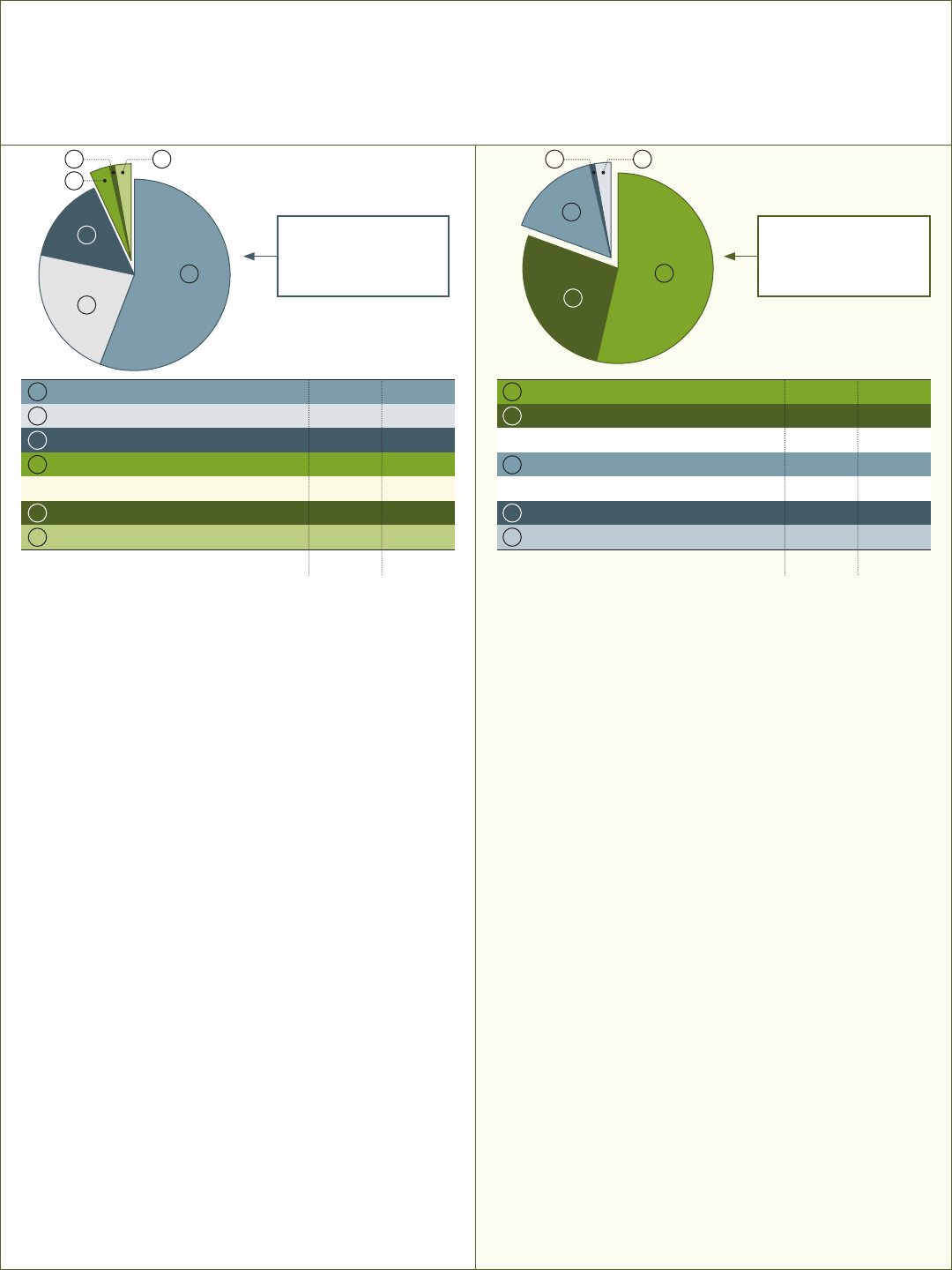

The largest portion of general fund revenue comes from the state school fund.

The Oregon Department of Education determines the total funding that each

district receives through a formula that includes:

• The amount of funding appropriated by the state legislature.

• The estimated permanent rate property taxes collected statewide.

• The number of students in the district, weighted for average teacher

experience, the number of special education and emerging bilingual students,

and other factors.

In the 2016-17 adopted budget the state school fund accounts for 74% of the

funds – with permanent rate property taxes at $215.9 million (36.4% of total

funds) and the state school fund at $222.8 million (37.6%).

PPS collects local option property taxes of $81.7 million (13.8%) in this budget

and also $23.1 million of other local property tax (3.9%). The local option is a

ve-year voter-approved levy that was most recently approved in November

2014. Remaining sources of funds include the beginning fund balance, which

is carried over from the prior year and includes the district’s general fund

contingency reserves. This balance accounts for $25.7 million (4.3%) in the

current budget.

Finally there is $23.4 million (3.9%) of other revenue, which includes funds

received via the Multnomah Education Service District ($8.5 million), the City

of Portland arts income tax ($4.5 million), overhead charged to grants ($4.2

million), and income from leasing and renting district facilities ($2.3 million).

Additional detail behind the sources of these funds can be found on p. 70 of the

adopted budget document.

PORTLAND PUBLIC SCHOOLS

UNDERSTANDING THE PPS BUDGET: 201617

School budgets are not easy to read or understand.

In response, we have produced this four-page document

to provide an easy-to-understand summary of the PPS

budget and to answer the questions we hear most often

about our general fund budget:

• Where does the money come from?

• What does the money pay for?

• How are schools funded?

• What about other funds?

Where does the money in the PPS general fund budget come from?

Beginning Fund Balance

2016/17($ millions)

Total $592.6

$23.4

$23.1

$81.7

$438.7

$222.8

$215.9

$25.7

100.0%

3.9%

3.9%

13.8%

74.0%

37.6%

36.4%

4.3%

Other Revenue

Property Tax – Other

Subtotal – State School Fund Formula

State School Fund Allocation

Property Tax – Local Option

Permanent Rate – Property Taxes

Permanent Rate –

Property Taxes

$215.9 million

36.4%

State School Fund

Allocation

$222.8 million

37.6%

Property Tax –

Local Option

$81.7 million

13.8%

Property Tax –

Other

$23.1 million

3.9%

Other

Revenue

$23.4 million

3.9%

Beginning

Fund Balance

$25.7 million

4.3%

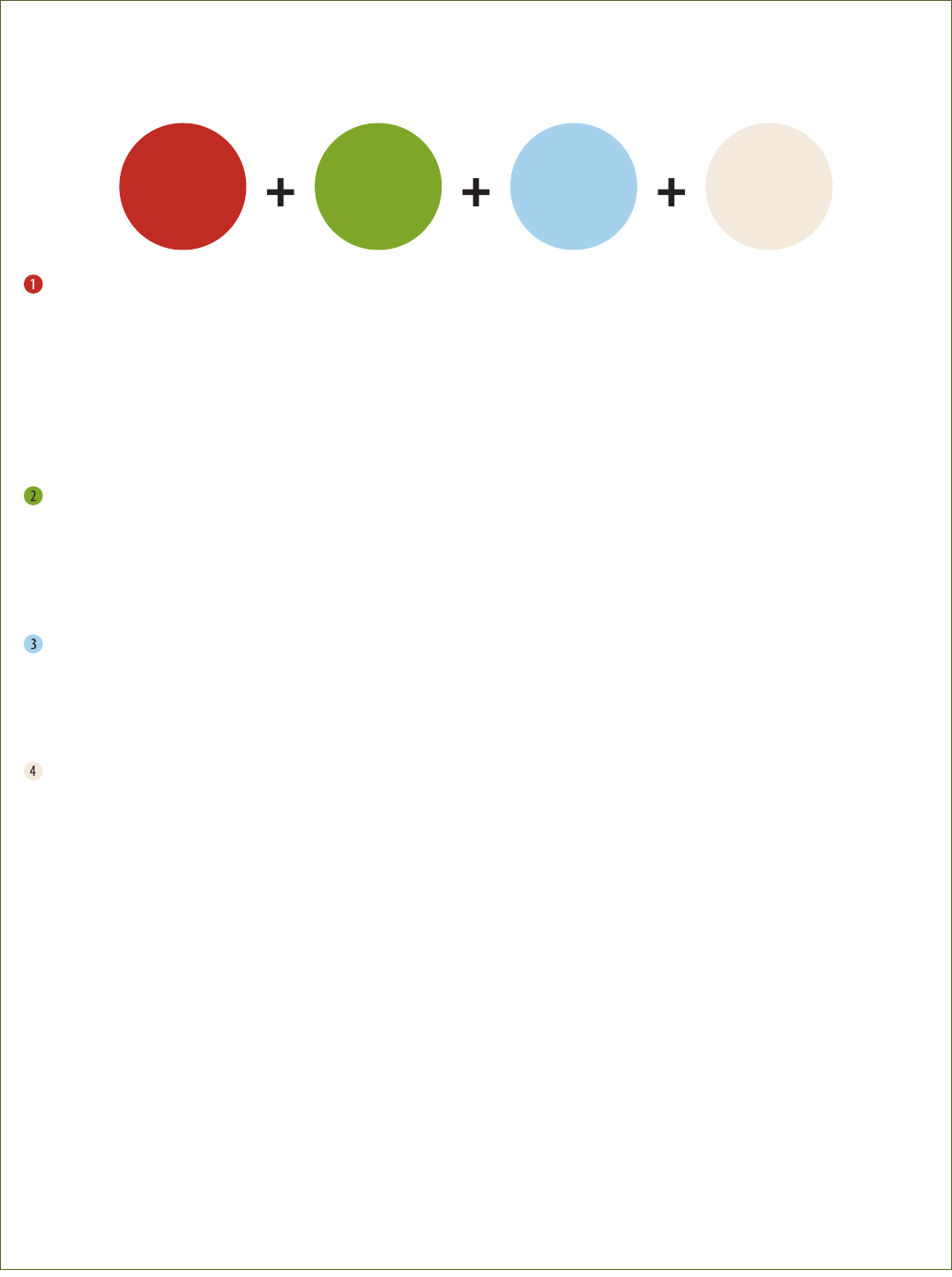

What does the money in the general fund budget pay for?

The largest share of PPS general fund budget goes to direct instruction,

which includes classroom teachers, special education and ESL teachers,

educational assistants, textbooks, and supplies. In 2016/17 PPS allocated

$332.3 million (56.1%) of its general fund budget to these uses.

The second largest allocation is for classroom support, which includes

librarians/media specialists, counselors, school principals, school psychologists,

attendance coordinators, extra-curricular activities, and other classroom

support activities. In 2016/17 PPS allocated $132.6 million (22.4%) of its

general fund budget to these uses.

Also directly impacting schools and students is building support, which

includes student transportation, utilities, maintenance, custodians, printing,

purchasing, technology services, and other building support. In 2016/17 PPS

allocated $86.5 million (14.6 %) of its general fund budget to these uses.

The nal category of operating costs is for central support/administration,

which includes the superintendent’s oce, public information, testing, legal,

nance, payroll, budgeting, human resources, and supervision of instruction.

In 2016/17 PPS allocated $20.5 million (3.5%) of its general fund budget to

these uses.

Debt service and fund transfers includes interest and principal payments on

borrowed funds and transfers to facilities and IT capital funds. In 2016/17 PPS

allocated $5.4 million (0.9%) of its general fund budget to these uses.

The nal category is contingency/reserves, which includes savings for

emergencies and unforeseen changes to revenues and expenditures, insurance

liabilities, and any specic committed reserve funds. In 2016/17 PPS allocated

$15.2 million (2.6%) of its general fund budget to these uses, of which $1.5

million is specically allocated to a self-insurance reserve.

More specic details of expenditures by program can be found on pp. 71-74 of

the adopted budget.

What does the PPS general fund pay for (looked at

another way)?

The previous breakout of budgeted spending was by program. The alternative

is by account category. As these gures show clearly, PPS spends most of its

budget on people, with $478.3 million (80.7 %) of the 2016/17 budget going

for salaries and benets for employees.

Only $93.7 million (15.8%) is spent on non-personnel products and services,

with the largest categories being $23.2 million (3.9%) for charter and

alternative schools, $18.5 million (3.1%) for property services and utilities,

$12.8 million (2.2%) for supplies and materials, including textbooks and

curriculum materials, and $13.9 million (2.3%) for transportation services.

Travel, which is an area we are often asked about, is only $0.5 million (0.1%).

Debt Service and Fund Transfers is $5.4 million (0.9%) and Contingency/

Reserves is $15.2 million (2.6%).

More specic detail of expenditures by account category can be found on

pp. 89-92 of the adopted budget.

There are two ways to answer this question, either by program or by account category. Programmatic use separates spending by teachers in classrooms, classroom and

building support, central administrative services and other programs, while categories of spending includes all programs but breaks out salaries and benets, supplies and

materials, services, etc.

Direct Instruction – Teachers and textbooks

2016/17

Total $592.6

$15.2

$5.4

$571.9

$20.5

$86.5

$132.6

$332.3

100.0%

2.6%

0.9%

96.5%

3.5%

14.6%

22.4%

56.1%

Contingency/Reserves

Debt Service and Fund Transfers

Central Support/Administration

Building Support – Buses, buildings and more

Subtotal – Operating Costs

Classroom Support – School sta and support

Salaries

2016/17

Total $592.6

$15.2

$5.4

$571.9

$93.7

$478.3

$159.8

$318.5

100.0%

2.6%

0.9%

96.5%

15.8%

80.7%

27.0%

53.7%

Contingency

Transfers & Debt Service

Subtotal – Non-Personnel

Subtotal – Salaries & Benets

Total Operating Costs

Benets

A

B

D

C

E

F

A

B

C

E

D

A

B

D

C

E

A

B

D

C

F

E

93% of the PPS general

fund budget impacts schools

and students directly

81% of the general fund is

dedicated to people

How do we fund each of the schools?

The largest investment we make in our schools is to pay for stang – the teachers, secretaries, principals, and other individuals working in schools. We refer to these

as FTEs or full-time equivalents, which are allocated to individual schools using the following approach:

Stang Assigned by Number of Students – The largest stang

allocation for each school is based on the number of students served. This

is mostly used to provide teachers and educational assistants. Positions are

designated in licensed FTEs, where one teacher equals two classied sta

members (e.g., secretary, clerk, educational assistant). Therefore, only 0.5

FTE is needed to hire a full-time secretary and 0.25 FTE is needed to hire

a half-time educational assistant. Kindergarten is covered by a separate

allocation. PPS uses stang ratios that are reviewed every year, and are

described on p. 36 of the adopted budget.

Equity Allocations – Some schools receive extra funding based on the

number of students qualifying for free or reduced-price meals and the

number of historically underserved students (Black, Latino, Native American,

Pacic Islander, learning English, and Special Education). Nineteen of 31 K-5

schools; 20 of 26 K-8s; 8 of 11 middle schools; and all 10 high schools receive

an equity allocation to provide extra support to students in need.

School-Wide Support – This allocation is based on a school’s needs due to

size and conguration (K-5, K-8, K-12, middle and high schools). Positions

include principals, vice principals, assistant principals, media specialists,

and school secretaries. Schools serving students in K-5 receive arts teacher

stang, funded by the City of Portland arts income tax.

Sta for Special Circumstances – Sta are allocated to address specic

considerations (such as split campus, recent changes, unique programs, etc.).

Additional sta are also allocated to support the ability of schools to oer

the core program (each spring for the following school year) and to address

higher-than-forecast student numbers and large class sizes (each fall).

Kindergarten

We sta kindergarten separately. Initial kindergarten teacher and educational

assistant allocation is based on the number of students projected to be enrolled

and a maximum class size of 26. Additional resources may be allocated in the fall

based on the number of students enrolled.

In 2015-16 Kindergarten was funded for a full-day by the state for the rst time.

In PPS schools with Kindergarten and where more than 50% of the students are

identied as historically underserved (26 of 57 schools), PPS provides additional

support through allocation of a half-time educational assistant in each

kindergarten classroom. Additionally, at 23 of these 26 schools, federal Title I

funds pay to make the educational assistants full time. This investment has been

made in support of the PPS third grade reading priority, which is focused on

ensuring that all children in PPS can read-to-learn by third grade.

Special Education and English as a Second Language (ESL)

Both Special Education and ESL programs provide sta in the schools. Each school

has some FTE allocation from each of these programs, based upon the number of

eligible students (see pp. 42-44 in adopted budget). Both programs are supported

by a combination of general fund and grant/special revenue funds.

Other funds

In addition to the general fund stang, schools may also receive funds via Title I,

raise funds through foundation activity, and receive grants.

Title I: Schools with higher numbers of students in poverty (measured by

percentage of students qualifying for free meals) receive federal Title I funds.

Schools receive a dollar amount per qualifying student. These funds may be used

to fund stang and/or to provide support and services to these students and

their families. In 2016-17 there are 9 K-5, 14 K-8, 2 middle schools and 3 high

schools that receive Title I funding.

Foundation and PTA funds: A number of schools raise money through

parent-led fundraising to support school stang and other activities, through

foundations. Use of funds for non-stang activity is at the discretion of each

school. Funds to pay for additional stang are subject to sharing; one-third of

the dollars raised by local school foundations (after the rst $10,000) is set aside

in an equity fund administered for PPS by All Hands Raised, which uses a formula

to fund grants to PPS schools each spring.

Discretionary Budgets: The amount of discretionary funds (referred to as

consolidated budget) each school receives is partly based upon the number of

students at the school. The amounts range from $35,000 for a small K-5 school to

$190,000 for a large high school. Principals use these funds to pay for such things

as supplies, limited-term personnel, printing costs, some teacher extended

responsibility, library books and materials, copy machines and toner, eld trips,

and substitute costs not covered centrally.

Schools do not pay for utilities, custodians, or maintenance work. These services

are budgeted centrally in the Facilities department.

A more detailed description of the school stang formulas and the allocations

by school is published in the PPS budget. It begins on p. 33 in the 2016/17

adopted budget.

Sta assigned

by number

of students

Sta assigned

by equity

allocation

School-wide

support

Sta for special

circumstances

The PPS scal year runs from July 1 to June 30. Figures in this document are from

the PPS adopted budget. Some items are hard to estimate (e.g. local option

revenue) or change after the budget is adopted (e.g. state school fund allocation)

and are revised in budget amendments approved by the board during the year.

We would like to thank the PPS Community Budget Review Committee for

encouraging us to develop this summary and for working with us to improve the

nal product.

To learn more:

View the PPS adopted budget for 2016/17:

http://bit.ly/PPSbudget

View the Superintendent’s budget framework:

http://bit.ly/PPSbudgetframework

Please send any questions or comments to Lori Baker, Deputy Chief Financial

Ocer, [email protected].

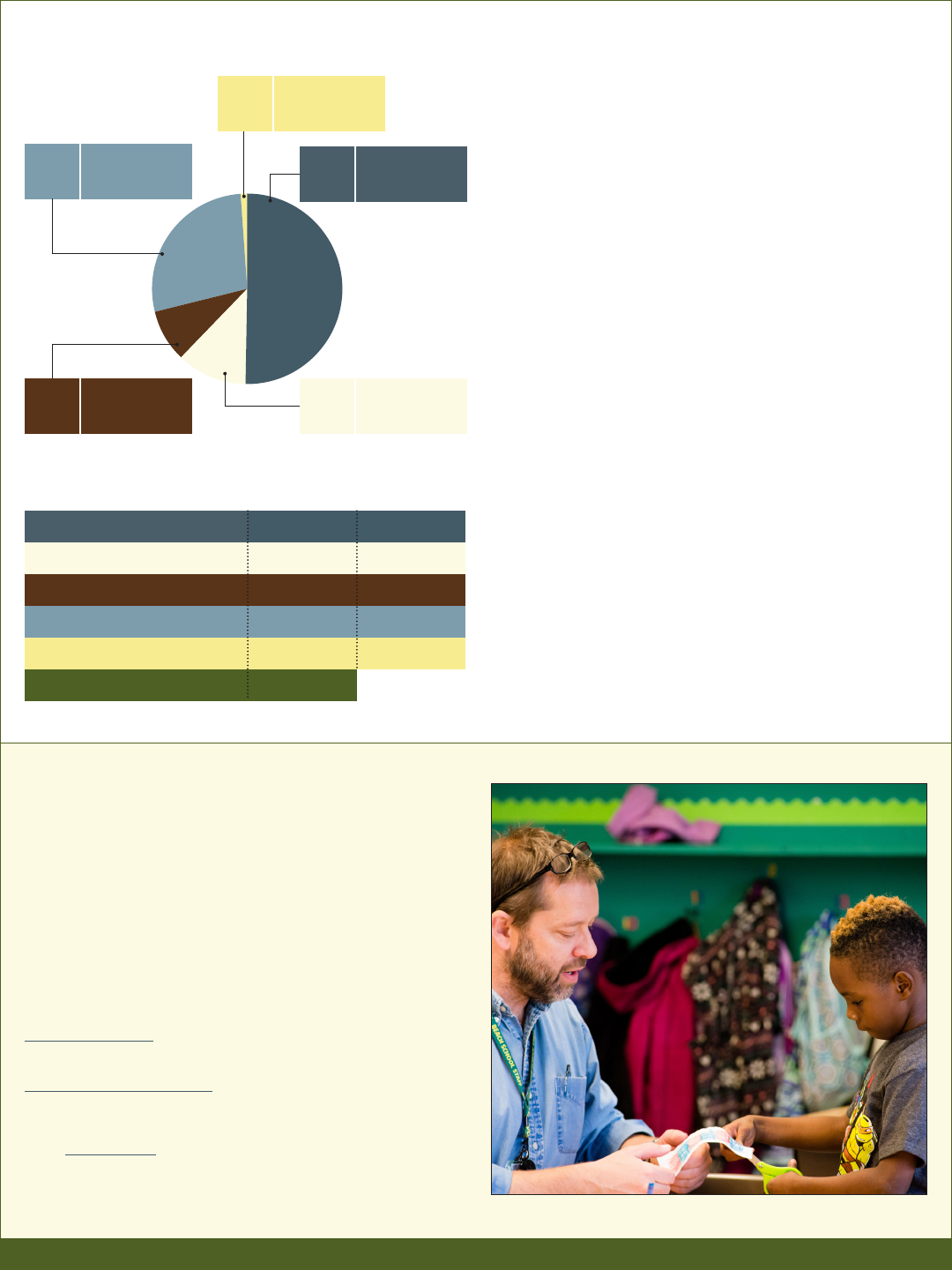

What about other funds?

Portland Public Schools is an armative action and equal opportunity employer.

Most of this information has been about the PPS general fund – because that’s

the primary day-to-day operating fund for the district.

In addition, PPS budgets and accounts for money in a number of other funds:

PPS has Special Revenue Funds which include specically dedicated revenues

such as federal, state and local grants, the school meals program fund ($24.3

million) and a PERS stabilization fund ($16.7 million). Also included in these

funds are Title I ($12.7 million), IDEA ($12.0 million) and both day and residential

treatment programs ($6.8 million), funding for regional programs for deaf

and hard of hearing ($15.0 million), Head Start ($10.0 million), GEAR Up grant

to improve college readiness ($3.2 million), and school foundation funds

($2.9 million).

PPS has ve Debt Service Funds which provide for the payment of principal

and interest on long-term debt, including PERS debt ($45.7 million) and capital

bonds ($49.7 million).

PPS has eight Capital Project Funds for the acquisition of technology, or the

construction or renovation of school facilities. The largest of these is funded by

the 2012 school capital improvement bond program ($270.6 million). Some of

that money is budgeted to be spent in future years.

Internal Service Funds are for services provided internally on a cost-

reimbursement basis. PPS has one fund which accounts for self-insurance for

workers compensation.

There is a summary of the 2016/17 budget by fund type on p. 11 of the adopted

budget, a list of each fund and the amount in the 2016/17 budget on p. 60, and

summaries of where the money comes from and how it is to be spent on pp. 65-69.

Total By

Fund Type

$1,155.9All Funds

Fund Type as %

of All Funds

($ millions)

$592.6General Fund 51%

$135.9 Special Revenue 12%

$99.7Debt Service 9%

$320.5Capital Projects 28%

$7.2Internal Service 1%

Capital Projects

$320.5 million

28%

Internal Service

$7.2 million

1%

Special Revenue

$135.9 million

12%

Debt Service

$99.7 million

9%

General Fund

$592.6 million

51%