2023

Property Tax

Statement Guide

Questions?

503-988-2225

Online Tax Statements

multcoproptax.com

(Use the Guest login)

DUE DATE: Nov. 15, 2023

(Received or US Mail Postmarked )

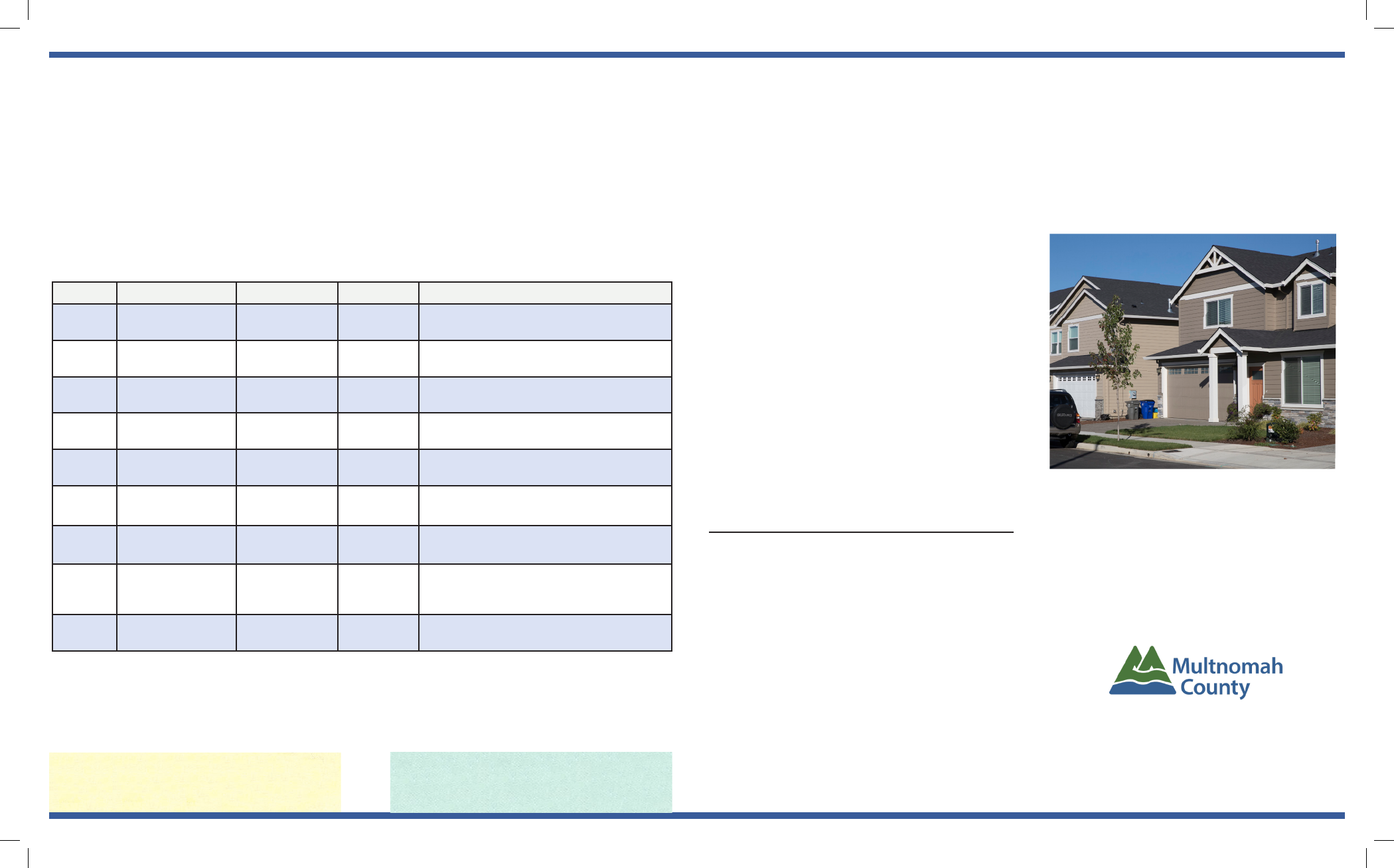

Measure District Item Rate Description

26-240 City of Portland Levy

$0.4026 per

$1,000 AV

Renewal; investment for ve years.

Begins 2024-25

03-592

Lake Oswego

School District

Local option levy

$1.64 per

$1,000 AV

Renewal to maintain teaching positions,

classroom programs. Begins 2024-25

03-594

Clackamas Fire

District

Local option levy

$0.52 per

$1,000 AV

For re and emergency medical services

26-225 Metro Local option levy

$0.096 per

$1,000 AV

Renewal; protects natural areas,

water quality, sh

26-224

Portland

Community College

Bond

$0.38 per

$1,000 AV

Bonds to construct job training space,

improve classrooms, safety, technology

34-321

Beaverton School

District

Levy

$1.25 per

$1,000 AV

Renewal to preserve teachers,

protect class sizes

26-227

David Douglas

School District

Bond

$0.88 per

$1,000 AV

Increase safety, security, repair, update

schools; vocational education

26-237 Corbett Fire District Bond

$0.65 per

$1,000 AV

Corbett Fire District No. 14 General

Obligation Bond; Authorization to nance

capital costs, improvements and equipment.

26-226

Alto Park Water

District

Local option levy

$0.60 per

$1,000 AV

Five-Year levy for district operations

Personal property taxes

Business equipment, most manufactured homes

and oating property receive a personal property tax

statement.

Personal property tax statements display all current

and delinquent years, unless the account number

has changed.

Delinquent tax may be owed on a prior account.

Your fall payment must include any delinquent taxes,

fees, and interest and at least one third of the current

year’s taxes. Failure to pay the minimum due may

lead to collection action including issuing a tax lien

warrant, additional fees, and potential garnishment.

Real property machinery and equipment will

receive a Real Property Tax Statement.

Special tax programs

A limited number of special tax programs are

available to homeowners from the Oregon

Department of Revenue.

For more information, visit oregon.gov/dor or

contact Property Tax and Ownership at

503-988-2225 or [email protected]

Many factors can aect the amount of your tax bill

Contrary to popular belief, tax increases are not limited to 3% per year. Factors that may result in a tax increase

of more than 3%, include:

• New voter-approved bonds or levies.

• Renovations or changes beyond general and ongoing maintenance made to your property as of

Jan. 1, 2023

• Loss of compression (the dierence between Measure 5 and Measure 50 tax calculations) on the property.

To see the compression history for your property, check out our DART TaxGraph on multcotax.org.

This guide is available in other languages.

Visit multco.us/tax-statement.

Esta guía está disponible en otros idiomas.

Visite multco.us/tax-statement.

Настоящее руководство доступно на других языках.

Посетите multco.us/tax-statement.

Hướng dẫn này hiện có bằng các ngôn ngữ khác.

Hãy truy cập multco.us/tax-statement.

本指南提供其他语言版本。

请访问 multco.us/tax-statement。

이 안내서는 다른 언어로도 제공됩니다.

다음 웹사이트를 참조하십시오. multco.us/tax-statement.

.

multco.us/tax-statement.

Questions regarding a specic bond or levy should be directed to the district.

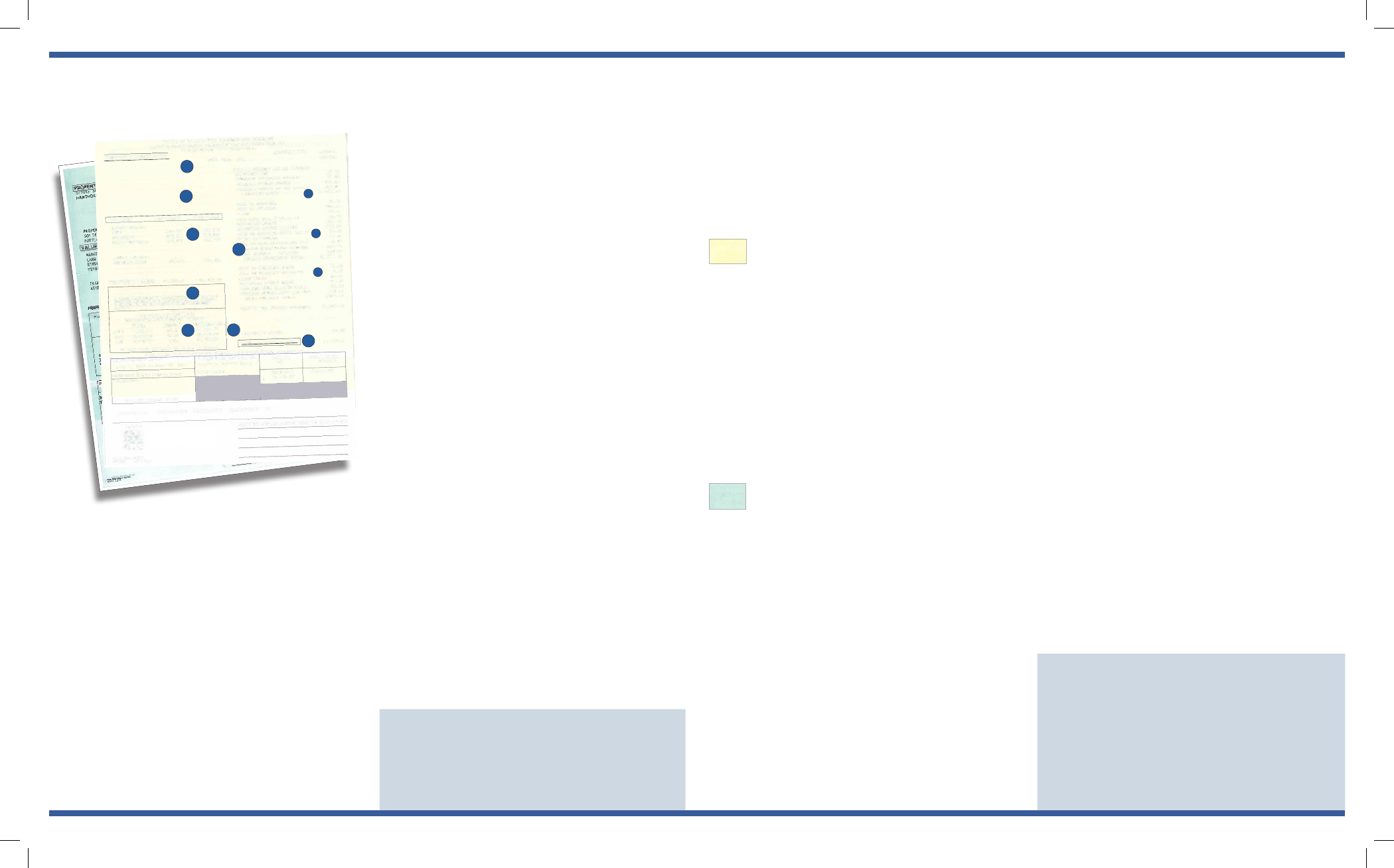

What does the color of my statement mean?

A green tax statement means you likely

have taxes to pay.

A yellow statement means a mortgage

company or the Department of Revenue has

requested a copy of your tax bill and may

pay it on your behalf.

List of new voter-approved bonds and levies

Understanding your property tax statement

Assessor information

1. Key property data

Property address, legal description and account

number (please have this information available when

contacting our oce).

2. Ownership and mailing address

By law, the owner is responsible for updating the

name and address on the tax bill.

More than 300,000 tax bills are mailed in late

October raising over $2 billion for 60 taxing districts

in Multnomah County.

To change the mailing address:

1. Write the change on the detachable portion of

your tax bill and submit with your payment.

OR

2. Email [email protected] and include the

following information:

• Owner name

• Property account number or address

• New mailing address

3. Your property values

Real market value (RMV) is the assessor’s estimate

of the market value of your property as of Jan. 1,

2023.

Assessed value is the lower of the RMV or

maximum assessed value (MAV).

For more information on RMV, MAV and assessed

value (AV), visit our website: multcotax.org.

4. Taxing districts

Your tax statement shows the taxes imposed for

each of the districts in which your property is located.

Each district collects a permanent tax rate for

ongoing services plus any additional taxes that have

been approved by voters.

Levies fall into three categories:

A. Education taxes

B. General government taxes

C. Bond taxes (additional taxes authorized by

voters)

Payment information

5. Yellow or green statement?

The color of your statement matters!

Yellow statement

If you received a yellow statement, this means

your mortgage company has requested your

property tax bill and may pay it on your behalf.

OR

You are on the deferral program for seniors or people

with disabilities, and the Oregon Department of

Revenue will pay all or part of your tax bill.

IMPORTANT! If the ownership or mortgage details

have changed in the past year, contact your lender to

ensure your taxes will be paid. Property owners are

ultimately responsible for taxes.

Green statement

If you received a green statement, return

the lower portion of the statement with your

payment in the envelope provided.

6. Payment options and due dates

Taxes may be paid in full, or in two-thirds or one-third

installments (due on Nov. 15, Feb. 15, and May 15).

Full payment qualies for a 3% discount.

Two-thirds payment qualies for a 2% discount.

To earn discounts and avoid interest, payment

must be received or postmarked by the due date.

Payment options

Electronic Check: Make a payment using electronic

check by visiting multcotax.org (fee for e-check is

$0.50 per transaction)

Online through Point and Pay

Make a payment using your credit or debit card

by visiting multcotax.org (fee for debit card: $3.50

per transaction, fee for credit card: 2.35% per

transaction)

Phone: 1-833-610-5715 (fees apply)

Drop Boxes: Submit your payment at a secure drop

site location. Find a drop site near you at

multcotax.org

Online bill pay via bank or credit union:

Make payment to “Multnomah County Tax Collector.”

Allow adequate processing time for this service,

set up payment early as Multnomah County must

receive the payment from the bank by the due date.

Mail: Check payable to Multnomah County,

P.O. Box 2716, Portland, OR 97208-2716

7. Delinquent taxes

This is the amount of tax and interest owed from

prior years.

Delinquent taxes identied with an asterisk (*) could

result in a property foreclosure if not paid.

Payments will be applied to the oldest tax year rst.

8. Total taxes due (after discount)

The amount shown on the pay stub reects a 3%

discount on the current year tax.

Appeal Information

The deadline to appeal your real market value

(RMV) is Jan. 2, 2024. Forms are available at

multcotax.org or by calling 503-988-2225

You should focus your appeal on the market

value of your property as of Jan. 1, 2023.

A $30 ling fee is required.

ACCOUNT NO:

I

•

'

.

11-15-2017

11-15-2017

Discount is lost and interest is applied after due date.

IN FULL

2 / 3

1 / 3

$3,167.03

$1,615.83

PROPERTY OWNER

501 SE

HAWTHORNE BLVD

PORTLAND, OR 97214

SITUS: 501 SE HAWTHORNE BLVD.

HAWTHORNE PK, BLOCK 131, LOT 1-15

11-15-2017

PROPERTY OWNER

501 SE

HAWTHORNE BLVD

PORTLAND, OR 97214

501 SE

HAWTHORNE BLVD

PORTLAND, OR 97214

1

2

3

4

5

6

A

B

C

7

8

Volunteers Needed

Serve on the Board of Property Tax Appeals.

The Board meets February-April to hear appeals

of real market value. If interested in applying,

please contact [email protected].