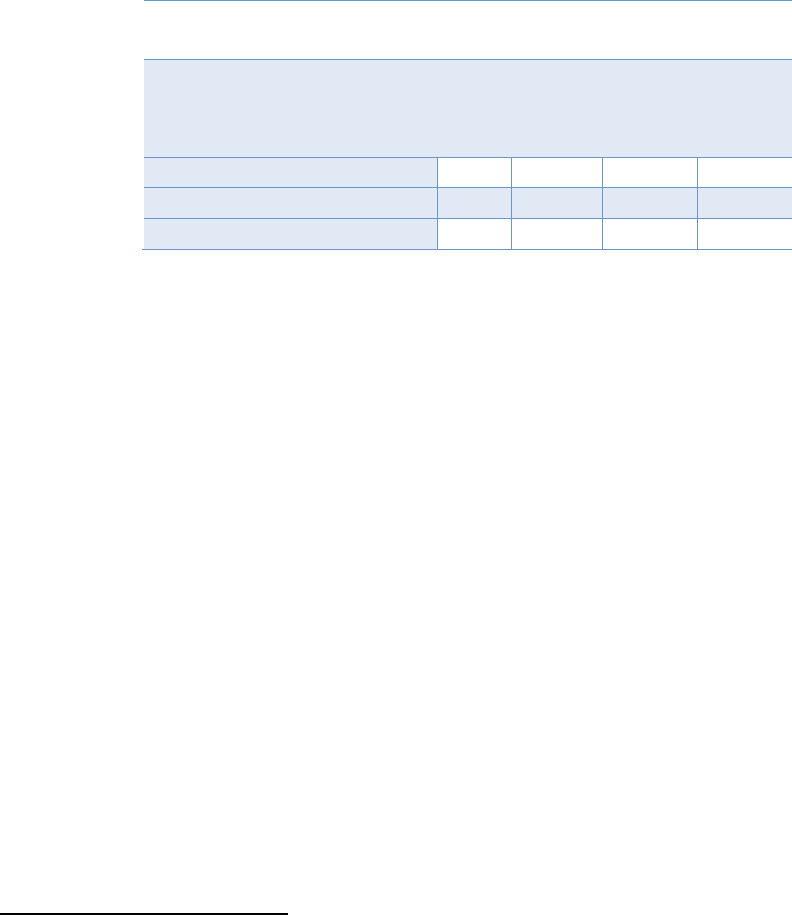

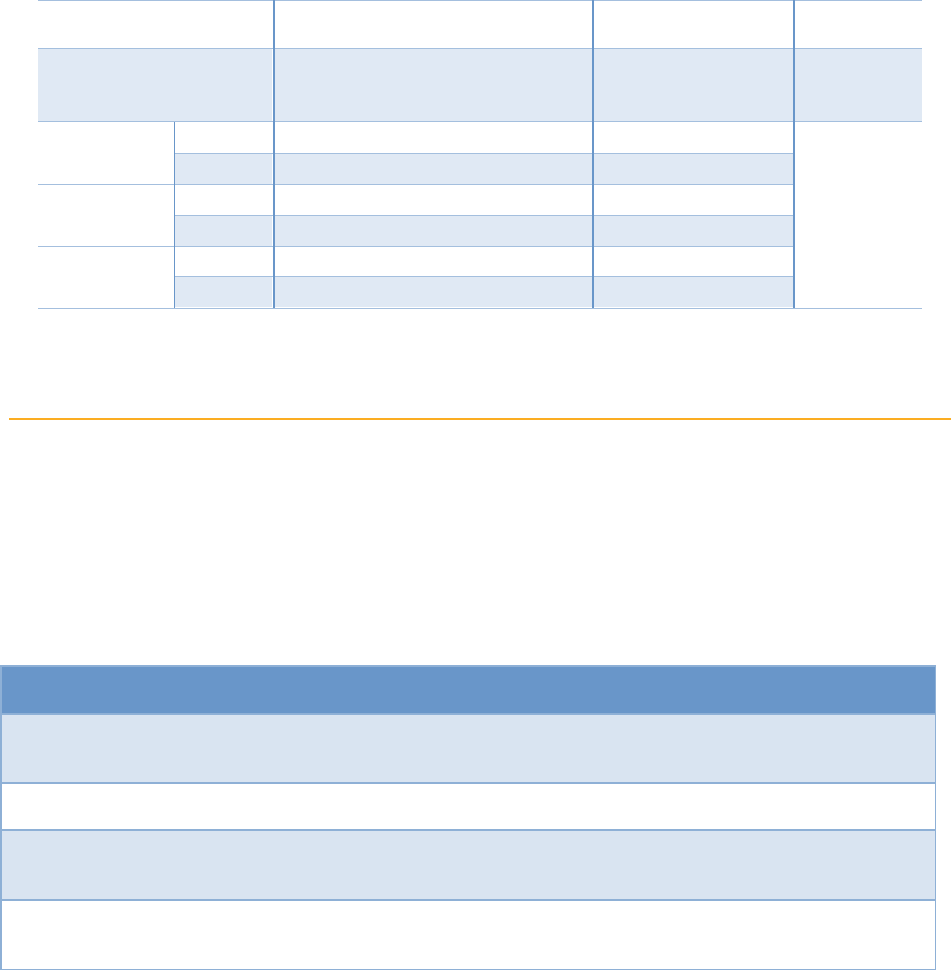

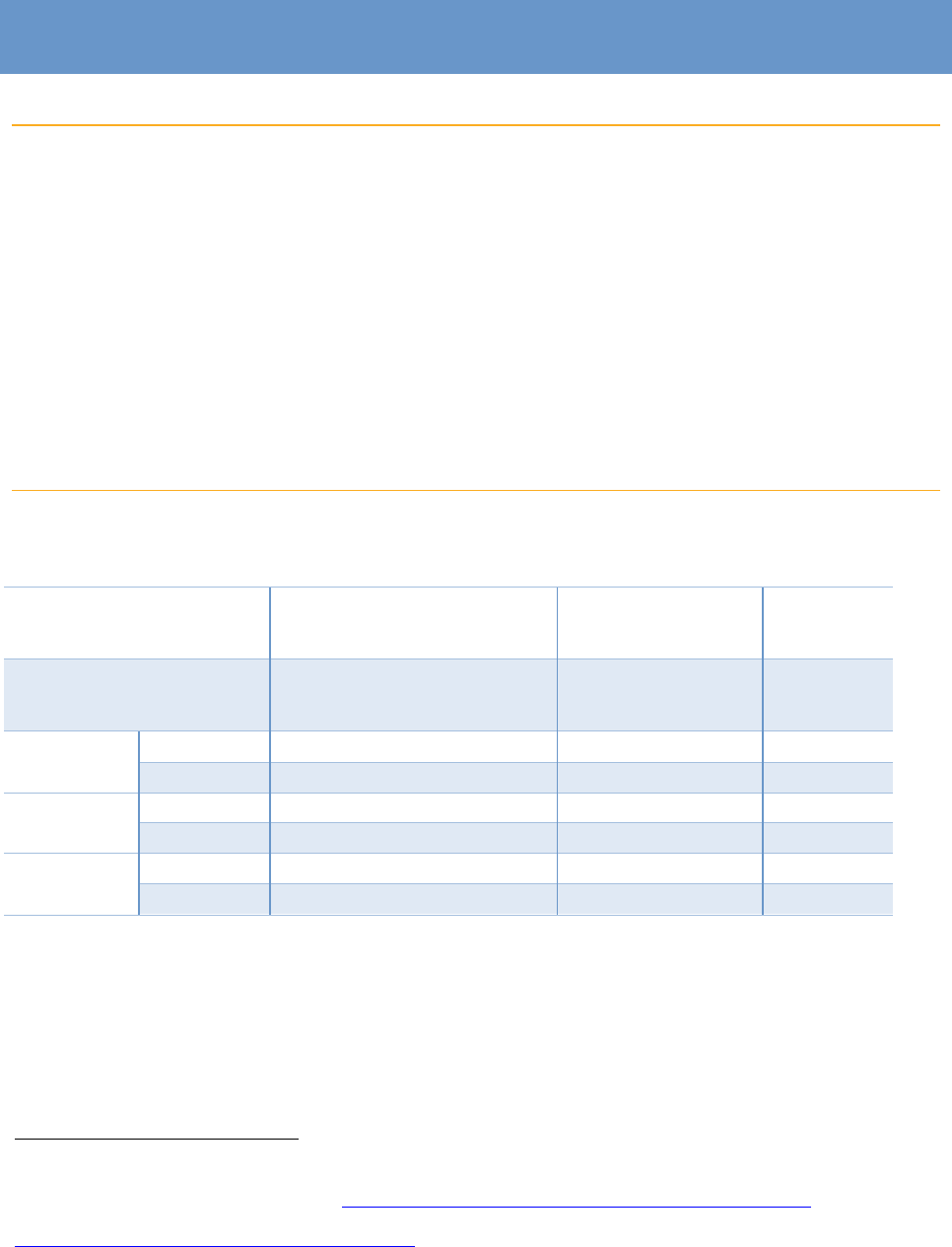

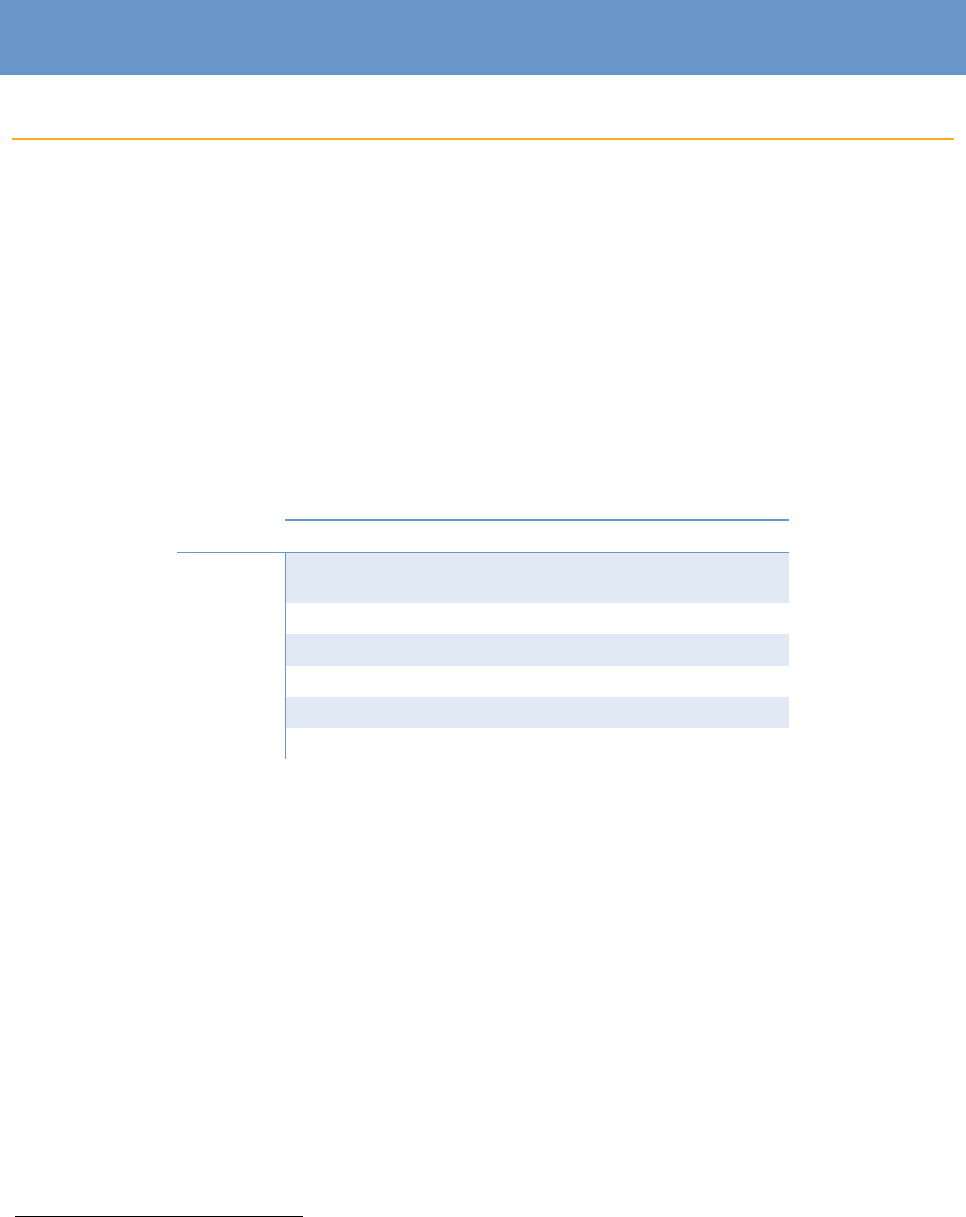

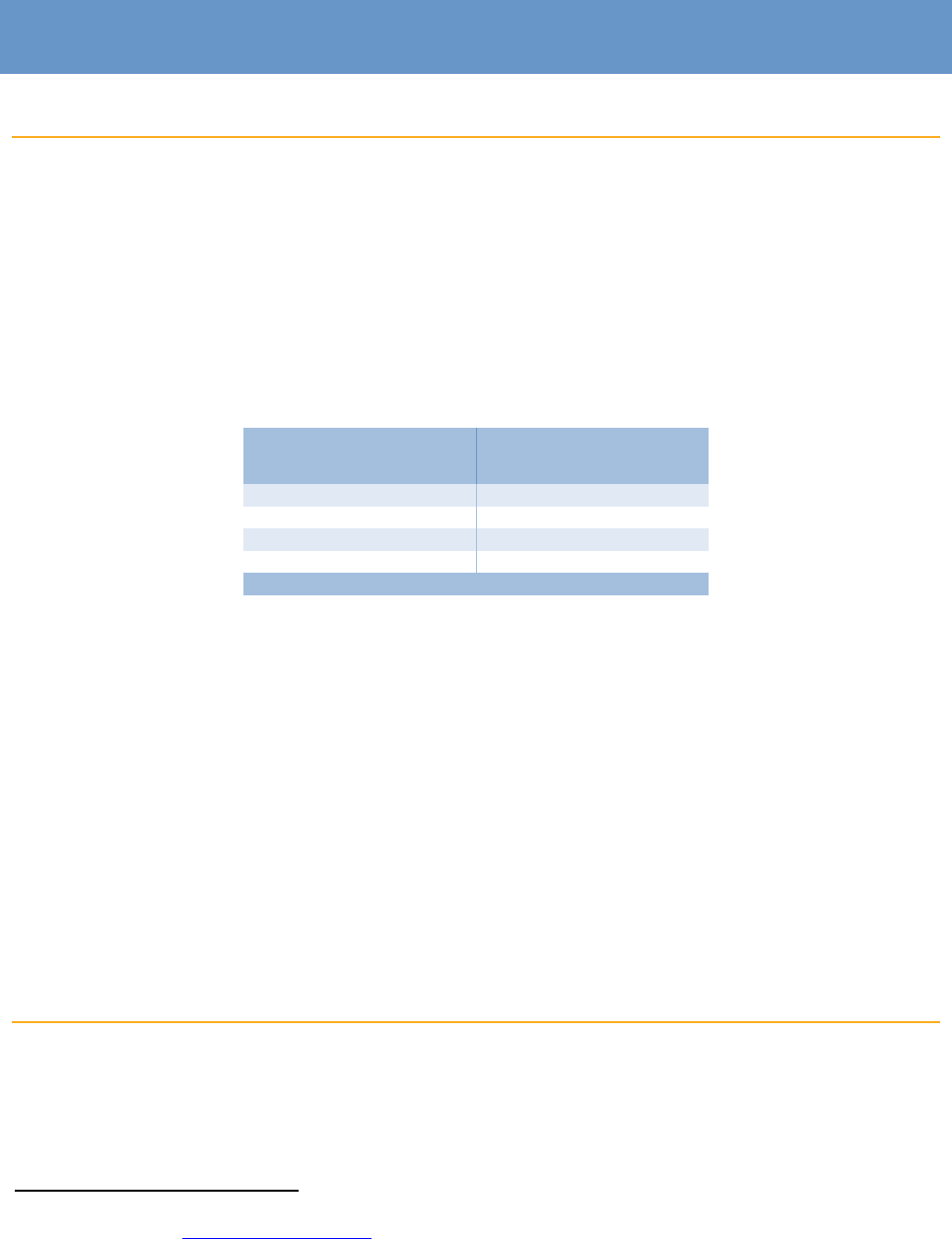

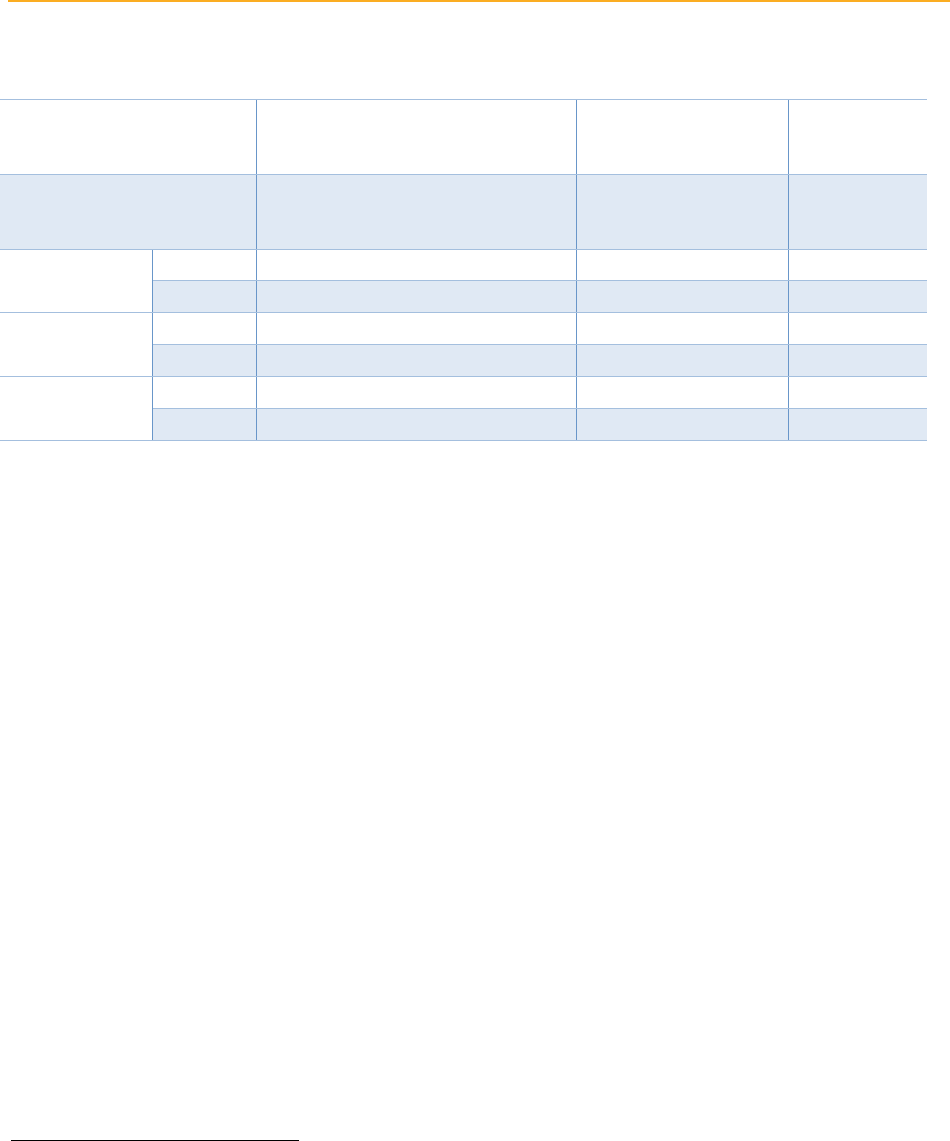

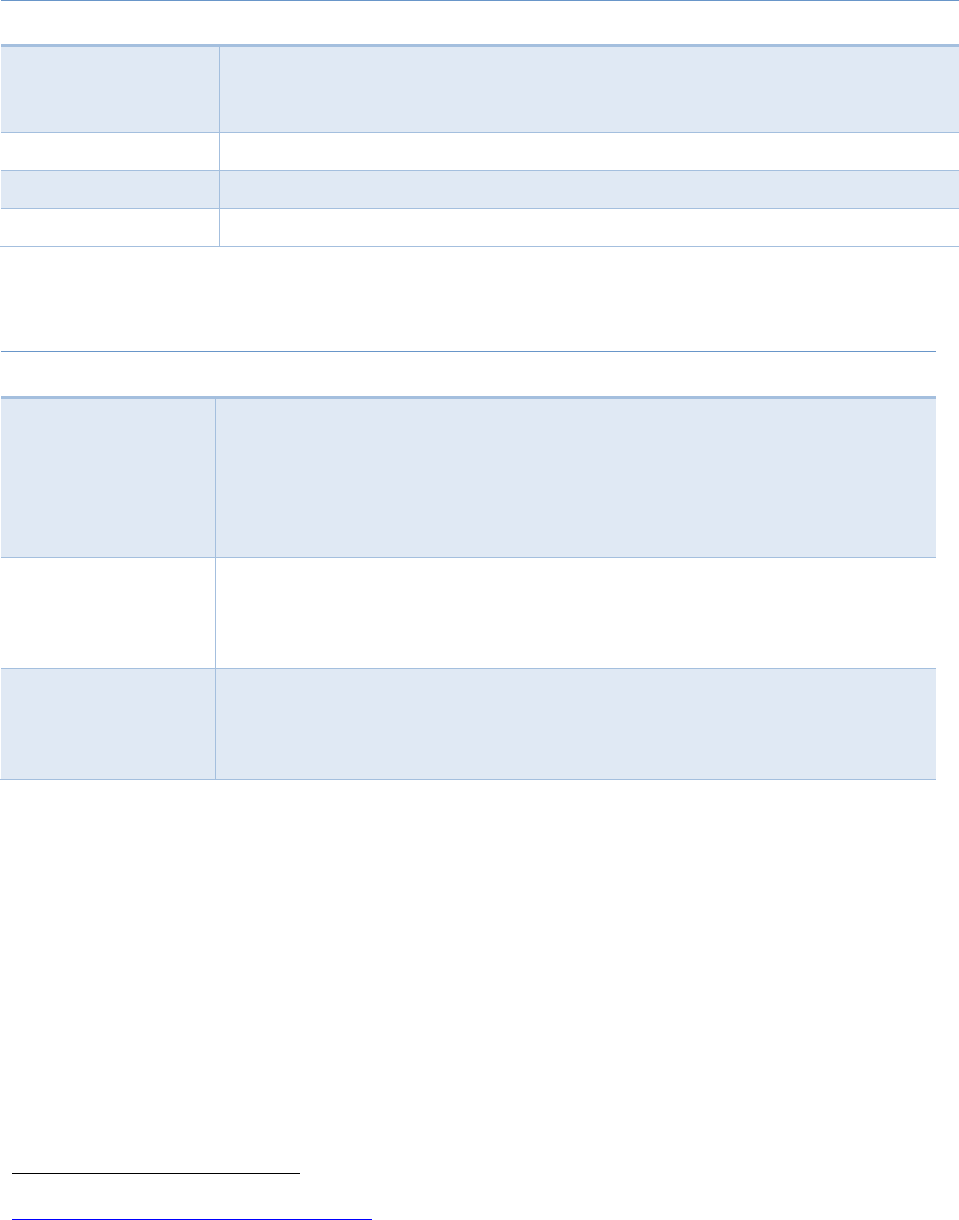

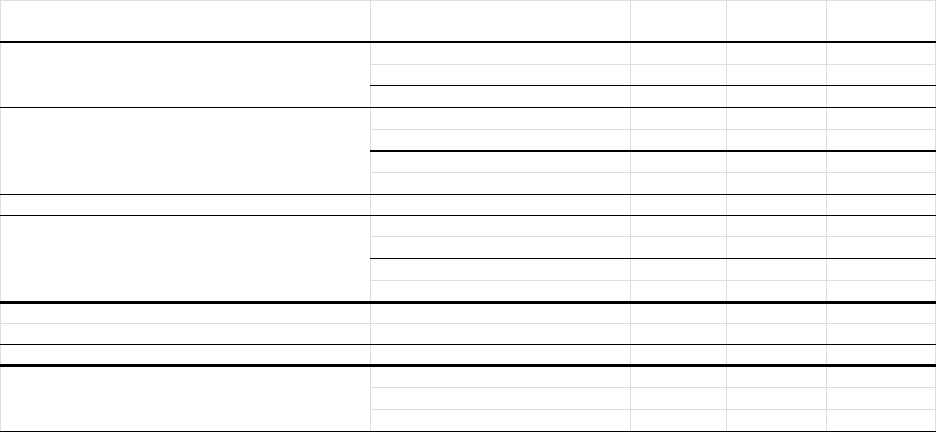

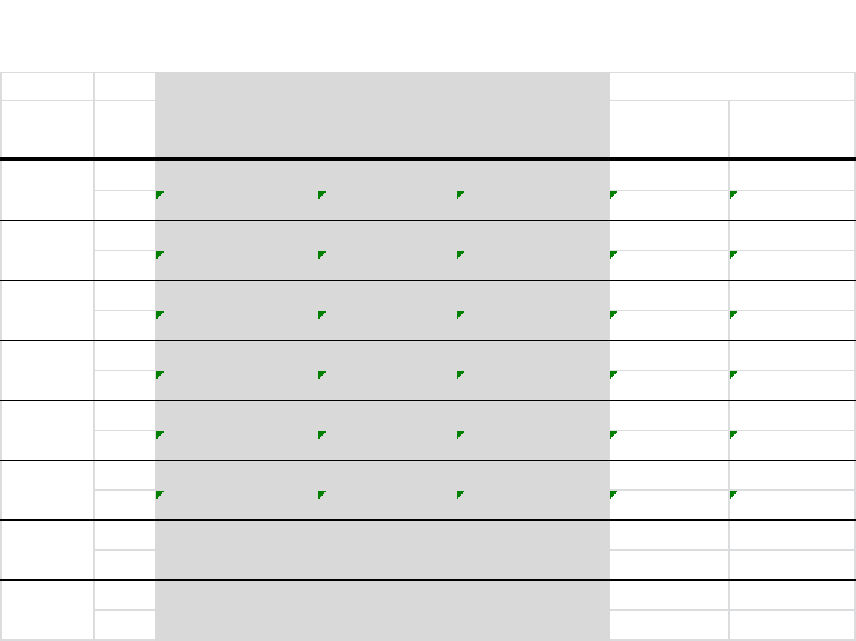

Table ES-1: Energy Efficiency Savings Goals

2013-2015 Energy Efficiency Portfolio Goals

Electric

(GWh)

Demand

(MW)

Natural

Gas

(MM

Therms)

Program Goals

Gross

4,410

830

130

Codes and Standards Goals

1,756

243

7

Combined Goals

6,166

1,073

137

For the 2013-2015 portfolio, the CPUC goals for the energy efficiency program were a reduction in electricity

usage of 4,410 GWh and 130MMtherms in gas usage. The CPUC allowed program administrators to include

low-income program savings in their goal attainment numbers, but established separate codes and standards

savings goals.

1

Table ES-1 shows the breakdown of savings goals for the program portfolio and codes and

standards. The combined goals are shown for illustrative purposes only.

The 2013-2015 Energy Efficiency Portfolio surpassed electricity savings goals while staying

within budget

The 2013-2015 energy efficiency programs served an important role in California’s energy sector, providing

large amounts of evaluated and verified energy savings and, by extension, avoiding large quantities of

greenhouse gases and particulate emissions. These programs achieved all of this while staying within the

allocated 3-year budget for the portfolio ($2.6 billion in expenditures out of a budget of $2.7 billion).

The energy and emissions savings accrued by the portfolio over the 3-year program cycle are shown in Table

ES-2. The realization rate is the ratio of evaluated savings to savings reported (pre-evaluation) by the Program

Administrator. It is an important metric in determining the accuracy of reporting and energy savings

estimates.

1

Decision 12-11-015, “Decision Providing Guidance on 2013-2014 Energy Efficiency Portfolios and 2012 Marketing, Education, and

Outreach” Date of Issuance: 18 May 2012, p.87

Energy Efficiency Report | 10

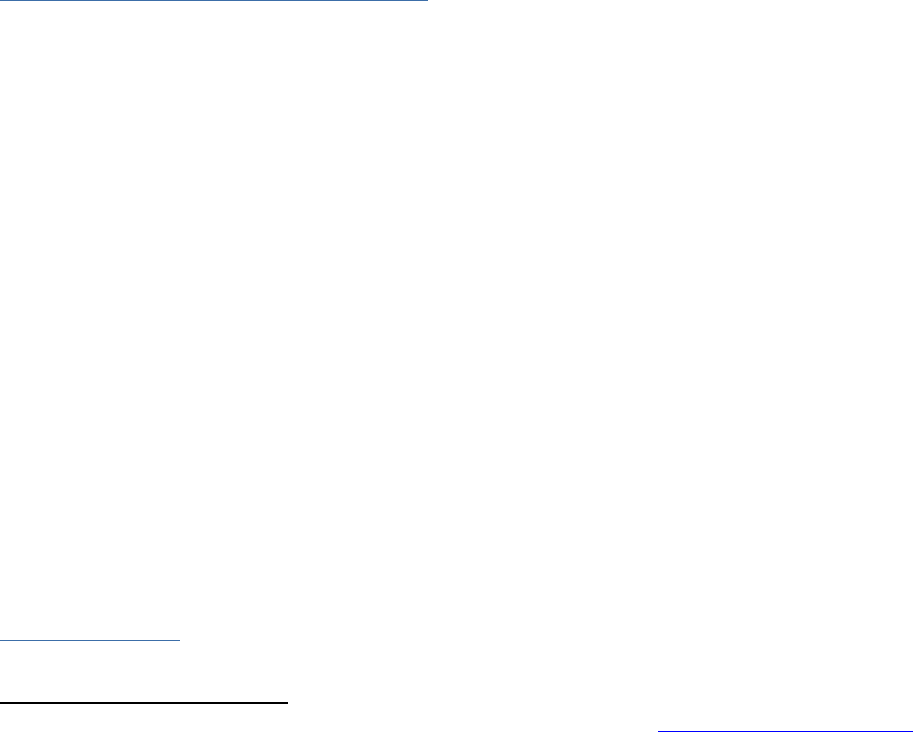

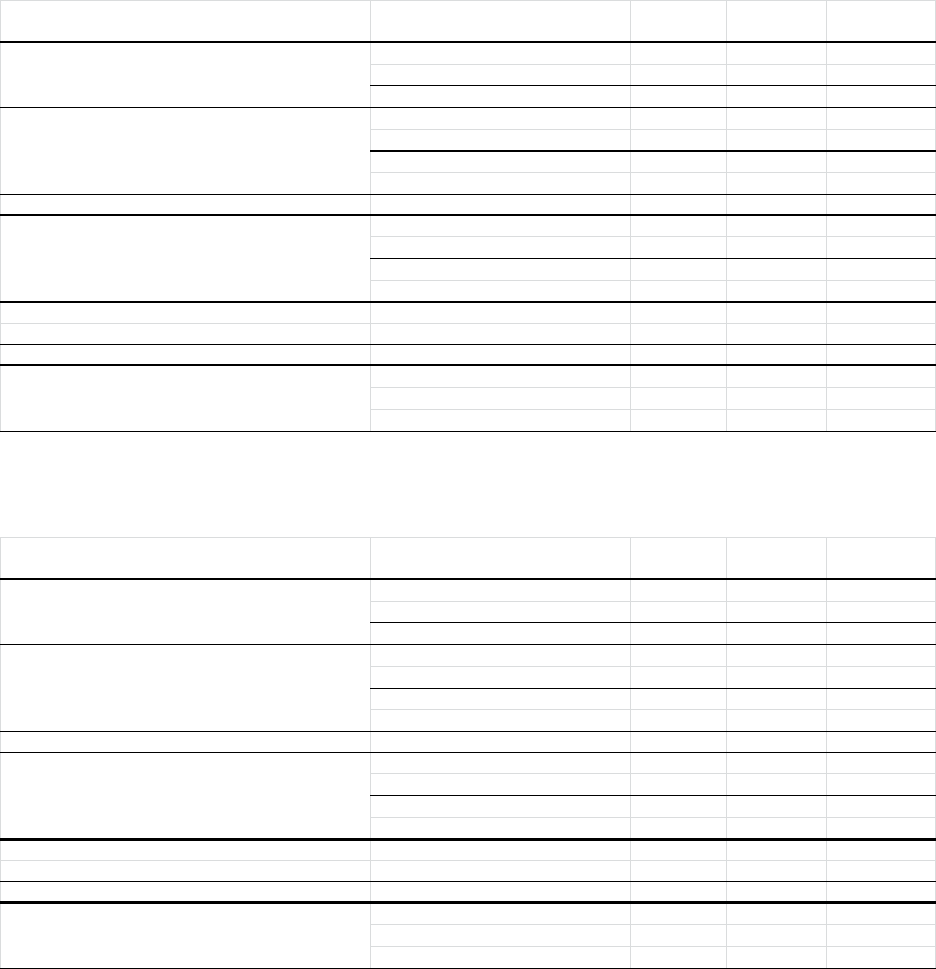

Table ES-2: 2013-2015 Energy Efficiency Programs Energy and Emissions Savings

(1)

Energy Savings

Emissions

(2)

Electric

(GWh)

Demand

(MW)

Natural

Gas

(MM

Therms)

CO

2

(Million

Tons)

NOx

(1000

Pounds)

Goals

Gross

4,410

830

130

Evaluated

Portfolio

Savings

Gross

5,070

954

100

7,053

2,607

Net

3,230

624

67

4,102

1,568

Realization

Rate

(3)

Gross

93%

94%

76%

Net

83%

87%

75%

Codes &

Standards

Savings

(4)

Gross

12,282

2,267

93

Net

3,597

546

39

(1) First-year savings. Program savings do not include low-income savings or Codes & Standards

savings. Program savings are used to calculate cost-effectiveness and to calculate emissions

savings.

(2) Emissions are not calculated for low-income programs or Codes and Standards savings

(3) Realization rate describes the ratio of evaluated savings to savings reported (pre-evaluation) by

the Program Administrator.

(4) See the Codes & Standards chapter for more information on Codes & Standards savings and

programs

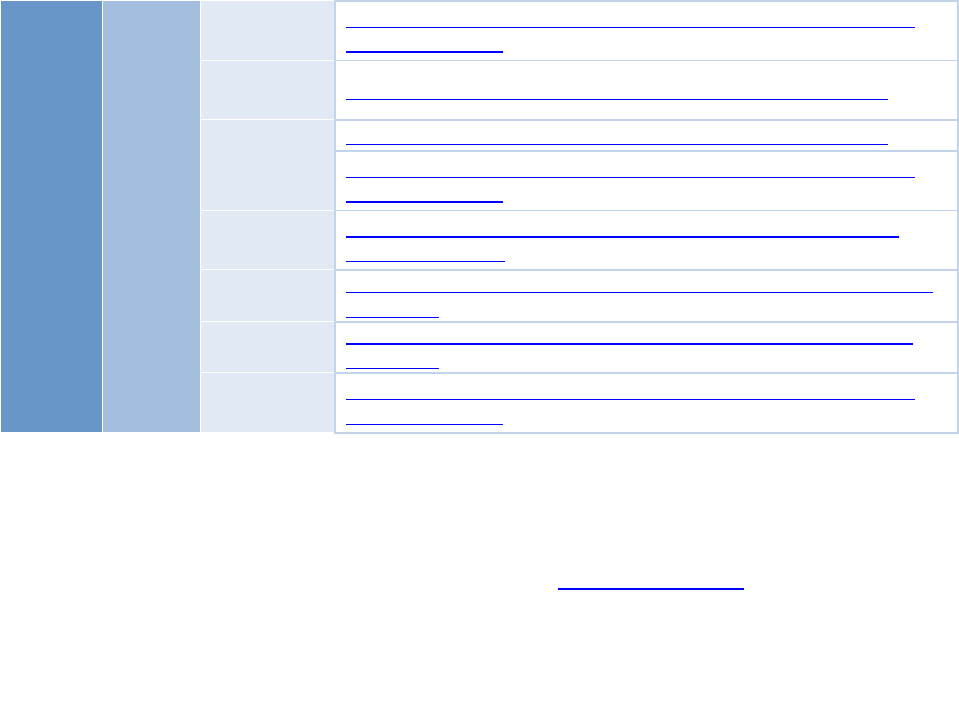

The 2013-2015 energy efficiency portfolio surpassed the electricity savings goals set by the CPUC, as shown

in Figure ES-1. The 2013-2015 energy efficiency program portfolio saved 5,070 gigawatt-hours of electricity,

954 megawatts of demand, and 100 million therms of natural gas, exclusive of the savings attributed to the

codes & standards and low-income programs. These savings are equivalent to avoiding the annual electricity

consumption of over 790,000 average California residences and the annual natural gas consumption of over

323,000 average California homes.

The Commercial customer sector surpassed the Residential sector as the largest share of electric savings,

compared to the 2010-2012 energy efficiency portfolio. This shift is mostly due to the successful market

adoption of efficient lighting in the Residential sector. As market adoption grows, the available savings for

lighting measures in the Residential sector decrease.

Energy Efficiency Report | 11

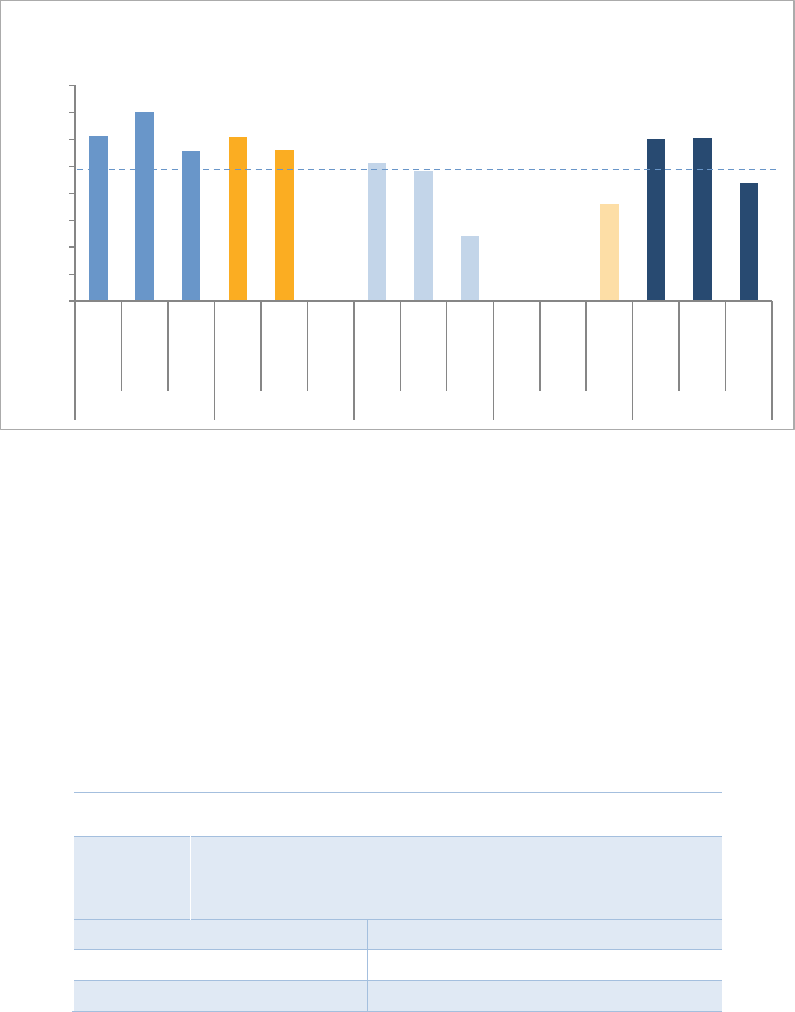

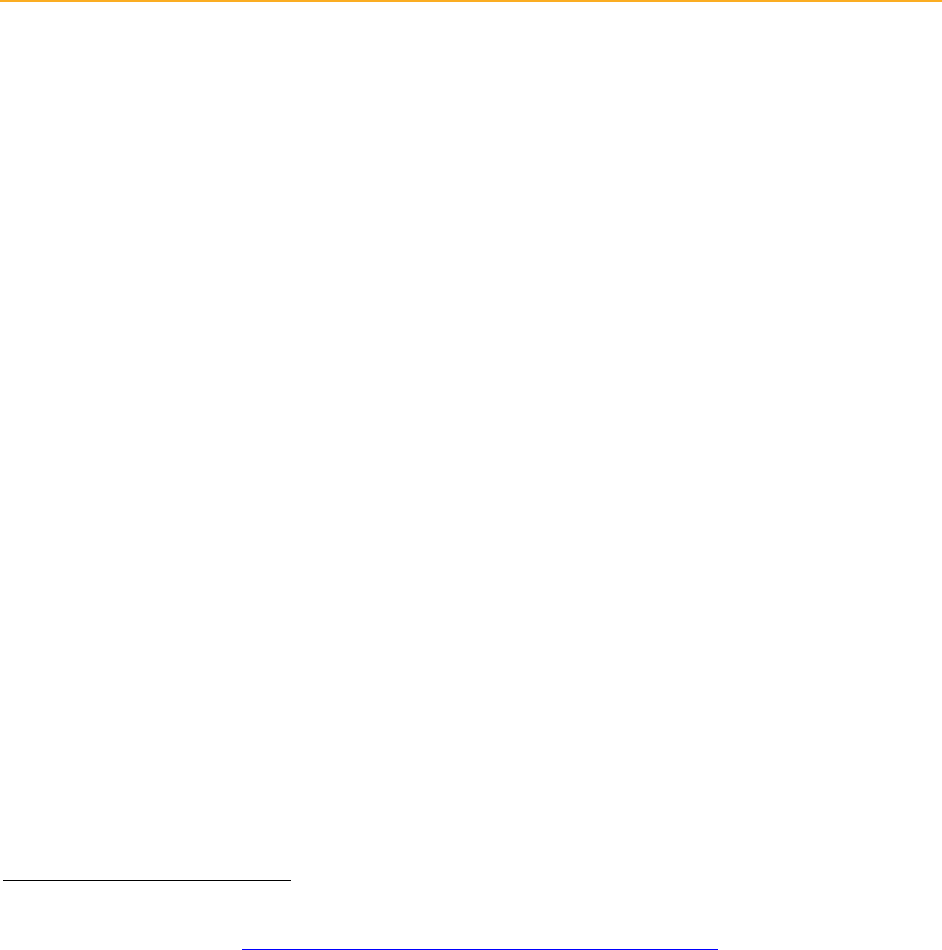

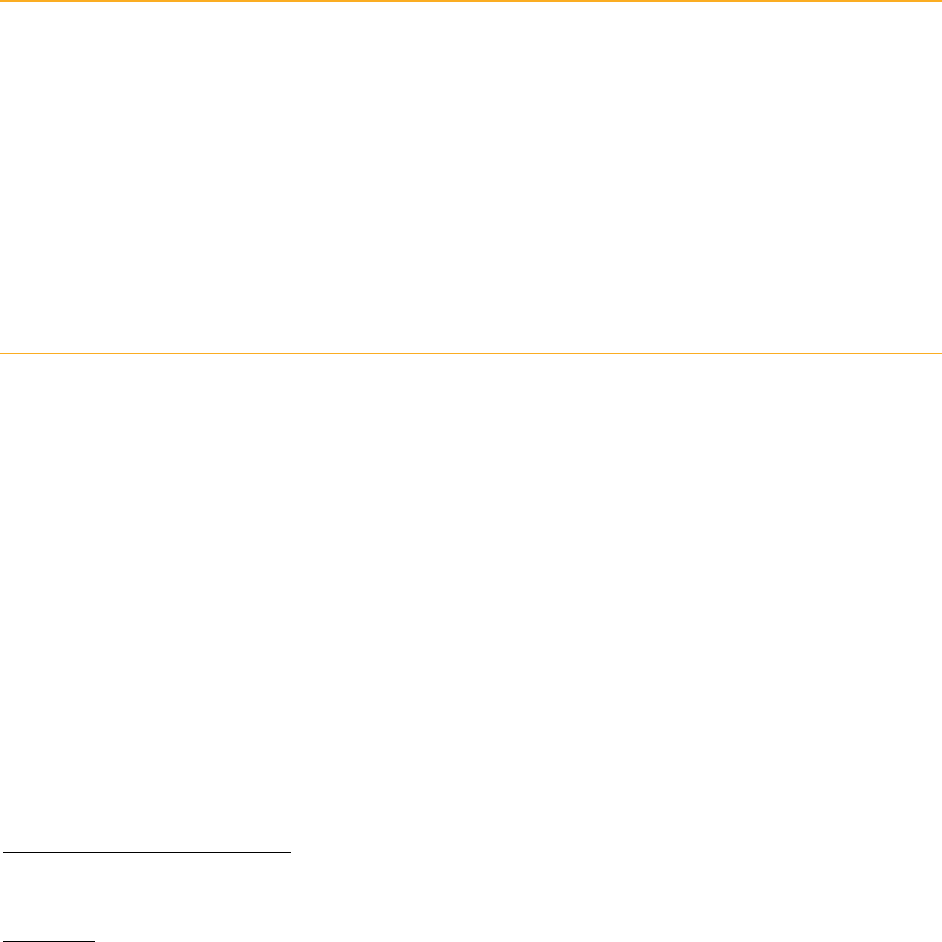

Figure ES-1: 2013-2015 Energy Efficiency Goal Attainment by IOU

For the 2013-2015 program cycle, the CPUC allowed PAs to include low-Income program savings in the

goal attainment calculation. The above chart is based on evaluated gross savings includes REN and CCA

savings within their respective IOU counterpart count and low-income savings. Codes and Standards

savings are not included in this chart.

Natural gas savings achieved 88 percent of their CPUC-set savings goals for the portfolio. In keeping with

past trends, the industrial customer sector contributed the largest share of natural gas savings throughout the

program cycle.

The program administrators exceeded their program savings goals for electric savings and peak demand

savings (120 percent and 121 percent, respectively), and came close to the natural gas savings goal (88

percent).

2

Codes and Standards savings greatly exceeded goals. Electric codes and standards savings achieved

223 percent of the gigawatt-hour savings goal and 237 percent of the peak demand savings goal, while natural

gas savings were 186 percent of the codes and standards savings goal. Codes and Standards savings are shown

in Table ES-2.

In addition to determining the total savings achieved, evaluation studies also calculate how much of these

savings can be directly attributed to program interventions, rather than other factors such as normal market

adoption. Evaluations of the 2013-2015 program cycle determined that CPUC energy efficiency programs

were the driving force behind California’s energy savings. Two-thirds of the energy savings achieved during

the 2013-2015 period can be tied directly to the energy efficiency programs implemented by program

administrators.

3

2

See Appendix A for further information on Goal Attainment calculations and a breakdown of goals and savings by program

administrator.

3

This calculation is known as the net-to-gross ratio and is explained further in the glossary.

123%

141%

111%

122%

112%

103%

97%

48%

72%

120%

121%

88%

0%

20%

40%

60%

80%

100%

120%

140%

160%

GWh

MW

MM Therms

GWh

MW

MM Therms

GWh

MW

MM Therms

GWh

MW

MM Therms

GWh

MW

MM Therms

PGE SCE SDGE SCG Portfolio

2013-2015 Energy Efficiency Portfolio Percent Savings

Programs Goal Attainment

Energy Efficiency Report | 12

The evaluated Energy Efficiency Portfolio was not cost-effective for the 2013-2015 program cycle

In addition to energy savings goals, the portfolio is evaluated for its cost-effectiveness. The cost effectiveness

of the portfolio is evaluated using two different cost-effectiveness tests: the Total Resource Cost (TRC) and

Program Administrator Cost (PAC) tests (together, the “the dual test”).The TRC equation divides the dollars

saved from energy efficiency by the costs incurred by both the PA (IOU, REN, or CCA) and the program

participants (customers), combined. Generally, activities that pass the TRC test will pass the PAC test, making

TRC the de facto test of portfolio cost effectiveness.

The combined portfolio for all program administrators, excluding Codes & Standards, as measured by Total

Resource Cost test (TRC), was 1.17 in 2013, 0.99 in 2014, and 0.78 in 2015, as shown in Table ES-3.

4

The

evaluated portfolio TRC for the three year (2013-2015) period was 0.87. Some reduction in cost –

effectiveness was expected in 2015 as the program administrators began preparing for the new Rolling

Portfolio framework that is currently in the process of being implemented. As program administrators

transition to this new framework, it is expected to see positive cost-effectiveness impacts.

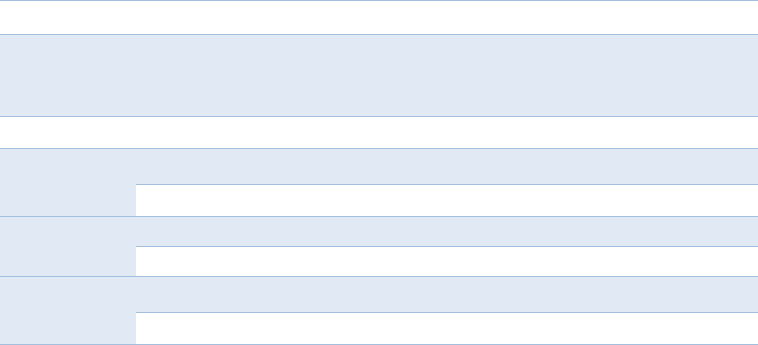

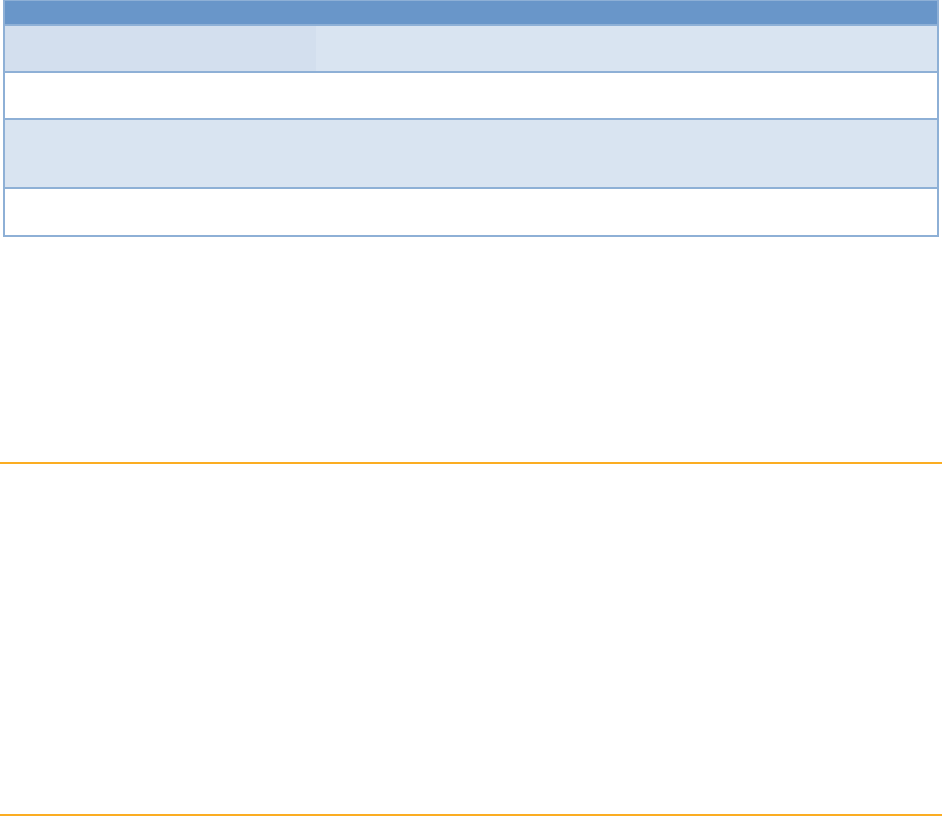

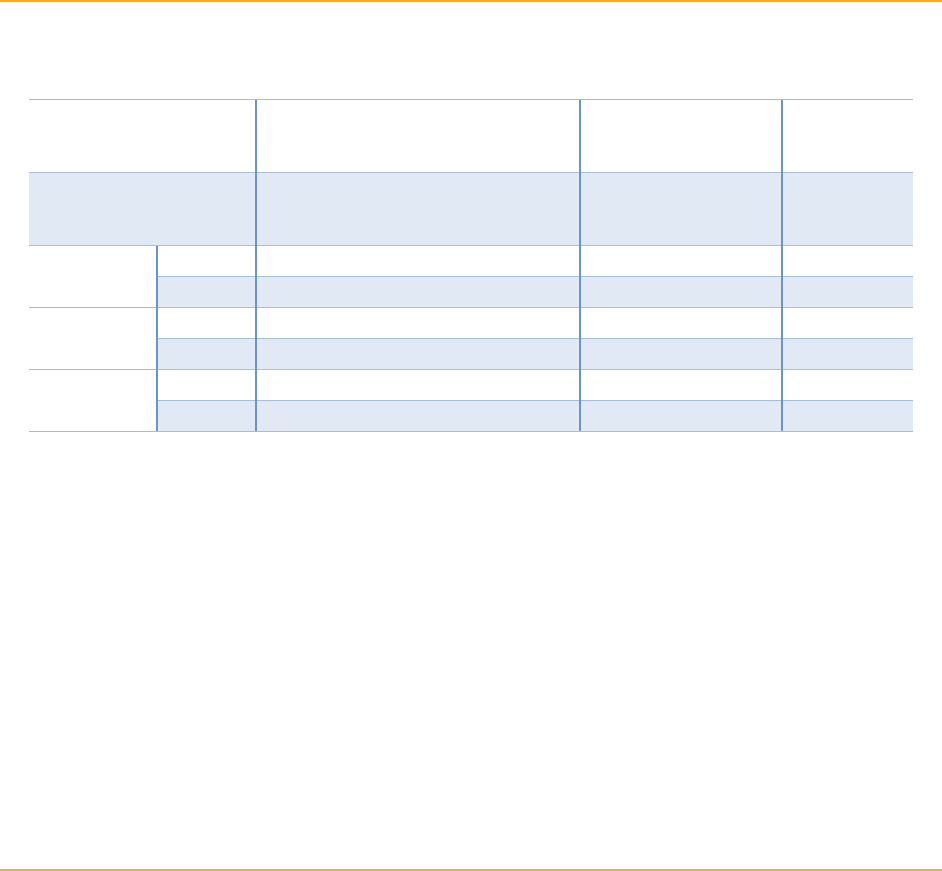

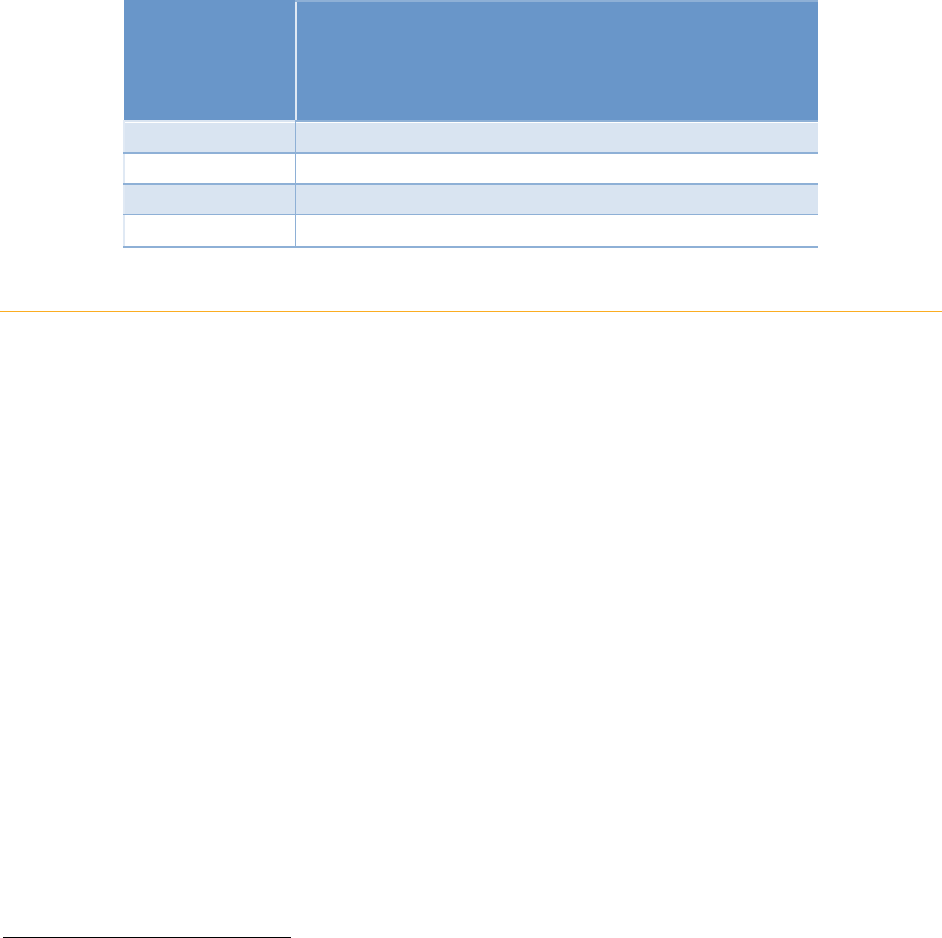

Table ES-3: Total Resource Cost by Year

Cost-effectiveness (Total Resource Cost)

2013-2015 Energy Efficiency Programs

2013

2014

2015

13-15 Program

Cycle

Evaluated Portfolio TRC

1.17

0.99

0.78

0.87

As noted previously, the CPUC does not include codes and standards savings or costs when determining

portfolio cost-effectiveness. Cost-effectiveness is calculated separately for the C&S programs and is

consistently very high. As noted in the guidance decision for this program cycle, the CPUC separated C&S

from the other programs in order to, “avoid the risk of overemphasis on codes and standards advocacy at the

expense of the utility programs that are needed to ensure technologies and building practices are available and

affordable as they become required by code.”

5

4

An evaluated TRC score of 1.0 or higher indicates a portfolio is cost effective, while a score lower than 1.0 indicates a portfolio is

not cost effective.

5

“Goals Proposal,” Attachment A of 2013-2014 Energy Efficiency Goals Ruling at 9.

Energy Efficiency Report | 13

Introduction

Scope of this Report

The CPUC’s Energy Efficiency Portfolio Report summarizes the achievements of the CPUC’s 2013-2015

energy efficiency programs, based on evaluation studies fielded during and after the three-year program cycle.

These programs help California become more energy efficient by reducing electricity and natural gas

consumption while, collectively, resulting in significant reductions in California’s greenhouse gas emissions.

The CPUC’s energy efficiency programs span a variety of economic sectors, encompassing residential homes

and commercial buildings, large and small appliances, lighting and HVAC end uses, industrial customers,

manufacturers, and agriculture. Within those sectors, efficiency programs achieve energy savings using a

number of different tools: financial incentives and rebates, research and development for energy efficiency

technologies, financing mechanisms, building codes and appliance standards development, and education and

public outreach.

The original guiding document for these programs is known as the California Long Term Energy Efficiency

Strategic Plan. This comprehensive plan is the state’s integrated framework of goals and strategies for saving

energy, covering government, utility, and private sector actions, and holds energy efficiency to its role as the

highest priority resource in meeting California’s energy needs.

6

Program administrators (PA) operate the energy efficiency programs ordered by the CPUC. PAs include the

IOU, regional energy networks (REN), and community choice aggregators (CCA).

7

The PAs are responsible

for implementing energy efficiency programs while the CPUC is responsible for guiding, overseeing, and

evaluating these activities to inform future policy direction, improve program design, and refine savings

estimates.

Specific guidance for the implementation of the 2013-2015 portfolio was administered to program

administrators through several CPUC decisions:

D.12-05-015, “Decision Providing Guidance on 2013-2014 Energy Efficiency Portfolios and 2012

Marketing, Education, and Outreach” (Proceeding R.09-11-014);

D. 12-11-015, “Approving 2013-2014 Energy Efficiency Programs and Budgets” (Proceeding

A1207001; A1207002; A1207003; A1207004);

D.14-10-046, “Decision Establishing Energy Efficiency Savings Goals and Approving 2015 Energy

Efficiency Programs and Budgets” (Proceeding R.13-11-005)

The Energy Efficiency Portfolio Report complies with Public Utilities Code section 913.5.

8

The CPUC issued

the last iteration of the Energy Efficiency Portfolio Report on March 2015 and summarized the 2010 – 2012

portfolio cycle. This report is based on the studies from the 2013-2015 portfolio cycle.

6

The California Long Term Energy Efficiency Strategic Plan can be accessed here: http://www.cpuc.ca.gov/General.aspx?id=4125

7

While the investor-owned utilities implement the bulk of energy efficiency programs statewide, the 2013-2015 portfolio cycle saw the

introduction of two new types of program administrators: regional energy networks and community choice aggregators.

8

Public Utilities Code 913.5: The CPUC shall submit a report to the Legislature by July 15, 2009, and triennially thereafter, on the

energy efficiency and conservation programs it oversees. The report shall include information regarding authorized utility budgets and

Energy Efficiency Report | 14

This report synthesizes and highlights the results from more than 100 evaluation studies conducted across a

set of more than 400 programs that constituted the 2013-2015 energy efficiency program portfolio. These

evaluation activities reviewed 65 percent of reported savings. Given the summary nature of this report,

readers are encouraged to return to the original source documents for a more comprehensive treatment of the

material summarized here, if interested in a particular sector or program area. The report provides references

to the original research described within and a list of impact evaluations is included in the appendices.

Organization of this Report

The report is organized into chapters that focus either on a customer sector (residential, commercial,

industrial, and agriculture) or on a crosscutting topic area (e.g. Codes and Standards, Lighting, HVAC) that

comprises an important program area. The inclusion of crosscutting topics as distinct chapters means that it

would be incorrect to sum the energy savings listed in each chapter to get the total portfolio savings. Each

chapter is simply a different view of a subset of the evaluation data. For instance, lighting programs’ energy

savings are addressed in their own chapter, although the savings from these end uses are included in relevant

customer sectors to show the contribution to lighting savings in that customer group. For synthesis of how

various sectors and end-uses affected the portfolio-level savings, please refer to the Overview sections below

or the Appendices.

The appendices to this report provide the detailed summaries of accomplishments by program administrator,

program, sector, and measure group. Detailed data on cost-effectiveness and emissions reductions impacts

are also provided in these appendices.

Evaluation Methodology and Terminology

The five evaluation, measurement, and verification (EM&V) research objectives for the portfolio are:

1. Savings Measurement and Verification

2. Program Evaluation

3. Market Assessment

4. Policy and Planning Support

5. Financial and Management Audits

These objectives are accomplished through three types of evaluation studies:

Impact Evaluations measure program impacts, estimating net changes in electricity usage, electricity

demand, usage of natural gas, and/or behavioral impacts that are expected to produce changes in

energy use.

9

Process Evaluations are systematic assessments of energy efficiency programs, products or services

for the purposes of identifying and recommending improvements that can be made to the program.

10

expenditures and projected and actual energy savings over the program cycle. (Added by renumbering Section 913.7 by Stats. 2016,

Ch. 842, Sec. 26. Effective January 1, 2017.)

9

California Public Utilities Commission, California Energy Efficiency Evaluation Protocols: Technical, Methodological, and Reporting Requirements

for Evaluation Professionals, April 2006 p.19

10

op. cit. note 9, p. 131

Energy Efficiency Report | 15

Market Studies gauge current market situations that inform savings baselines, identify and track

appropriate baseline metrics of market change, measure progress toward achieving long-term

Strategic Plan objectives, and inform estimates of remaining potential for energy efficiency.

Savings reported by the program administrators are evaluated and verified. Evaluated savings may differ from

reported savings because of a number of different factors including, the energy efficiency measure not being

installed properly, the use of incorrect hours of operation, or the use of incorrect baseline assumptions for

the reported values. In the 2013-2015 portfolio cycle, 69 percent of reported gross electricity savings and 68

percent of gross natural gas savings received some form of field evaluation. For the reported savings that are

not evaluated, the reported savings may be determined to be pass-through values using IOU-reported

savings.

11

Savings are reported as both gross savings and net savings. Gross savings are the savings, in total, that

occurred in a sector, program area, or portfolio. Net savings are the savings that are directly applicable to

program interventions, as in they would not have occurred if the program had not been implemented. The

difference between net and gross is attributed to free ridership, which describes savings that would have

occurred without program intervention.

A Note on the Numbers:

This report contains data on both the reported and evaluated, as well as gross and net, savings values. While

the reported savings are contained within tables and the appendices, any portfolio-level analysis in the

following chapters (e.g. percentage of portfolio calculations) is based on evaluated net savings values, except

where explicitly stated. The discussion of savings at the portfolio level focuses on evaluated gross savings

because the 2013-2015 portfolio goals were set for evaluated gross savings. Therefore, Staff compares

evaluated gross savings at the portfolio level to the evaluated gross savings goals. In individual sector or

program chapters, however, the default savings values discussed are evaluated net savings, in order to focus

the discussion on the savings that occurred as a direct result of program impacts.

Additionally, all savings data in tables or figures are first-year savings, inclusive of REN and CCA savings and

exclusive of codes and standards savings, except where explicitly stated. First-year savings are the savings that

a measure accrues in the first year after installation, as opposed to lifecycle savings that accrue over the entire

lifetime of the equipment or measure that was installed. Lifecycle savings are used in cost effectiveness

calculations.

All savings and expenditures data are sourced from the 2013-2015 evaluation data, prepared by Itron and

based on the results from all program evaluations.

11

Claimed savings may not be evaluated as they are determined to be pass through values, or accepted claims that do not fall within

the frame of an impact evaluation or may not evaluated due to resource or time constraints on evaluators.

Energy Efficiency Report | 16

2013-2015 Portfolio Overview

Goals and Overview of 2013-2015 Portfolio Activities

Based on CPUC direction for the 2013-2015 portfolio, the portfolio is considered successful if it is cost-

effective and meets all of the CPUC’s savings goals. Savings goals are set via CPUC decision, based on the

Energy Efficiency Potential and Goals study.

12

,

13

Goals were set for electric savings (expressed in gigawatt-

hours or GWh), peak megawatt load reductions (also called demand savings and expressed in megawatts or

MW), and natural gas savings (expressed in millions of therms or MM Therms). As previously noted, the

2013-2015 savings goals were set for gross savings, not net savings. Consequently, each IOU’s gross

(evaluated) savings achievements were compared to the CPUC’s goals to determine portfolio success. The

CPUC-adopted 2013-2015 savings goals for each IOU territory are provided in Table 1 below. In Decision

12-05-015, the CPUC directed that codes and standards goals be separated from the program goals. This is a

distinct change from the 2010-12 program cycle in which IOUs could credit codes and standards advocacy

savings toward their energy efficiency goals.

14

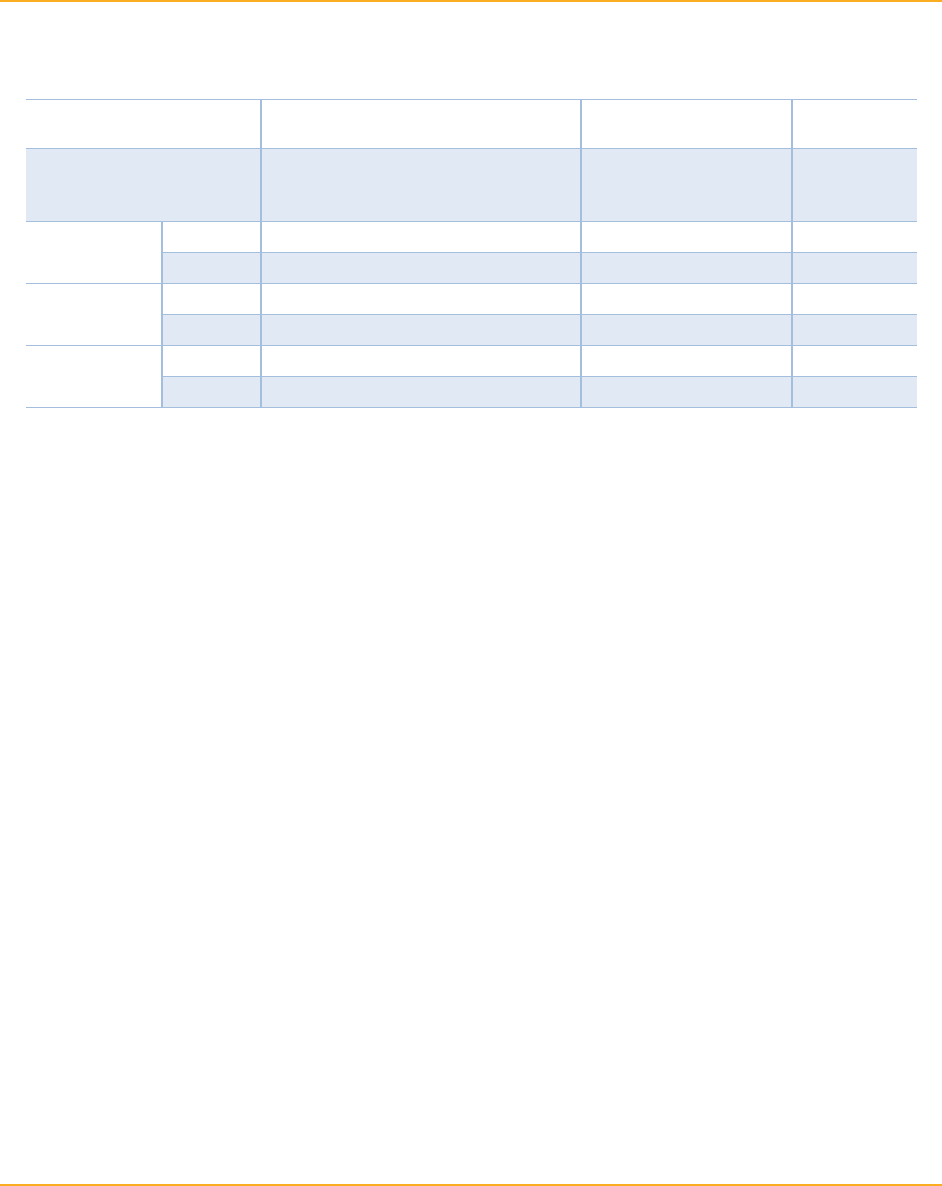

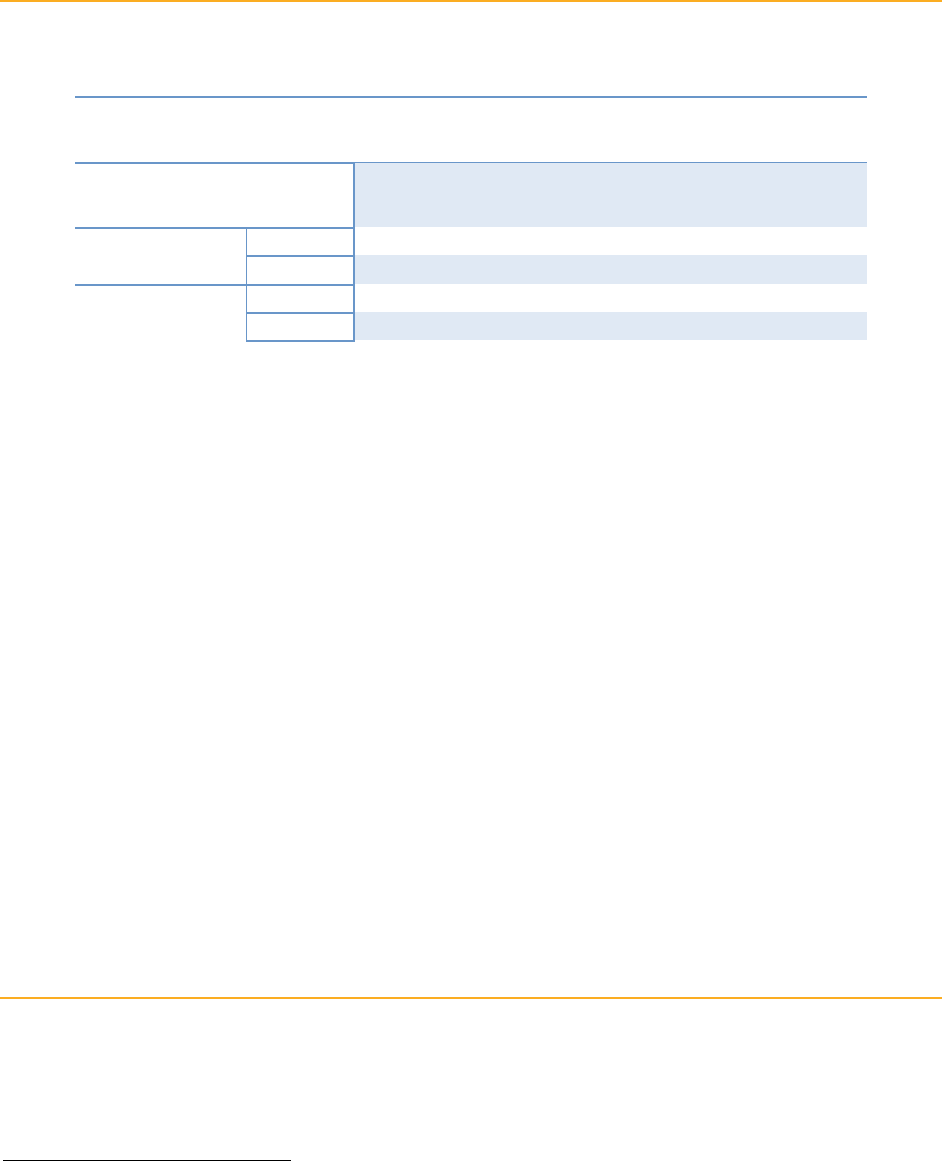

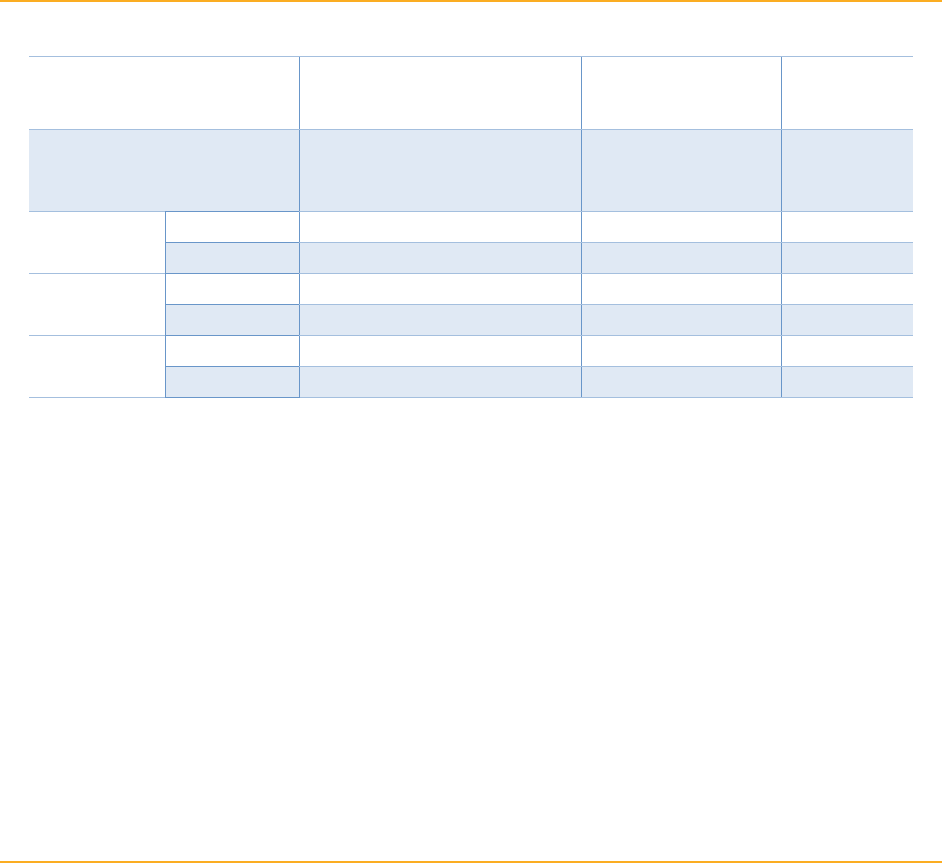

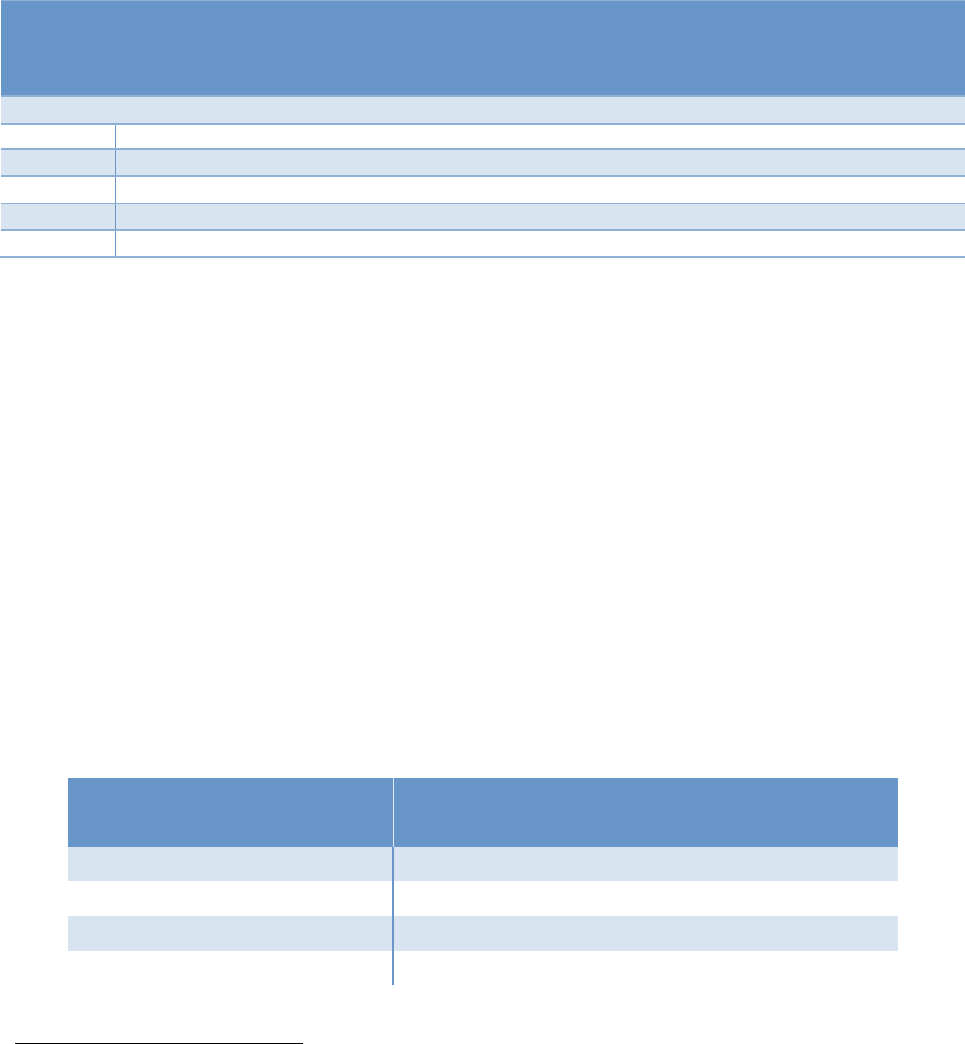

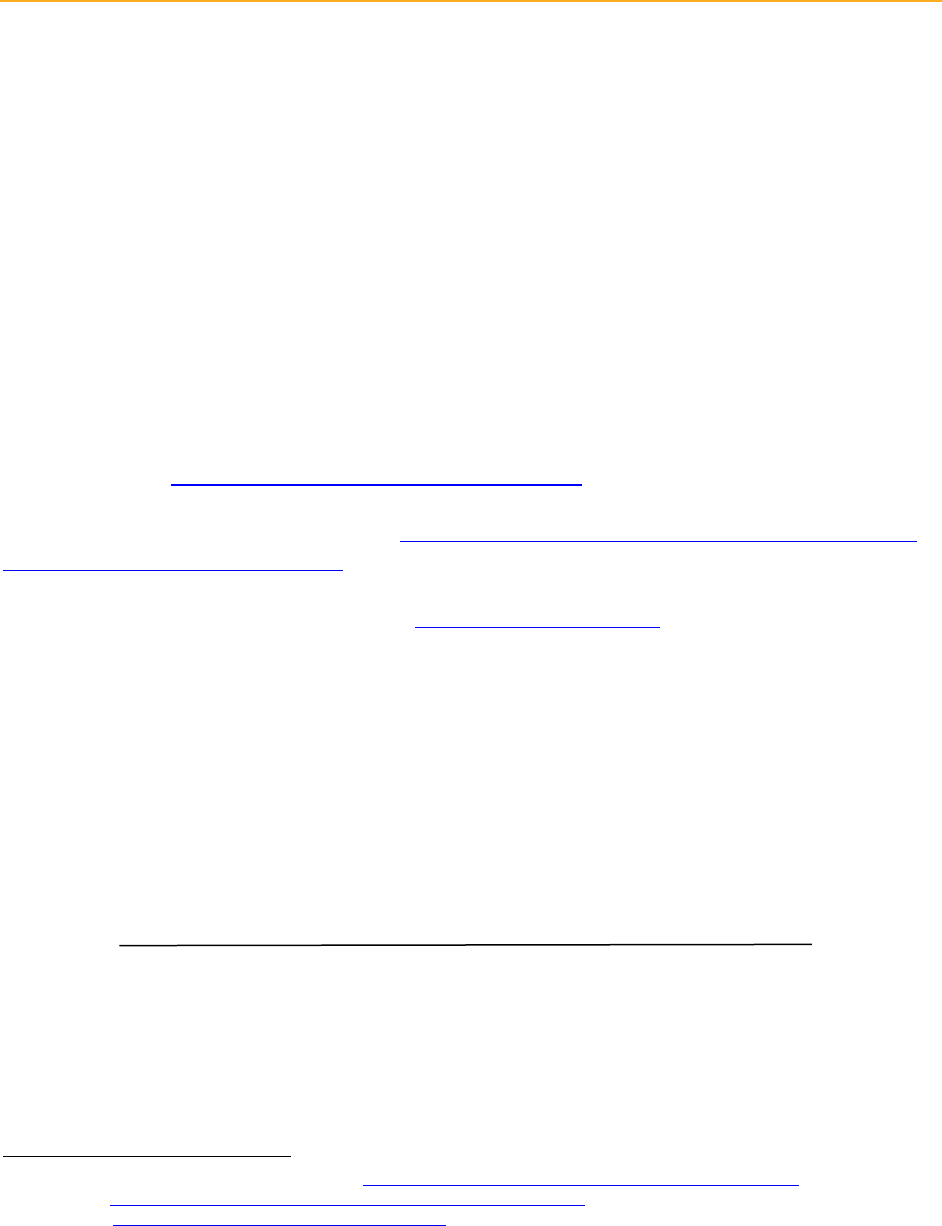

Table 1: 2013-2015 IOU Program Goals

2013-2015 Goals by Investor-Owned Utility

Electric

(GWh)

Demand

(MW)

Natural Gas (MM

Therms)

PGE

1,889

324

56

SCE

2,030

408

-

SDGE

492

98

7

SCG

-

-

68

Total Portfolio

4,410

830

130

In addition to achieving the savings goals, each IOU must reach their savings goals in a cost-effective manner.

As clarified in D.09-09-047, the cost effectiveness of the portfolio is evaluated using two different cost-

effectiveness tests: the Total Resource Cost (TRC) and Program Administrator Cost (PAC) tests (together,

the “the dual test”).The TRC equation divides the dollar benefits gained from energy efficiency by the costs

incurred by both the PAs and the program participants, combined.

15

Generally, activities that pass the TRC

test will pass the PAC test, making TRC the de facto test of portfolio cost effectiveness. Cost-effectiveness

12

D.12-05-015, “Decision Providing Guidance on 2013-2014 Energy Efficiency Portfolios and 2012 Marketing, Education, and

Outreach” Date of Issuance: 18 May 2012, p.95;

D.14-10-046, “Decision Establishing Energy Efficiency Savings Goals and Approving 2015 Energy Efficiency Programs and

Budgets,” Date of Issuance: 24 October 2014, p.10

13

Navigant Consulting, Inc. Analysis to Update Energy Efficiency Potential, Goals, and Targets for 2013 and Beyond. 19 March 2012. Available

at: http://www.cpuc.ca.gov/General.aspx?id=6442452622

14

Decision 12-11-015, “Decision Providing Guidance on 2013-2014 Energy Efficiency Portfolios and 2012 Marketing, Education,

and Outreach” Date of Issuance: 18 May 2012, p.87

15

Since incentives are paid by Program Administrators to participants, participant incentive payments net to zero in the TRC, while

the PAC test includes all Program Administrator costs (including all incentive payments) but excludes customer costs (i.e., any out of

pocket costs beyond the incentive for more expensive efficiency equipment)

Energy Efficiency Report | 17

calculations use net savings in the numerator, and remove “free rider” incentive payments out of the

denominator, to measure the costs of the program against the estimated impacts of the program.

16

In the guidance for the 2013 and 2014 programs, the CPUC set the requirement that each IOU’s portfolio

needed to achieve a TRC ratio of at least 1.25, independent of the costs and benefits of the REN, spillover

effects, and Codes and Standards program costs and benefits. In D.14-10-046, which established guidance for

the 2015 energy efficiency programs, the CPUC modified the cost-effectiveness threshold to 1.0 for the PAC

and TRC for 2015, in order to accommodate a transition period into a new regulatory framework for energy

efficiency programs, known as the Rolling Portfolio.

The IOUs are accountable for achieving the total portfolio goals defined by the CPUC in Decision 12-05-015

and for ensuring that the portfolio is cost-effective, according to the guidance in Decision 12-11-015.

However, the IOUs’ success is measured at the portfolio level, giving the program administrators the

flexibility at the sector or program level to include activities that may not, by themselves, be cost-effective.

In addition to programs and activities that directly generate energy savings, the IOUs support complementary

programs that address long-term market transformation. Known as non-resource programs, these programs

represent energy efficiency activities that do not focus on displacement of supply-side resources at the time

they are implemented, but may lead to displacement over the longer-term or may enhance program

participation overall. Non-resource programs do not provide direct energy savings, but do add costs to the

portfolio, making them not cost-effective on their own. However, non-resource programs frequently provide

necessary support to resource programs.

The CPUC authorized $2.7 billion in ratepayer-funded energy efficiency programs for the 2013-2015 program

cycle. The PAs spent $2.6 billion of that authorized amount over the three-year cycle.

17

Impacts of the 2013-2015 Energy Efficiency Portfolio

The impact of the energy efficiency portfolio is measured via four distinct metrics (corresponding units in

parentheses):

energy savings (electricity in GWh and natural gas in MM Therms)

peak electricity demand savings (MW)

emissions savings (tons of CO2 and tons of NOx)

cost-effectiveness (total resource cost)

16

California Standard Practice Manual: Economic Analysis of Demand-Side Programs and Projects. October 2001, p. 18. TRC equals the net

present value of the avoided costs of the supply-side resources avoided divided by the net present value of the net costs to

participants for installed measures over the measure life, plus all costs incurred by the program administrator. The net benefits and net

participant costs excluded the benefits derived from and costs paid by free-rider participants.

17

Unspent funds are allocated to subsequent program cycle funding requirements. See D.12-11-015, section 6.1 “Treatment of

Unspent Funds from Prior Portfolio Cycles” for details.

Energy Efficiency Report | 18

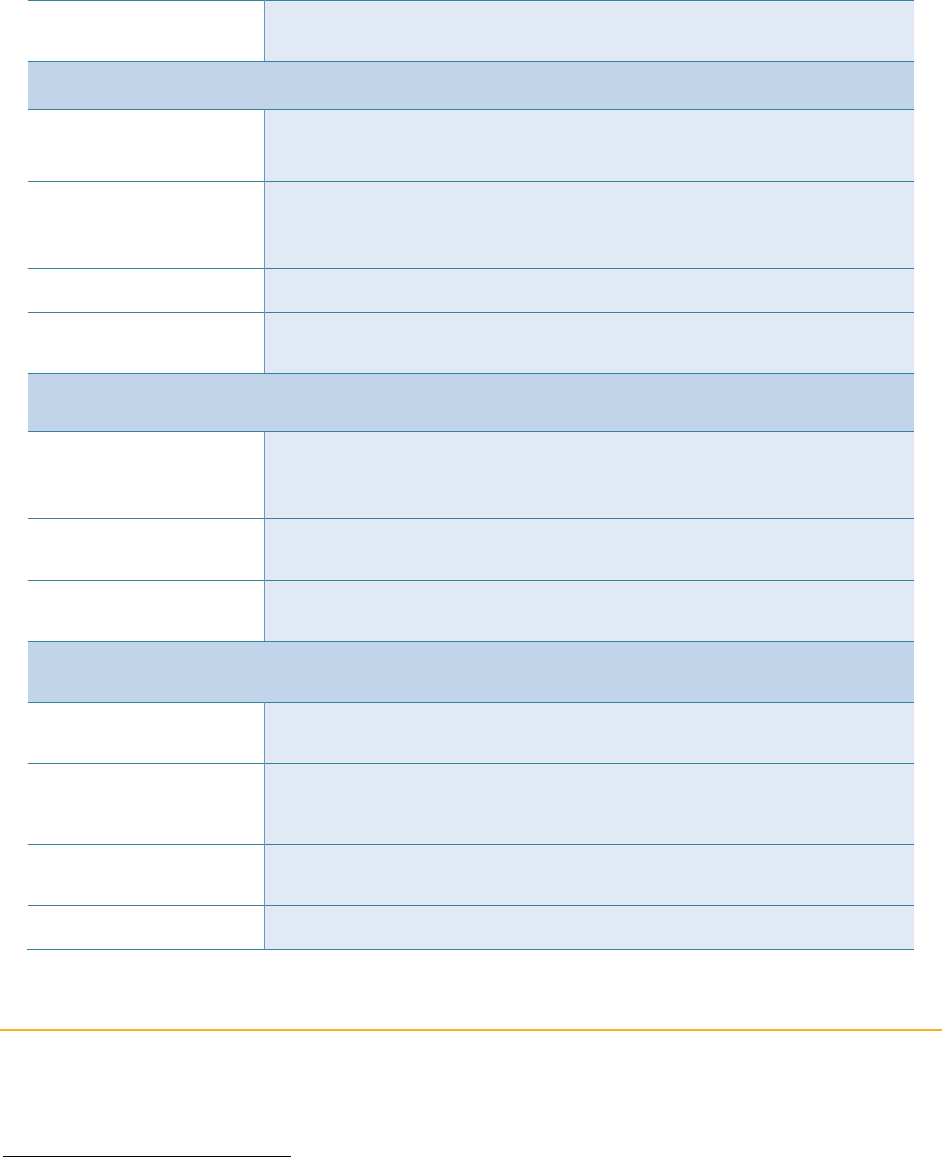

Table 2: Savings, Emissions, and Cost-Effectiveness of 2013-2015 Portfolio

Energy and Emission Savings from 2013-2015 Energy Efficiency Programs

(1)

Energy Savings

Emissions

(2)

Cost

Effectiveness

Electric

(GWh)

Demand

(MW)

Natural

Gas

(MM

Therms)

CO

2

(Million

Tons)

NOx

(1000

Pounds)

TRC

Goals

Gross

4,410

830

130

Reported

Gross

5,430

1,007

132

Net

3,877

719

89

1.15

Evaluated

Gross

5,070

954

100

7,053

2,607

Net

3,230

624

67

4,102

1,568

0.87

Table Notes: (1) First-Year Savings. Includes RENs and CCAs savings, Codes & Standards advocacy savings, and

low-income program savings. (3) Program savings do not include low-income savings or Codes & Standards

savings, but do include RENs and CCA savings. Program savings are used to calculate cost-effectiveness and to

calculate emissions savings. (2) Emissions are not calculated for low-income programs or Codes and Standards

savings.

At the statewide portfolio level, the 2013-2015 energy efficiency portfolio saved 5,070 gigawatt-hours of

electricity, 954 megawatts of demand, and 100 million therms of natural gas, exclusive of the savings

attributed to the codes & standards program and low-income programs, as shown in Table 2.

18

These savings

are equivalent to avoiding the annual electricity consumption of over 790,000 average California residences

and the annual natural gas consumption of over 323,000 average California homes.

19

When considering just these program impacts, the energy efficiency portfolio already exceeded most of its

savings goals. The 5,070 gigawatt-hours of savings exceeded the electricity savings goal for the statewide

portfolio by 20 percent. Peak demand savings for the statewide portfolio also exceeded its goals, achieving

954 MW saved or 9 percent above the statewide goal. The evaluated gross natural gas savings achieved 88

percent of the statewide goals, however, delivering 100 MM therms out of a goal of 130 MM therms of

savings.

18

Codes & Standards savings are tracked separately from the customer-targeted programs savings and goals. Codes & Standards have

their own set of goals, for which further detail can be found in the Codes & Standards chapter.

19

Equivalent homes were calculated using data from the U.S Energy Information Administration. Average California household

electricity consumption for 2015 equals 6,684 kwh. Total annual residential natural gas consumption in California in 2015 equaled

401,172 million cubic feet of gas while the Census Bureau reports California had 12,700,000 households in 2015.

Avg. Electricity Consumption: https://www.eia.gov/tools/faqs/faq.php?id=97&t=3

Natural Gas Consumption: https://www.eia.gov/dnav/ng/ng_cons_sum_dcu_sca_a.htm

Number of Households: https://www.census.gov/quickfacts/CA

Energy Efficiency Report | 19

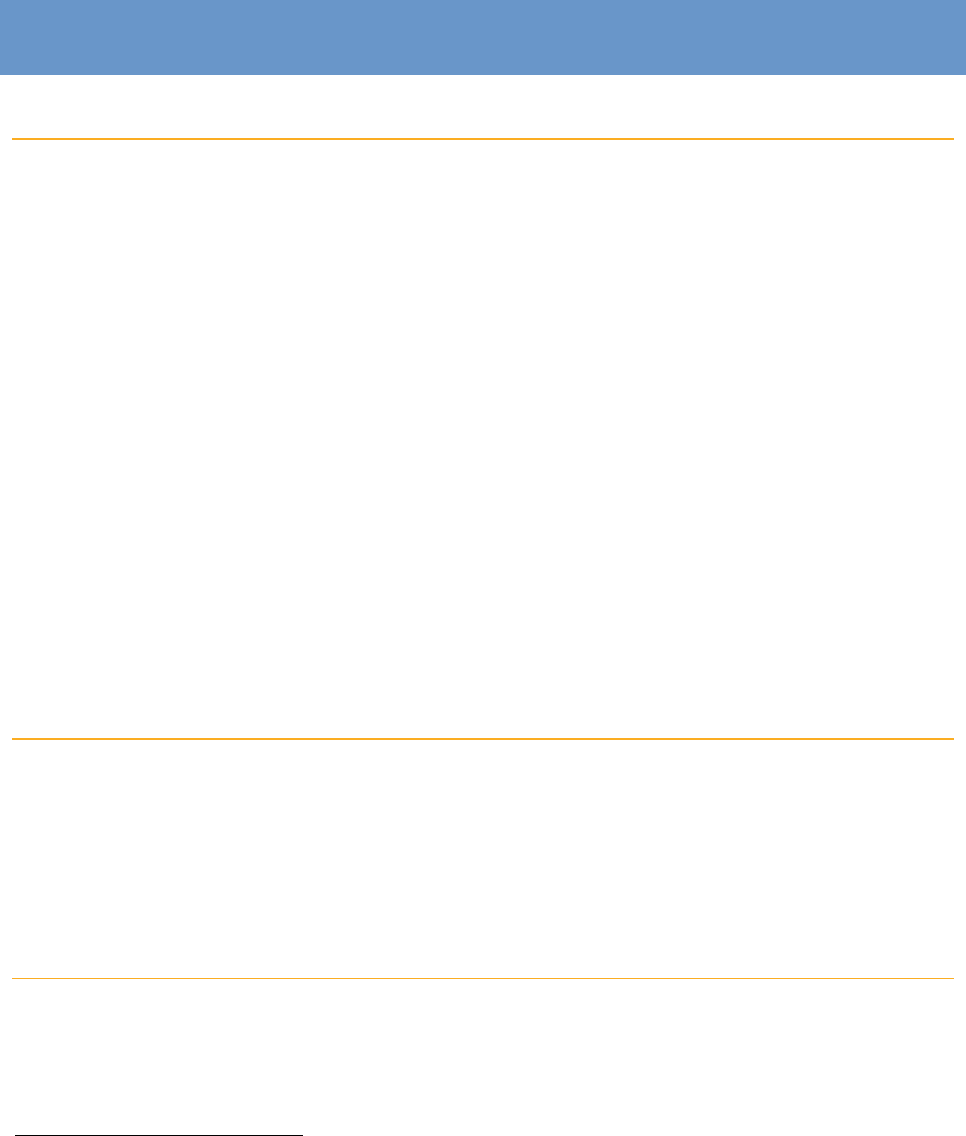

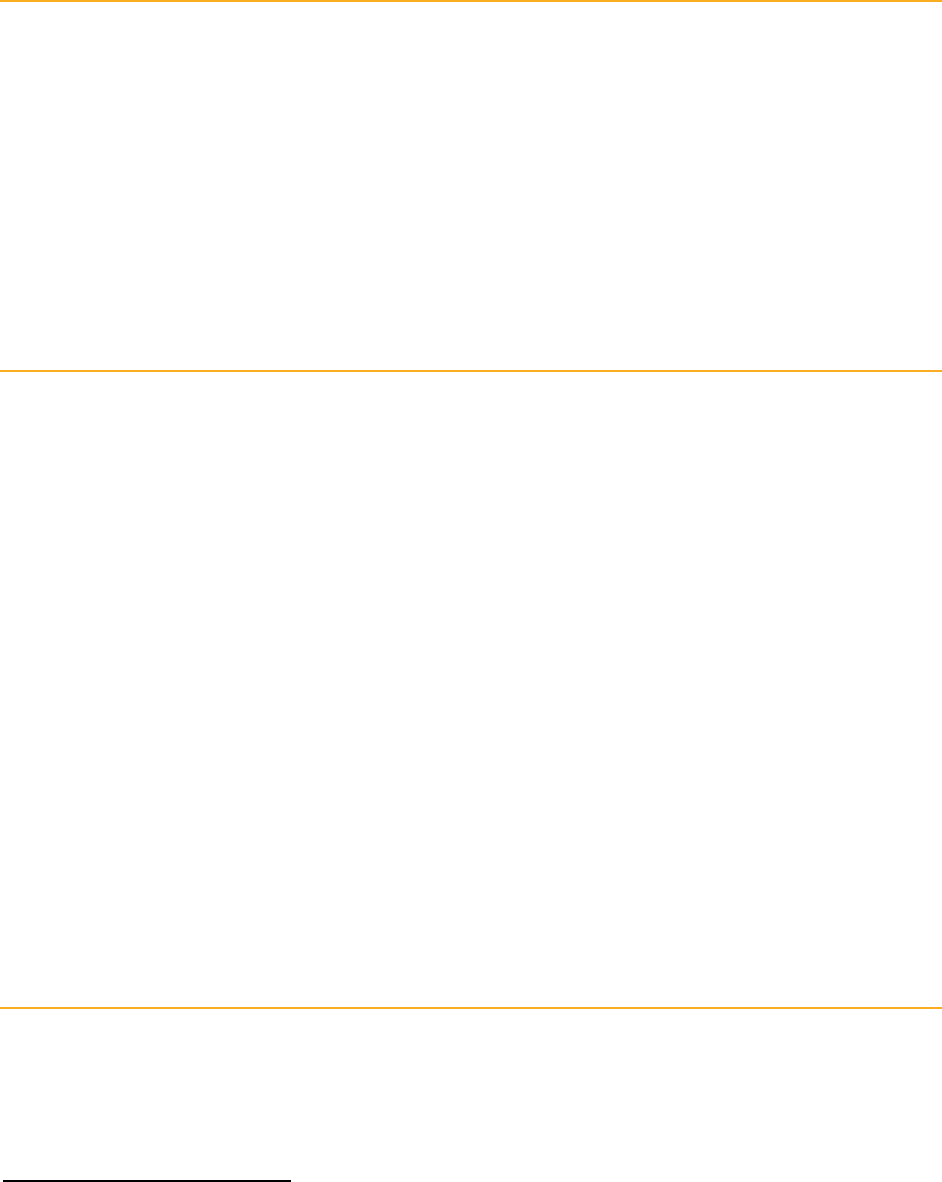

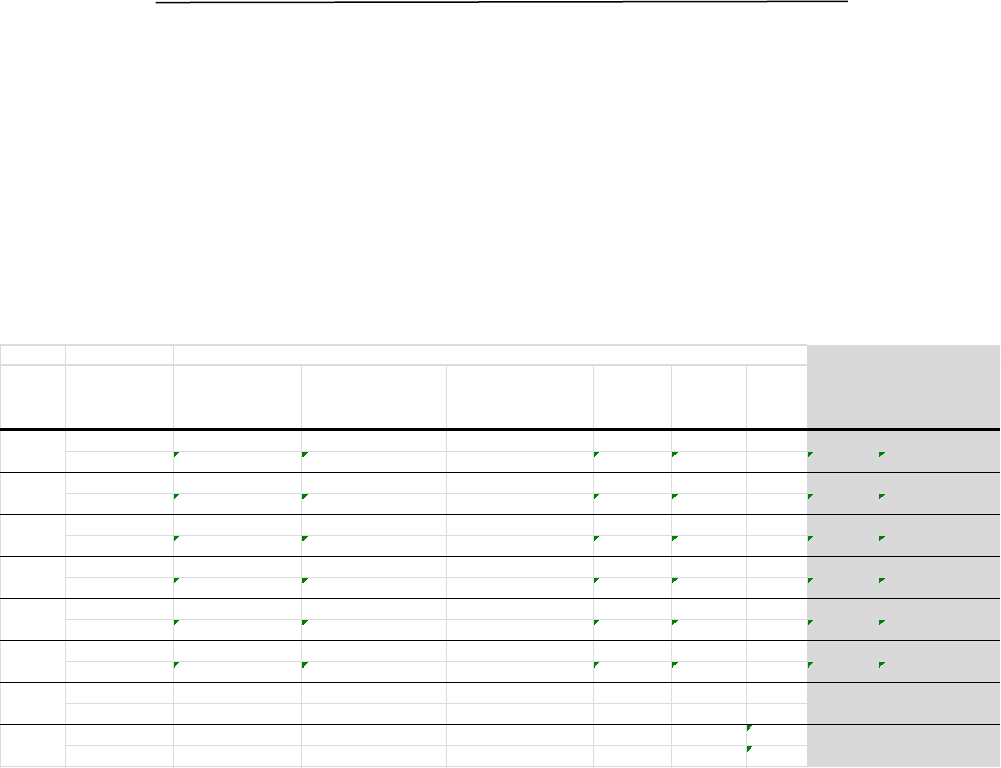

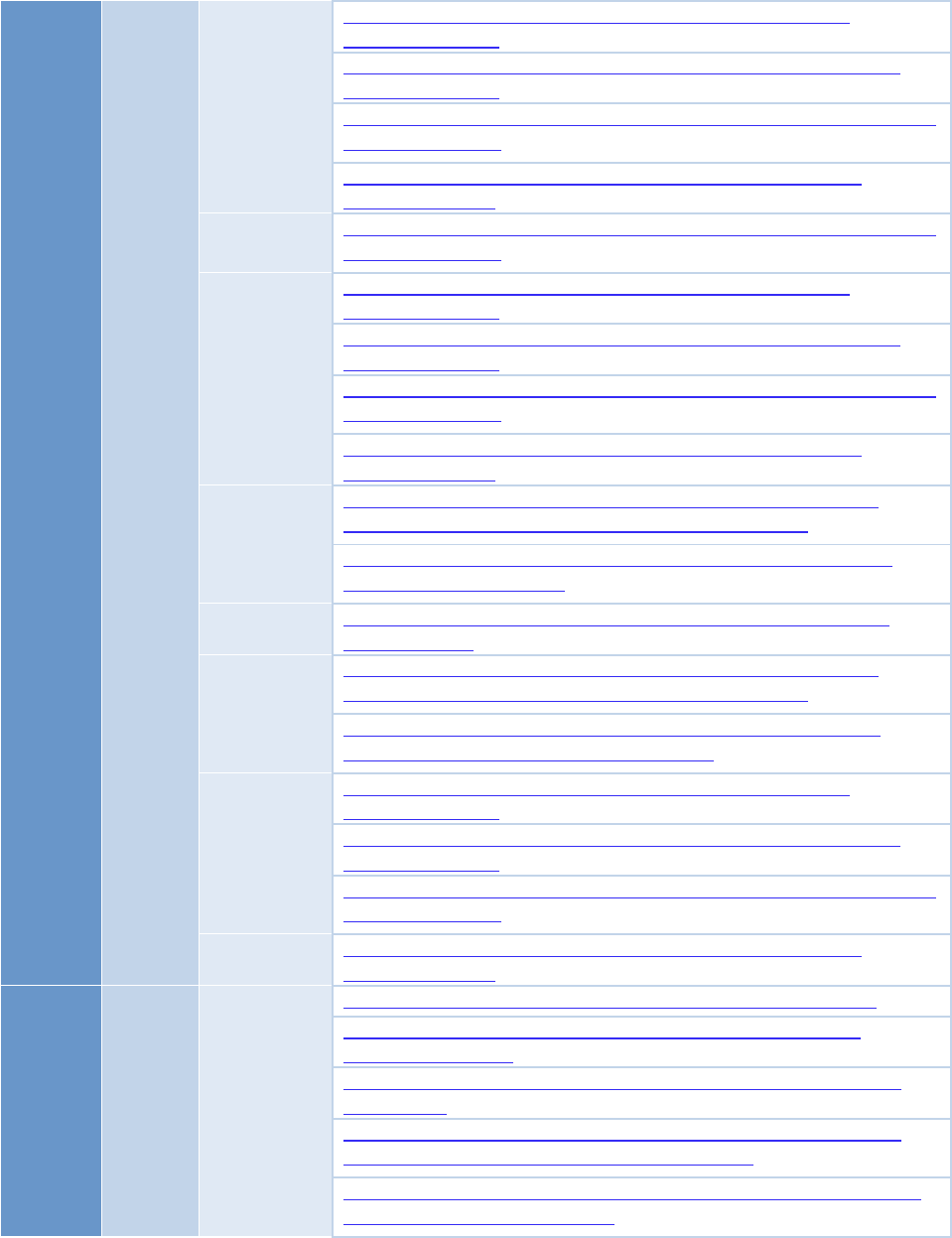

Figure 1: 2013-2015 Energy Efficiency Goal Attainment by IOU

For the 2013-2015 program cycle, the CPUC allowed PAs to include low-Income program savings in the

goal attainment calculation. The above chart is based on evaluated gross savings includes REN and

CCA savings within their respective IOU counterpart count and low-income savings. Codes and

Standards savings are not included in this chart.

For the 2013-2015 portfolio, however, the CPUC allowed program administrators to include low-income

program savings in their goal attainment numbers. When inclusive of these program savings, the goal

attainment percentages reach 120 percent, 121 percent, and 88 percent for electric savings, demand savings,

and natural gas savings, respectively. Figure 1 shows the percent goal attainment by IOU while Table 3 below

shows the goals values.

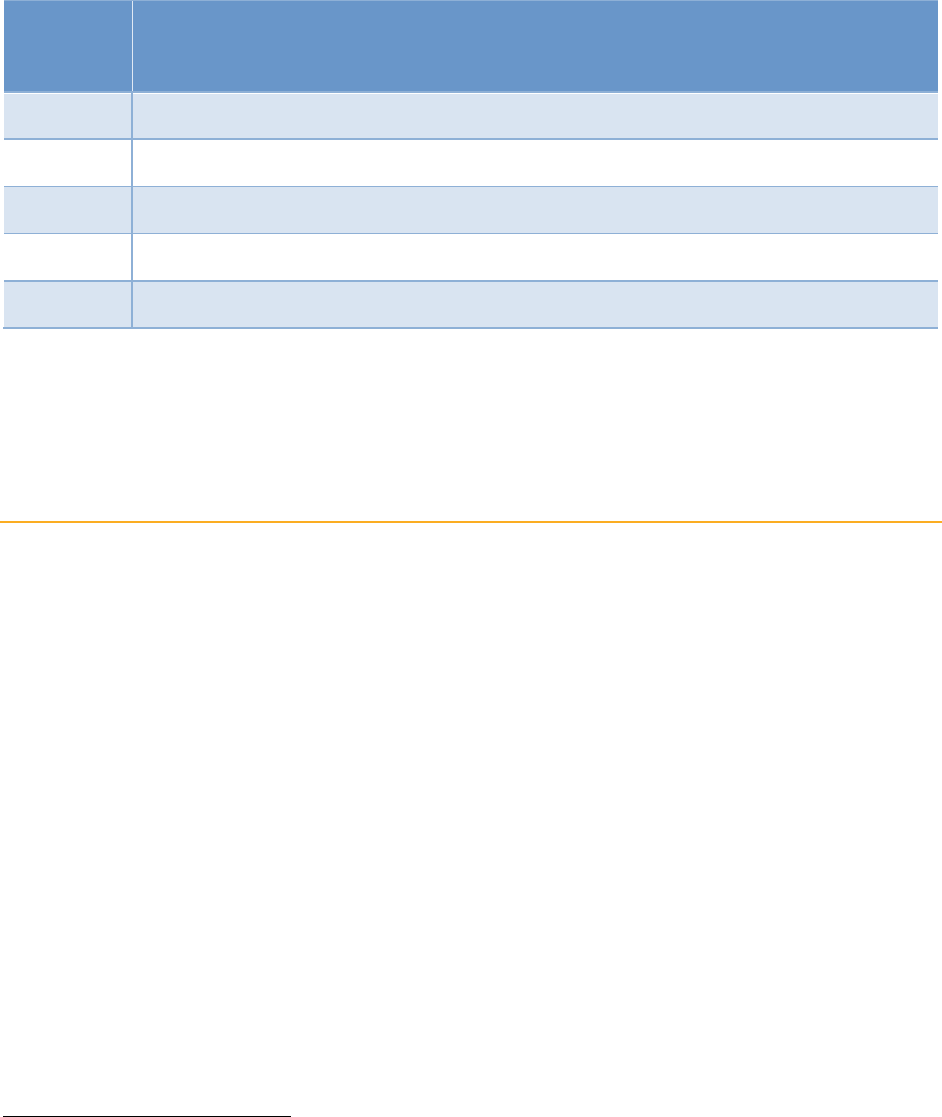

Table 3: Goals for the 2013-2015 Portfolio

2013-2015 Energy Efficiency Portfolio Goals

Electric

(GWh)

Demand

(MW)

Natural

Gas

(MM

Therms)

Program Goals

Gross

4,410

830

130

Codes and Standards Goals

1,756

243

7

Combined Goals

6,166

1,073

137

Excluding Codes & Standards costs and benefits, the statewide portfolio’s evaluated savings fell short of its

cost-effectiveness goal of a 1.25 TRC in 2013 and 2014 and its goal of a 1.0 TRC in 2015.

2 below shows the annual cost-effectiveness ratios of each IOU portfolio. The only year in which any of the

IOUs met their cost-effectiveness goals was 2013. PG&E and SCG both managed to meet or exceed the 1.25

TRC threshold in in 2013, but then fell below 1.25 in 2014 and below 1.0 TRC in 2015. SCG and SDG&E

123%

141%

111%

122%

112%

103%

97%

48%

72%

120%

121%

88%

0%

20%

40%

60%

80%

100%

120%

140%

160%

GWh

MW

MM Therms

GWh

MW

MM Therms

GWh

MW

MM Therms

GWh

MW

MM Therms

GWh

MW

MM Therms

PGE SCE SDGE SCG Portfolio

2013-2015 Energy Efficiency Portfolio Percent Savings

Programs Goal Attainment

Energy Efficiency Report | 20

came in below the TRC thresholds in each year. One factor that contributes to lower cost-effectiveness is

accounting for energy efficiency activities that would have occurred absent program intervention.

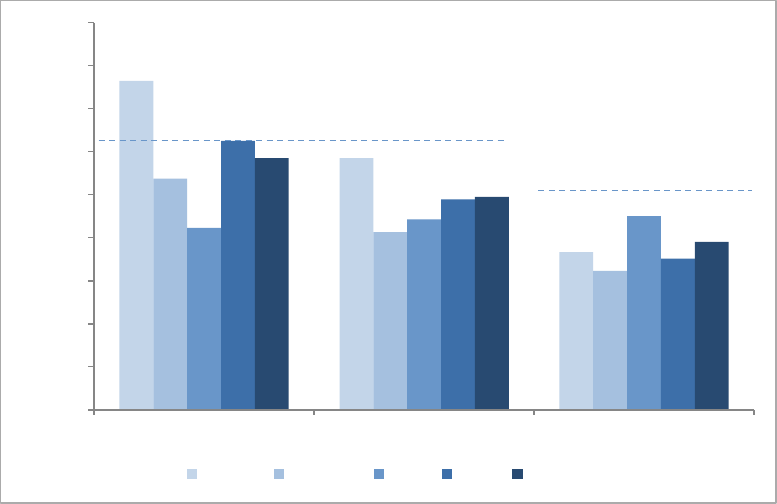

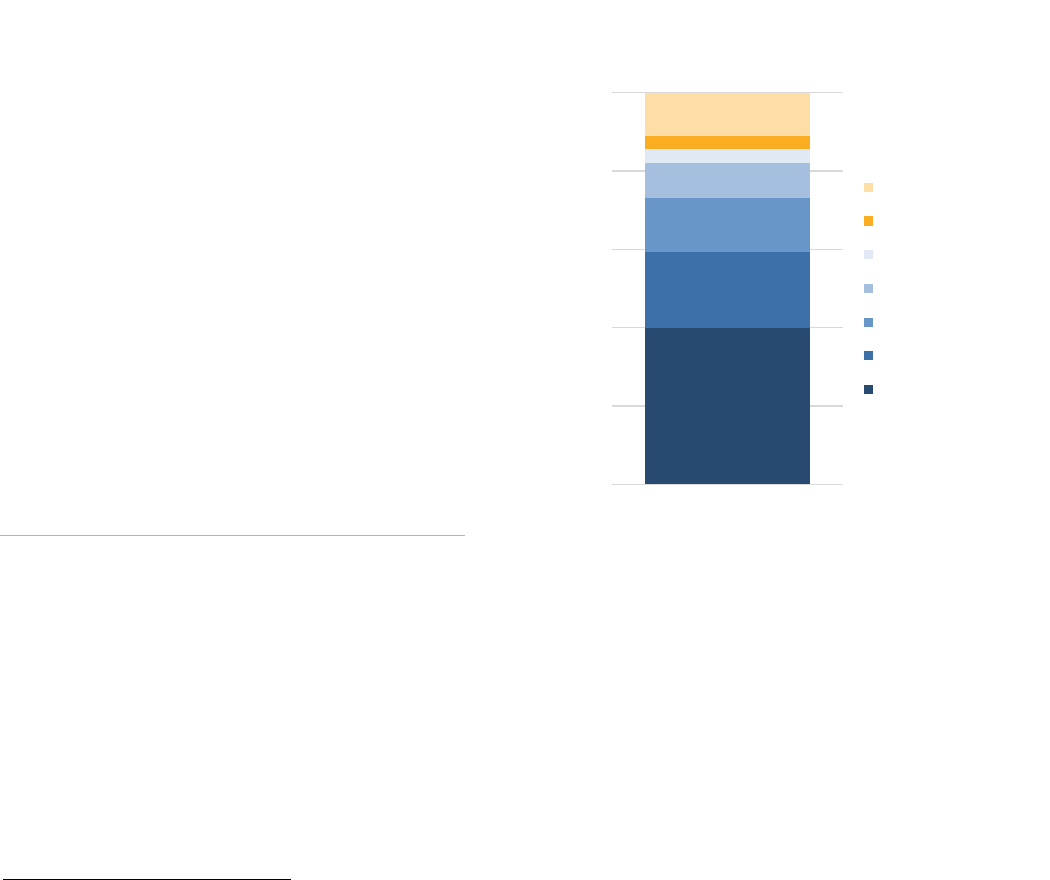

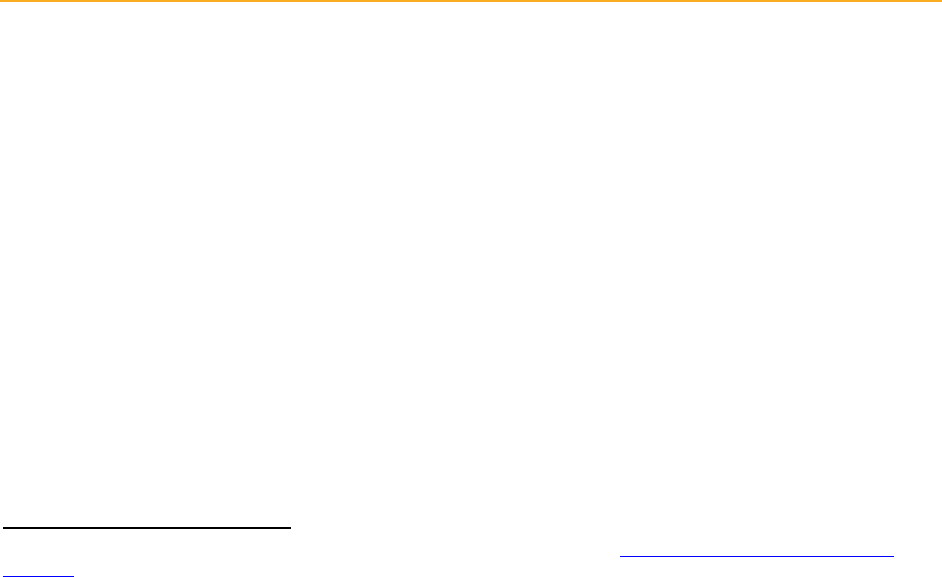

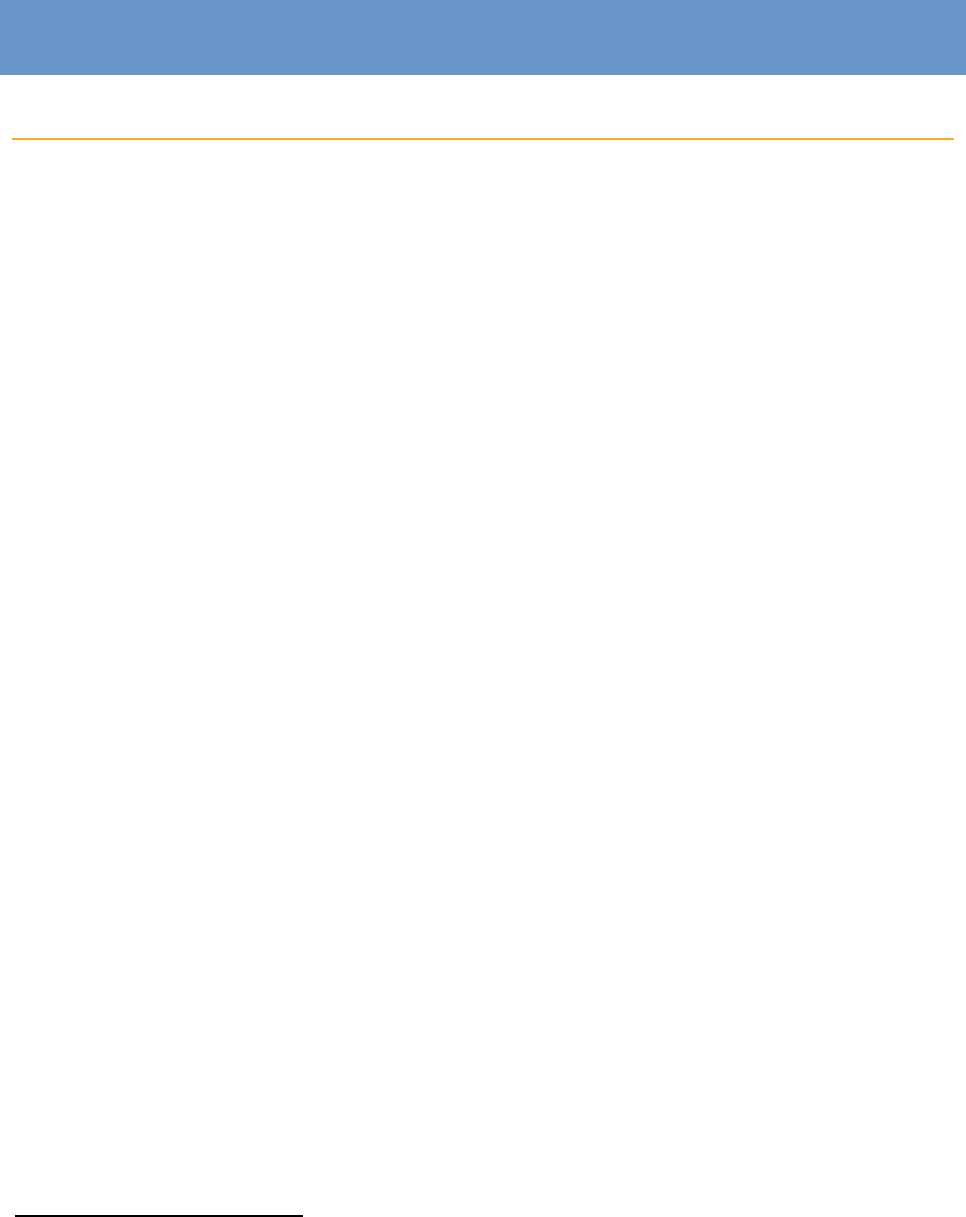

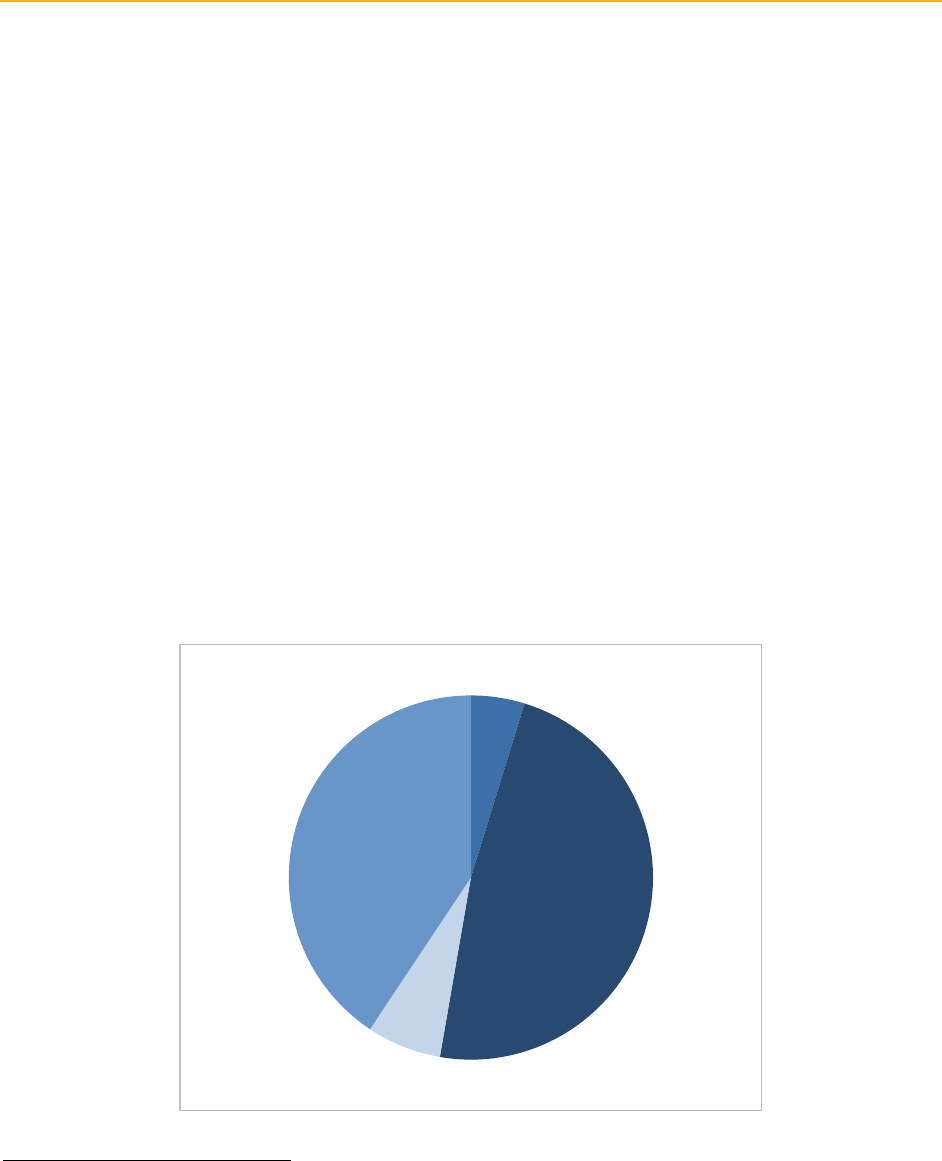

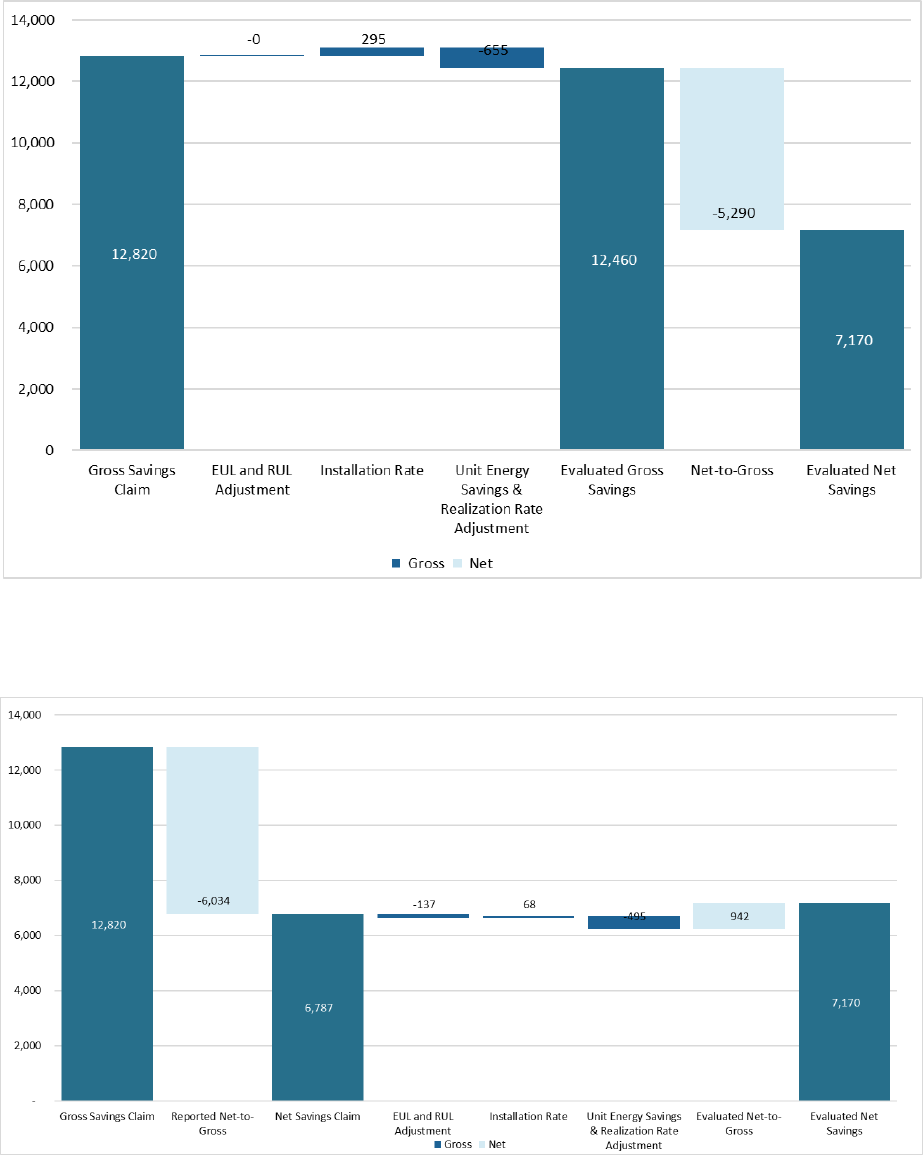

Figure 2: Annual IOU Portfolio Cost Effectiveness Ratios (2013-2015)

The blue dotted lines in the chart above show the TRC threshold of 1.25 (2013 and 2014) and 1.0 (2015)

that were set by the CPUC via decision. Program savings used for this calculation do not include

Codes & Standards savings.

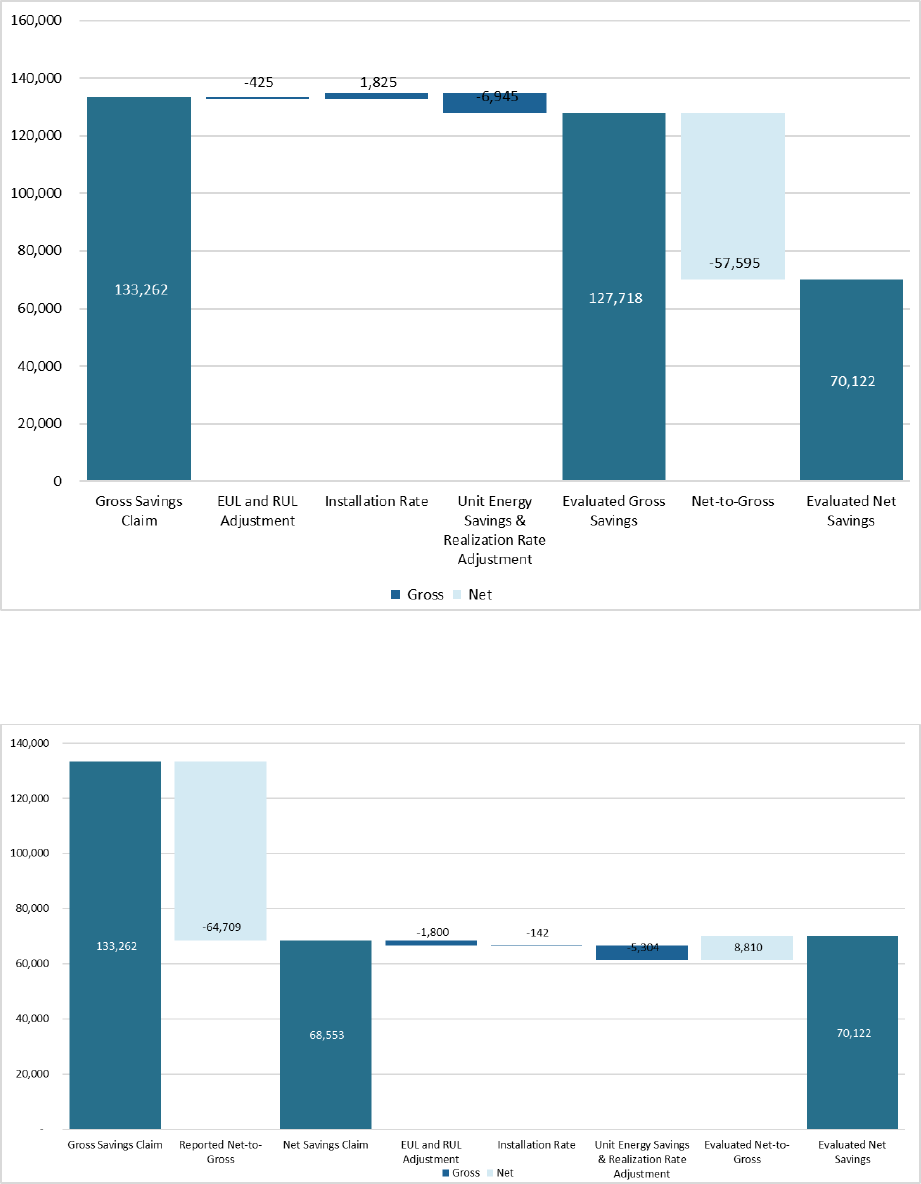

Cost-effectiveness of the entire portfolio increases, however, if one considers the costs and benefits of the

Codes & Standards programs combined with the above portfolio cost-effectiveness. The Codes & Standards

program has been discussed in past decisions as a potential hedge against failure to meet savings goals or

cost-effectiveness targets given that C&S advocacy reliably produces savings year over year in a significantly

cost-effective manner. While the decision to separate C&S savings and program savings is discussed at length

in D.12-05-015 (page 87), the impact of C&S savings on portfolio cost-effectiveness is discussed below for

illustrative purposes.

Codes & Standards Savings

The Codes and Standards (C&S) program saves energy by influencing continuous improvements in energy

efficiency regulations, improving compliance with existing codes and standards, and working with local

governments to develop ordinances that exceed statewide minimum requirements. Both the C&S program

advocacy and compliance improvement activities extend to virtually all buildings and potentially all appliances

in California. C&S savings result from the IOUs advocacy to the California Energy Commission (CEC) and

the federal Department of Energy for stricter building codes and appliance standards.

The savings from C&S programs are treated differently than the customer-oriented program savings. C&S

programs have their own savings goals, distinct from the portfolio goals described previously. Codes and

Standards savings greatly exceeded all of the separate Codes and Standards goals. Electric codes and

1.53

1.17

0.73

1.07

0.83

0.65

0.85

0.89

0.90

1.25

0.98

0.70

1.17

0.99

0.78

0.0

0.2

0.4

0.6

0.8

1.0

1.2

1.4

1.6

1.8

2013 2014 2015

TRC

Total Resource Cost by IOU and Year (2013-2015)

PG&E SDG&E SCE SCG Portfolio

Energy Efficiency Report | 21

standards savings achieved 223 percent of the gigawatt-hour savings goal, while codes and standards achieved

237 percent of its peak demand savings goal and 186 percent of its natural gas savings goal.

With inclusion of savings from C&S programs, portfolio-wide evaluated net savings increase to 7,037 GWh

(51 percent of total combined electricity savings); 1,212 MW (45 percent of total combined demand savings);

and 105 MM Therms (37 percent of total combined natural gas savings).

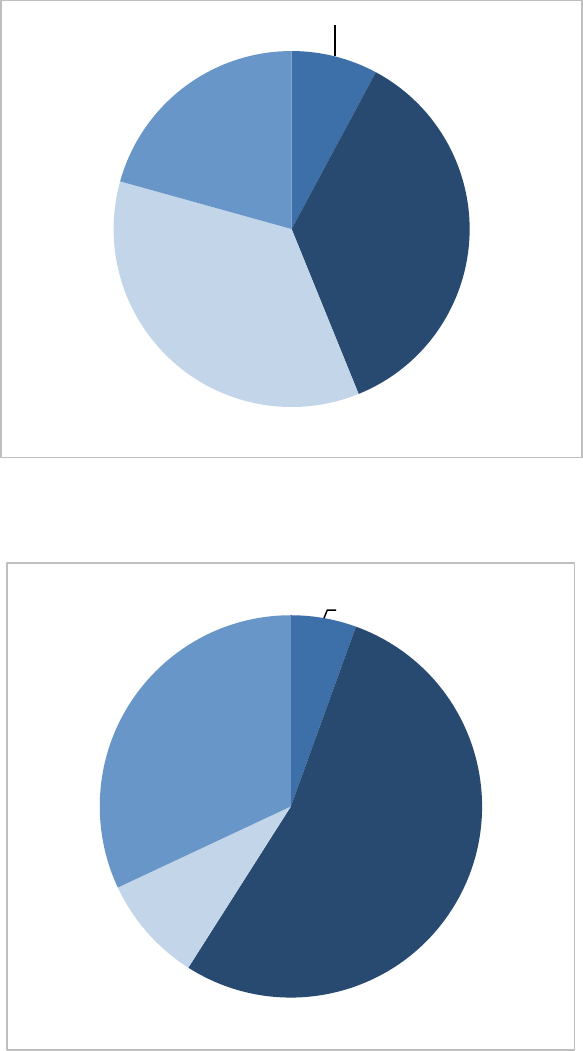

As shown below in Error! Reference source not found., including C&S in the TRC calculation increases

the cost-effectiveness of the portfolio significantly. As discussed above, previous CPUC decisions have

explored the idea of using C&S savings as a hedge against the IOUs failing to meet their savings goals or cost-

effectiveness targets. In the 2013-2015 program cycle, C&S savings were not allowable as a hedging tactic for

meeting performance goals, but the decision adopting separate goals is silent on whether cost-effectiveness

should be estimated separately or on a portfolio basis. The concept of codes & standards providing a hedge

for cost-effectiveness is illustrated in Figure 3 by the fact that in each of the program years, incorporating

C&S into cost-effectiveness results in cost-effective portfolios.

20

Figure 3: Portfolio Cost-Effectiveness Ratios, Including Codes & Standards

The blue dotted lines in the chart above show the TRC threshold of 1.25 (2013 and 2014) and 1.0

(2015) that were set by the CPUC via decision.

More information on Codes & Standards programs and savings can be found in Chapter 7: Codes &

Standards.

20

The calculation methodology of the Codes & Standards TRC is not entirely identical to the TRC methodology used for program

TRC ratios and is one of the reasons that the CPUC does not explicitly count codes & standards as a hedge for cost-effectiveness.

However, codes & standards do provide benefits to customers that may not apparent by looking at the portfolio cost-effectiveness

results in isolation. As such, the explanation and illustrative chart are provided above.

0.0

0.2

0.4

0.6

0.8

1.0

1.2

1.4

1.6

1.8

2.0

2013 2014 2015

TRC

Portfolio Total Resource Cost (2013-2015)

TRC w/ C&S

TRC w/o C&S

Energy Efficiency Report | 22

Portfolio Savings by Program Administrator

Each of the four IOUs develops and executes a portfolio of energy efficiency programs. The savings accrue

to their customers and are an opportunity to offset future procurement in their service territories. As stated

above, savings goals for electricity, gas, and peak demand are set for the total portfolio, as well as each IOU.

Figure 1 above shows the performance of each IOU compared to their goals for the 2013-2015 portfolio.

The IOUs exceeded their electricity and peak demand savings goals, but SDG&E and SCG did not meet their

natural gas savings targets.

While IOUs are required by statute to procure all cost-effective energy efficiency, neither statute nor the

CPUC sets a specific penalty for not meeting the CPUC-adopted goals. However, IOUs do receive

shareholder incentives for achieving energy savings and lower savings equate to lower levels of shareholder

rewards. This shareholder incentive framework is known as the Efficiency Savings and Performance

Incentive (ESPI). The ESPI awards the IOUs for performance in both non-resource and resource activities.

Thus, while SDG&E and SCG are not levied a specific penalty for missing the natural gas savings goals, their

shareholder incentive levels will be lower commensurate with the lower savings achieved. Regional Energy

Networks (RENs) and Community Choice Aggregators (CCAs) also contribute savings to the portfolio.

However, the CPUC does not set savings goals for these entities. Savings from RENs activities are counted

within their respective associated investor-owned utility savings count. CCAs are not fully under the purview

of the CPUC and therefore are not prescribed savings goals for their energy efficiency activities.

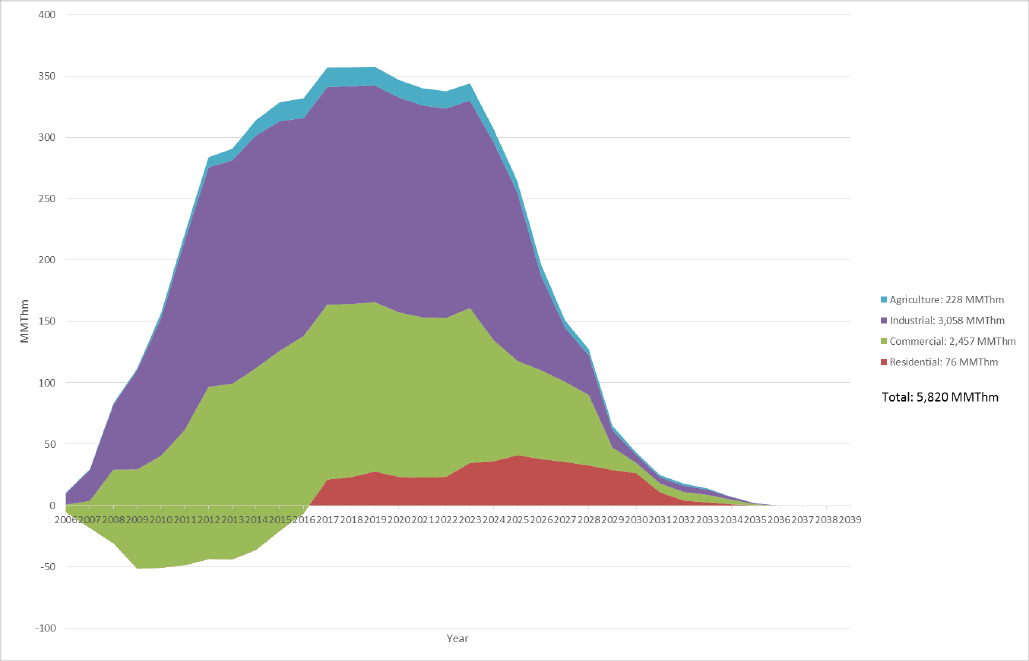

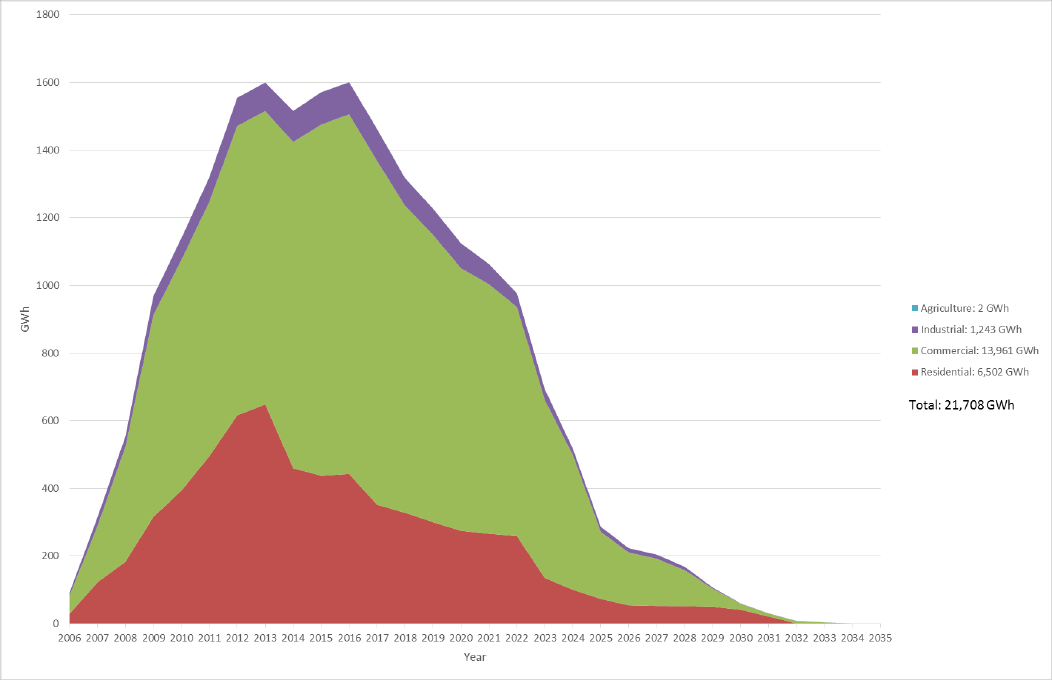

Portfolio Savings by Customer Sector

The residential, commercial, industrial, and agricultural sectors are the four primary customer segments in the

state. Electricity savings for the 2013-2015 cycle were driven mainly by the commercial sector, which

comprised 48 percent of total evaluated electricity savings. Comparatively, the residential sector accounted for

38 percent while the industrial and agriculture sectors contributed a combined 14 percent. This breakdown

reflects a shift from the 2010-2012 cycle, in which the residential sector accounted for the majority, 55

percent, of the electricity savings. This shift from residential savings to commercial savings was driven by the

residential upstream lighting program, which had successfully supported market adoption for Compact

Fluorescent Lights (CFLs) by the end of the 2010-2012 portfolio cycle. As such, installations began to

decrease in 2013 and thus reduced the residential savings proportion with respect to commercial savings.

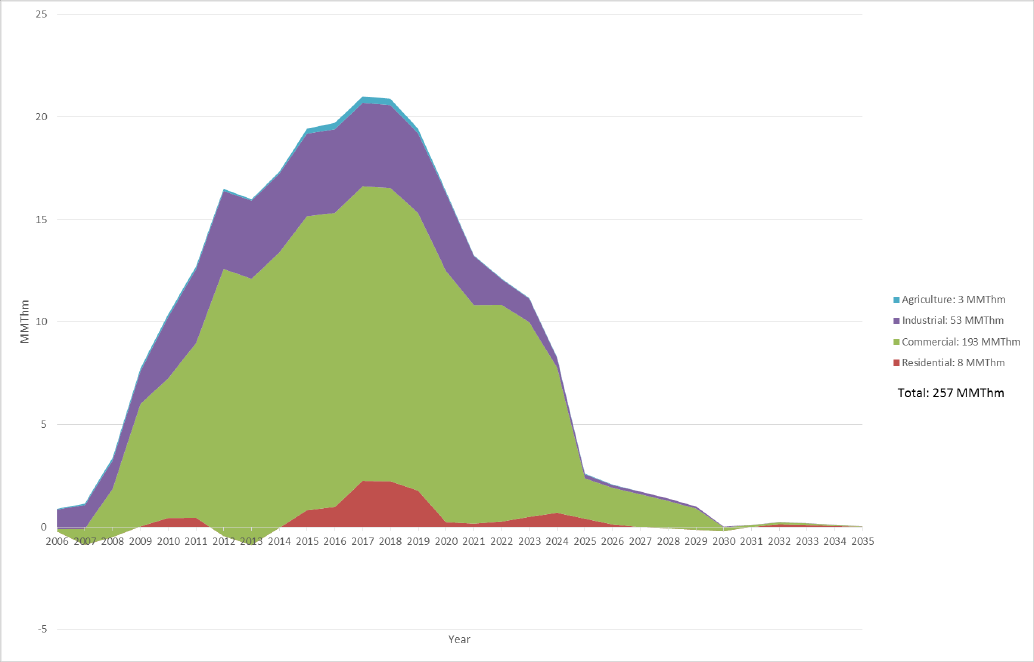

Natural gas savings are driven mainly by the industrial sector, which accounted for 52 percent of the natural

gas savings in the 2013-2015 portfolio. The commercial sector contributed 40 percent of gas savings while the

residential sector has a much smaller impact, contributing 8 percent to the portfolio. It is worth noting that

natural gas savings in the commercial and residential sectors are impacted by the interactive effects of certain

other energy efficiency measures (mainly efficient lighting). These interactive effects are described in more

depth in the next section, “Portfolio Savings by End Use.”

Portfolio Savings by End Use

The end uses that drive electricity savings vary by customer segment or sector. However, lighting and HVAC

measures contribute large amounts of savings across the portfolio. As shown in Figure 4 below, HVAC and

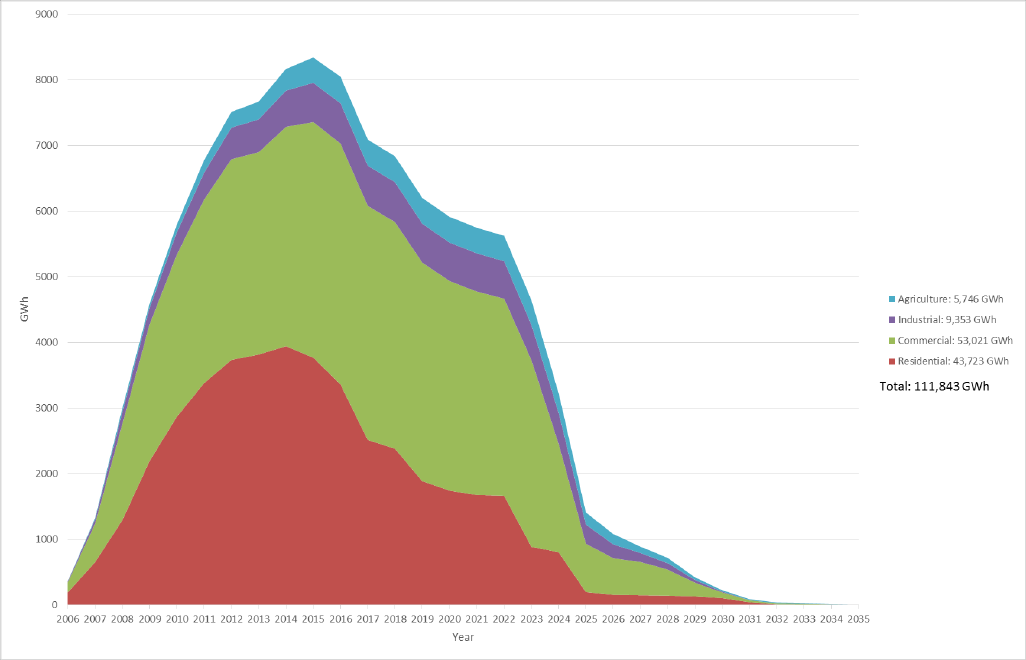

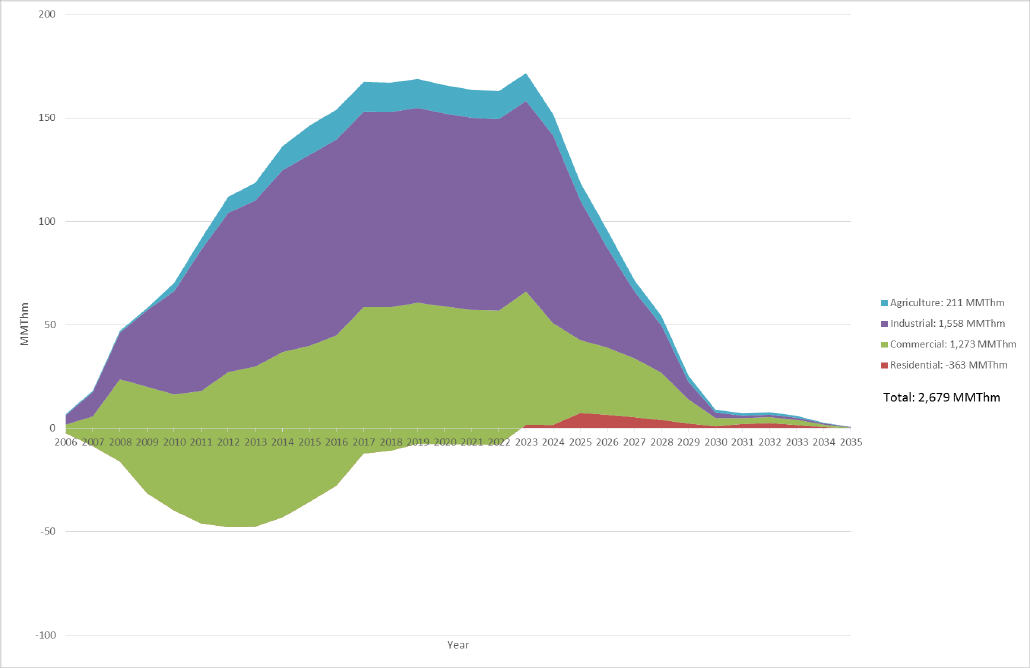

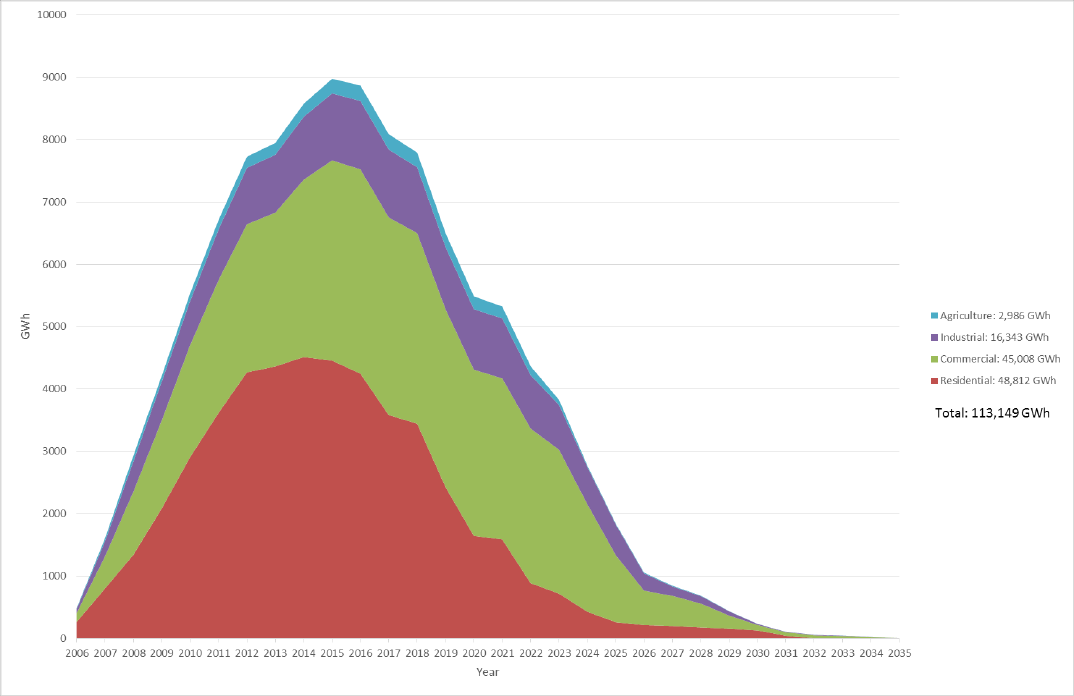

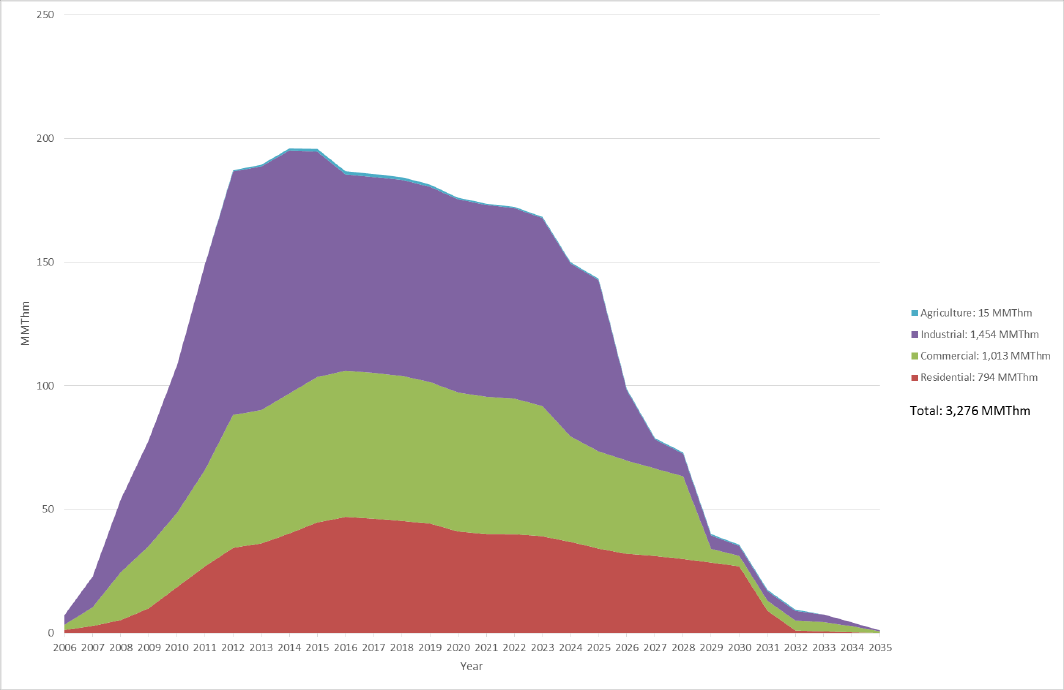

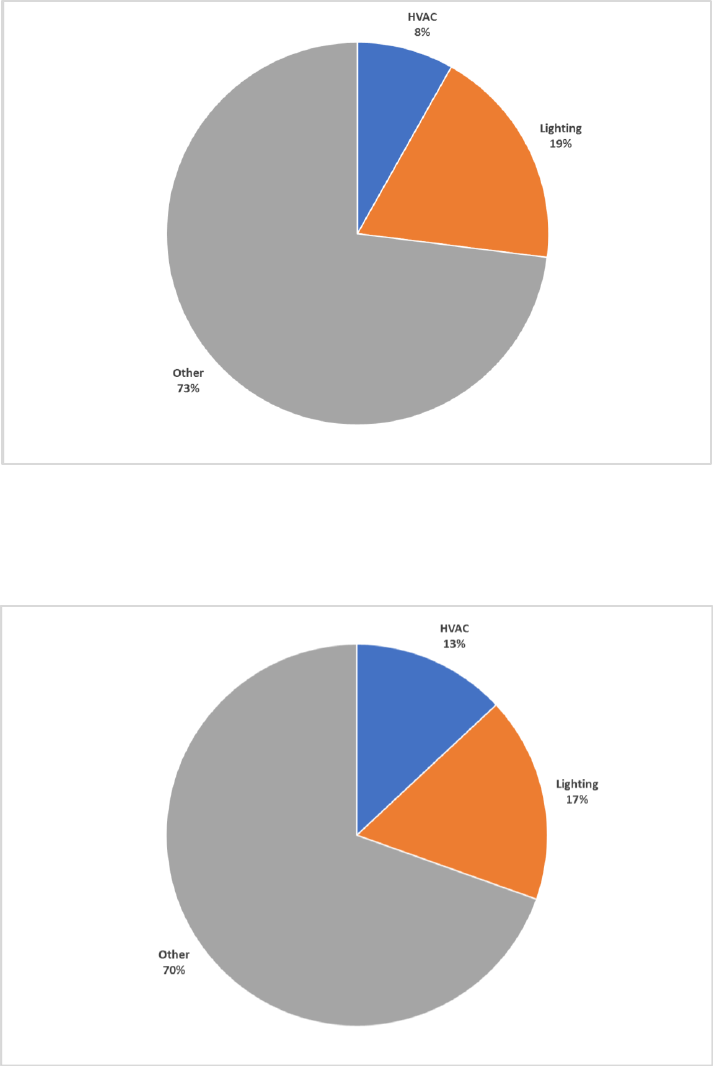

lighting measures combined account for 67 percent of electricity savings in the 2013-2015 portfolio, with